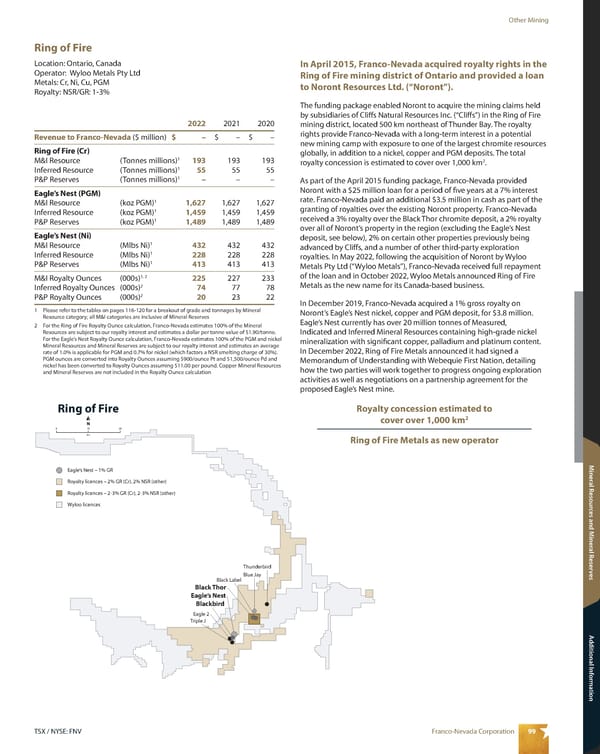

99 Franco-Nevada Corporation TSX / NYSE: FNV Other Mining Mineral Resources and Mineral Reserves Additional Information Ring of Fire Location: Ontario, Canada Operator: Wyloo Metals Pty Ltd Metals: Cr, Ni, Cu, PGM Royalty: NSR/GR: 1-3% Thunderbird Blue Jay Black Label Black Thor Eagle’s Nest Blackbird Eagle 2 Triple J Ring of Fire N km 0 10 20 Eagle’s Nest – 1% GR Royalty licences – 2% GR (Cr), 2% NSR (other) Wyloo licences Royalty licences – 2-3% GR (Cr), 2-3% NSR (other) In April 2015, Franco-Nevada acquired royalty rights in the Ring of Fire mining district of Ontario and provided a loan to Noront Resources Ltd. (“Noront”). The funding package enabled Noront to acquire the mining claims held by subsidiaries of Cliffs Natural Resources Inc. (“Cliffs”) in the Ring of Fire mining district, located 500 km northeast of Thunder Bay. The royalty rights provide Franco-Nevada with a long-term interest in a potential new mining camp with exposure to one of the largest chromite resources globally, in addition to a nickel, copper and PGM deposits. The total royalty concession is estimated to cover over 1,000 km 2 . As part of the April 2015 funding package, Franco-Nevada provided Noront with a $25 million loan for a period of five years at a 7% interest rate. Franco-Nevada paid an additional $3.5 million in cash as part of the granting of royalties over the existing Noront property. Franco-Nevada received a 3% royalty over the Black Thor chromite deposit, a 2% royalty over all of Noront’s property in the region (excluding the Eagle’s Nest deposit, see below), 2% on certain other properties previously being advanced by Cliffs, and a number of other third-party exploration royalties. In May 2022, following the acquisition of Noront by Wyloo Metals Pty Ltd (“Wyloo Metals”), Franco-Nevada received full repayment of the loan and in October 2022, Wyloo Metals announced Ring of Fire Metals as the new name for its Canada-based business. In December 2019, Franco-Nevada acquired a 1% gross royalty on Noront’s Eagle’s Nest nickel, copper and PGM deposit, for $3.8 million. Eagle’s Nest currently has over 20 million tonnes of Measured, Indicated and Inferred Mineral Resources containing high-grade nickel mineralization with significant copper, palladium and platinum content. In December 2022, Ring of Fire Metals announced it had signed a Memorandum of Understanding with Webequie First Nation, detailing how the two parties will work together to progress ongoing exploration activities as well as negotiations on a partnership agreement for the proposed Eagle’s Nest mine. Royalty concession estimated to cover over 1,000 km 2 Ring of Fire Metals as new operator 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – Ring of Fire (Cr) M&I Resource (Tonnes millions) 1 193 193 193 Inferred Resource (Tonnes millions) 1 55 55 55 P&P Reserves (Tonnes millions) 1 – – – Eagle’s Nest (PGM) M&I Resource (koz PGM) 1 1,627 1,627 1,627 Inferred Resource (koz PGM) 1 1,459 1,459 1,459 P&P Reserves (koz PGM) 1 1,489 1,489 1,489 Eagle’s Nest (Ni) M&I Resource (Mlbs Ni) 1 432 432 432 Inferred Resource (Mlbs Ni) 1 228 228 228 P&P Reserves (Mlbs Ni) 1 413 413 413 M&I Royalty Ounces (000s) 1, 2 225 227 233 Inferred Royalty Ounces (000s) 2 74 77 78 P&P Royalty Ounces (000s) 2 20 23 22 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For the Ring of Fire Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources are subject to our royalty interest and estimates a dollar per tonne value of $1.90/tonne. For the Eagle’s Nest Royalty Ounce calculation, Franco-Nevada estimates 100% of the PGM and nickel Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates an average rate of 1.0% is applicable for PGM and 0.7% for nickel (which factors a NSR smelting charge of 30%). PGM ounces are converted into Royalty Ounces assuming $900/ounce Pt and $1,500/ounce Pd and nickel has been converted to Royalty Ounces assuming $11.00 per pound. Copper Mineral Resources and Mineral Reserves are not included in the Royalty Ounce calculation

2023 Asset Handbook Page 100 Page 102

2023 Asset Handbook Page 100 Page 102