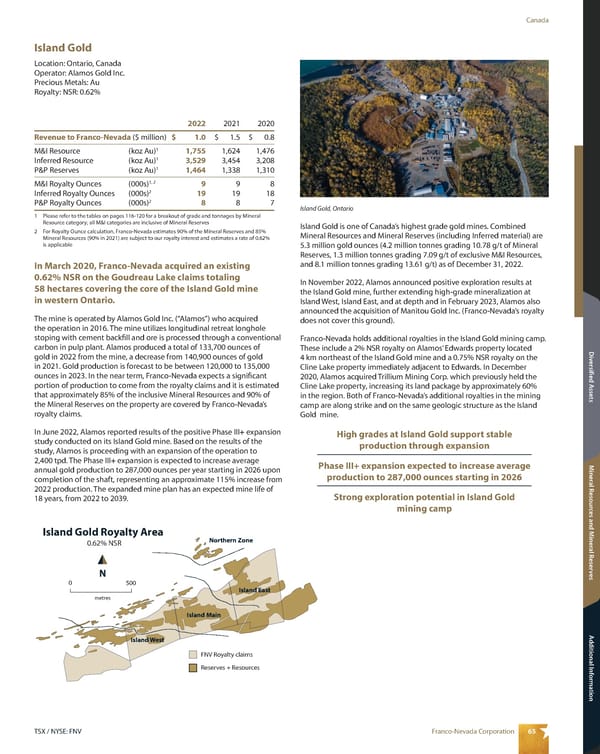

65 Franco-Nevada Corporation TSX / NYSE: FNV Canada Mineral Resources and Mineral Reserves Additional Information Diversified Assets Island Gold Location: Ontario, Canada Operator: Alamos Gold Inc. Precious Metals: Au Royalty: NSR: 0.62% N metres 0 500 Island Gold Royalty Area 0.62% NSR Island East Northern Zone Island Main Island West FNV Royalty claims Reserves + Resources Island Gold is one of Canada’s highest grade gold mines. Combined Mineral Resources and Mineral Reserves (including Inferred material) are 5.3 million gold ounces (4.2 million tonnes grading 10.78 g/t of Mineral Reserves, 1.3 million tonnes grading 7.09 g/t of exclusive M&I Resources, and 8.1 million tonnes grading 13.61 g/t) as of December 31, 2022. In November 2022, Alamos announced positive exploration results at the Island Gold mine, further extending high-grade mineralization at Island West, Island East, and at depth and in February 2023, Alamos also announced the acquisition of Manitou Gold Inc. (Franco-Nevada’s royalty does not cover this ground). Franco-Nevada holds additional royalties in the Island Gold mining camp. These include a 2% NSR royalty on Alamos’ Edwards property located 4 km northeast of the Island Gold mine and a 0.75% NSR royalty on the Cline Lake property immediately adjacent to Edwards. In December 2020, Alamos acquired Trillium Mining Corp. which previously held the Cline Lake property, increasing its land package by approximately 60% in the region. Both of Franco-Nevada’s additional royalties in the mining camp are along strike and on the same geologic structure as the Island Gold mine. High grades at Island Gold support stable production through expansion Phase III+ expansion expected to increase average production to 287,000 ounces starting in 2026 Strong exploration potential in Island Gold mining camp 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 1.0 $ 1.5 $ 0.8 M&I Resource (koz Au) 1 1,755 1,624 1,476 Inferred Resource (koz Au) 1 3,529 3,454 3,208 P&P Reserves (koz Au) 1 1,464 1,338 1,310 M&I Royalty Ounces (000s) 1, 2 9 9 8 Inferred Royalty Ounces (000s) 2 19 19 18 P&P Royalty Ounces (000s) 2 8 8 7 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 90% of the Mineral Reserves and 85% Mineral Resources (90% in 2021) are subject to our royalty interest and estimates a rate of 0.62% is applicable In March 2020, Franco-Nevada acquired an existing 0.62% NSR on the Goudreau Lake claims totaling 58 hectares covering the core of the Island Gold mine in western Ontario. The mine is operated by Alamos Gold Inc. (“Alamos”) who acquired the operation in 2016. The mine utilizes longitudinal retreat longhole stoping with cement backfill and ore is processed through a conventional carbon in pulp plant. Alamos produced a total of 133,700 ounces of gold in 2022 from the mine, a decrease from 140,900 ounces of gold in 2021. Gold production is forecast to be between 120,000 to 135,000 ounces in 2023. In the near term, Franco-Nevada expects a significant portion of production to come from the royalty claims and it is estimated that approximately 85% of the inclusive Mineral Resources and 90% of the Mineral Reserves on the property are covered by Franco-Nevada’s royalty claims. In June 2022, Alamos reported results of the positive Phase III+ expansion study conducted on its Island Gold mine. Based on the results of the study, Alamos is proceeding with an expansion of the operation to 2,400 tpd. The Phase III+ expansion is expected to increase average annual gold production to 287,000 ounces per year starting in 2026 upon completion of the shaft, representing an approximate 115% increase from 2022 production. The expanded mine plan has an expected mine life of 18 years, from 2022 to 2039. Island Gold, Ontario

2023 Asset Handbook Page 66 Page 68

2023 Asset Handbook Page 66 Page 68