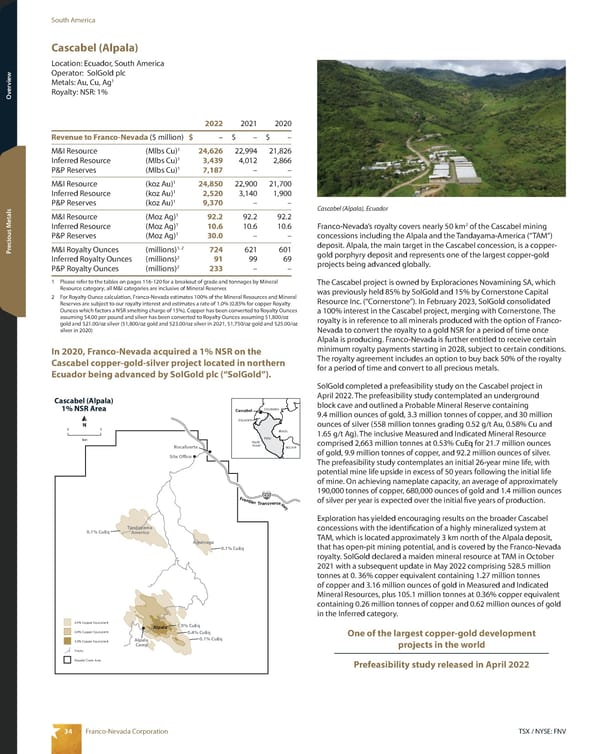

34 TSX / NYSE: FNV Franco-Nevada Corporation South America Overview Overview Precious Metals Cascabel (Alpala) Location: Ecuador, South America Operator: SolGold plc Metals: Au, Cu, Ag 1 Royalty: NSR: 1% N 0 1 km Hwy Transverse Frontier 0.1% Copper Equivalent 0.4% Copper Equivalent 1.0% Copper Equivalent Tracks Royalty Claim Area Alpala Rocafuerte Alpala Camp Tandayama America Aguinaga 1.0% CuEq 0.1% CuEq 0.4% CuEq 0.1% CuEq 0.1% CuEq Site Office Cascabel (Alpala) 1% NSR Area Franco-Nevada’s royalty covers nearly 50 km 2 of the Cascabel mining concessions including the Alpala and the Tandayama-America (“TAM”) deposit. Alpala, the main target in the Cascabel concession, is a copper- gold porphyry deposit and represents one of the largest copper-gold projects being advanced globally. The Cascabel project is owned by Exploraciones Novamining SA, which was previously held 85% by SolGold and 15% by Cornerstone Capital Resource Inc. (“Cornerstone”). In February 2023, SolGold consolidated a 100% interest in the Cascabel project, merging with Cornerstone. The royalty is in reference to all minerals produced with the option of Franco- Nevada to convert the royalty to a gold NSR for a period of time once Alpala is producing. Franco-Nevada is further entitled to receive certain minimum royalty payments starting in 2028, subject to certain conditions. The royalty agreement includes an option to buy back 50% of the royalty for a period of time and convert to all precious metals. SolGold completed a prefeasibility study on the Cascabel project in April 2022. The prefeasibility study contemplated an underground block cave and outlined a Probable Mineral Reserve containing 9.4 million ounces of gold, 3.3 million tonnes of copper, and 30 million ounces of silver (558 million tonnes grading 0.52 g/t Au, 0.58% Cu and 1.65 g/t Ag). The inclusive Measured and Indicated Mineral Resource comprised 2,663 million tonnes at 0.53% CuEq for 21.7 million ounces of gold, 9.9 million tonnes of copper, and 92.2 million ounces of silver. The prefeasibility study contemplates an initial 26-year mine life, with potential mine life upside in excess of 50 years following the initial life of mine. On achieving nameplate capacity, an average of approximately 190,000 tonnes of copper, 680,000 ounces of gold and 1.4 million ounces of silver per year is expected over the initial five years of production. Exploration has yielded encouraging results on the broader Cascabel concessions with the identification of a highly mineralized system at TAM, which is located approximately 3 km north of the Alpala deposit, that has open-pit mining potential, and is covered by the Franco-Nevada royalty. SolGold declared a maiden mineral resource at TAM in October 2021 with a subsequent update in May 2022 comprising 528.5 million tonnes at 0. 36% copper equivalent containing 1.27 million tonnes of copper and 3.16 million ounces of gold in Measured and Indicated Mineral Resources, plus 105.1 million tonnes at 0.36% copper equivalent containing 0.26 million tonnes of copper and 0.62 million ounces of gold in the Inferred category. One of the largest copper-gold development projects in the world Prefeasibility study released in April 2022 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – M&I Resource (Mlbs Cu) 1 24,626 22,994 21,826 Inferred Resource (Mlbs Cu) 1 3,439 4,012 2,866 P&P Reserves (Mlbs Cu) 1 7,187 – – M&I Resource (koz Au) 1 24,850 22,900 21,700 Inferred Resource (koz Au) 1 2,520 3,140 1,900 P&P Reserves (koz Au) 1 9,370 – – M&I Resource (Moz Ag) 1 92.2 92.2 92.2 Inferred Resource (Moz Ag) 1 10.6 10.6 10.6 P&P Reserves (Moz Ag) 1 30.0 – – M&I Royalty Ounces (millions) 1, 2 724 621 601 Inferred Royalty Ounces (millions) 2 91 99 69 P&P Royalty Ounces (millions) 2 233 – – 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.0% (0.85% for copper Royalty Ounces which factors a NSR smelting charge of 15%). Copper has been converted to Royalty Ounces assuming $4.00 per pound and silver has been converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz silver ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz silver in 2020) In 2020, Franco-Nevada acquired a 1% NSR on the Cascabel copper-gold-silver project located in northern Ecuador being advanced by SolGold plc (“SolGold”). Cascabel (Alpala), Ecuador Pacific Ocean ARGENTINA BOLIVIA PERU BRAZIL COLOMBIA EQUADOR CHILE Cascabel

2023 Asset Handbook Page 35 Page 37

2023 Asset Handbook Page 35 Page 37