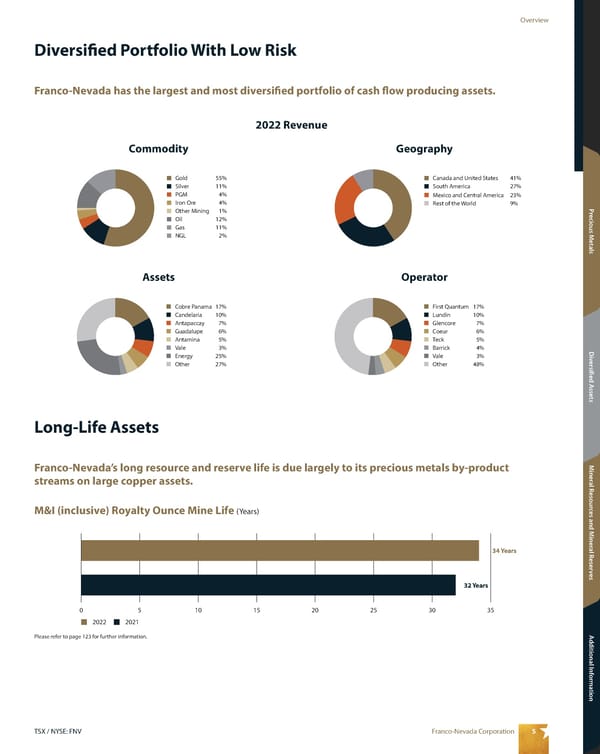

5 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Diversified Portfolio With Low Risk Long-Life Assets Commodity Assets M&I (inclusive) Royalty Ounce Mine Life (Years) Geography Operator Franco-Nevada has the largest and most diversified portfolio of cash flow producing assets. Franco-Nevada’s long resource and reserve life is due largely to its precious metals by-product streams on large copper assets. Gold 55% Silver 11% Gas 11% NGL 2% PGM 4% Iron Ore 4% Other Mining 1% Oil 12% Cobre Panama 17% Candelaria 10% Energy 25% Other 27% Antapaccay 7% Guadalupe 6% Antamina 5% Vale 3% Canada and United States 41% South America 27% Mexico and Central America 23% Rest of the World 9% First Quantum 17% Lundin 10% Vale 3% Other 48% Glencore 7% Coeur 6% Teck 5% Barrick 4% Please refer to page 123 for further information. 2022 Revenue 0 5 10 15 20 25 30 35 2022 2021 34 Years 32 Years

2023 Asset Handbook Page 6 Page 8

2023 Asset Handbook Page 6 Page 8