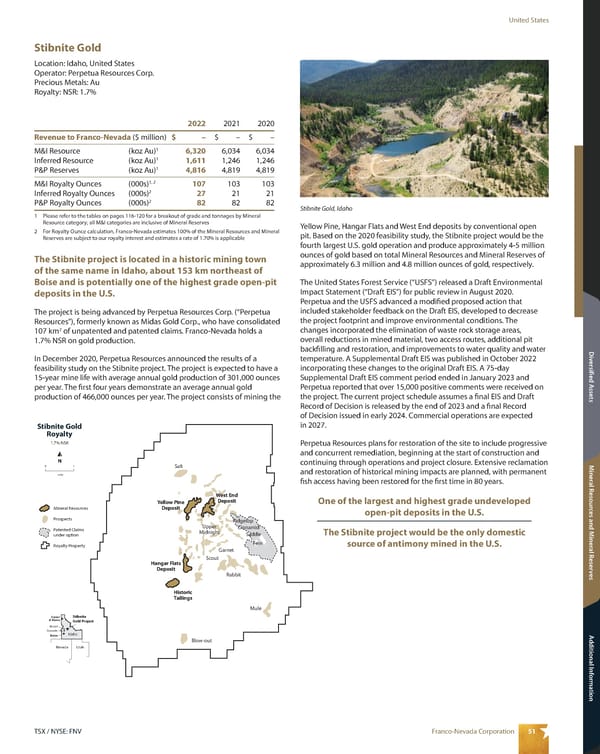

51 Franco-Nevada Corporation TSX / NYSE: FNV United States Mineral Resources and Mineral Reserves Additional Information Diversified Assets Stibnite Gold Location: Idaho, United States Operator: Perpetua Resources Corp. Precious Metals: Au Royalty: NSR: 1.7% Stibnite Gold Royalty 1.7% NSR N mile 0 1 Mineral Resources Prospects Patented Claims under option Royalty Property Salt Yellow Pine Deposit West End Deposit Hangar Flats Deposit Historic Tailings Blow-out Mule Rabbit Scout Garnet Ridgetop Cinnamid Saddle Fern Upper Midnight Idaho Utah Nevada Boise Cascade McCall Coeur d'Alene Stibnite Gold Project Yellow Pine, Hangar Flats and West End deposits by conventional open pit. Based on the 2020 feasibility study, the Stibnite project would be the fourth largest U.S. gold operation and produce approximately 4-5 million ounces of gold based on total Mineral Resources and Mineral Reserves of approximately 6.3 million and 4.8 million ounces of gold, respectively. The United States Forest Service (“USFS”) released a Draft Environmental Impact Statement (“Draft EIS”) for public review in August 2020. Perpetua and the USFS advanced a modified proposed action that included stakeholder feedback on the Draft EIS, developed to decrease the project footprint and improve environmental conditions. The changes incorporated the elimination of waste rock storage areas, overall reductions in mined material, two access routes, additional pit backfilling and restoration, and improvements to water quality and water temperature. A Supplemental Draft EIS was published in October 2022 incorporating these changes to the original Draft EIS. A 75-day Supplemental Draft EIS comment period ended in January 2023 and Perpetua reported that over 15,000 positive comments were received on the project. The current project schedule assumes a final EIS and Draft Record of Decision is released by the end of 2023 and a final Record of Decision issued in early 2024. Commercial operations are expected in 2027. Perpetua Resources plans for restoration of the site to include progressive and concurrent remediation, beginning at the start of construction and continuing through operations and project closure. Extensive reclamation and restoration of historical mining impacts are planned, with permanent fish access having been restored for the first time in 80 years. One of the largest and highest grade undeveloped open-pit deposits in the U.S. The Stibnite project would be the only domestic source of antimony mined in the U.S. 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – M&I Resource (koz Au) 1 6,320 6,034 6,034 Inferred Resource (koz Au) 1 1,611 1,246 1,246 P&P Reserves (koz Au) 1 4,816 4,819 4,819 M&I Royalty Ounces (000s) 1, 2 107 103 103 Inferred Royalty Ounces (000s) 2 27 21 21 P&P Royalty Ounces (000s) 2 82 82 82 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.70% is applicable The Stibnite project is located in a historic mining town of the same name in Idaho, about 153 km northeast of Boise and is potentially one of the highest grade open-pit deposits in the U.S. The project is being advanced by Perpetua Resources Corp. (“Perpetua Resources”), formerly known as Midas Gold Corp., who have consolidated 107 km 2 of unpatented and patented claims. Franco-Nevada holds a 1.7% NSR on gold production. In December 2020, Perpetua Resources announced the results of a feasibility study on the Stibnite project. The project is expected to have a 15-year mine life with average annual gold production of 301,000 ounces per year. The first four years demonstrate an average annual gold production of 466,000 ounces per year. The project consists of mining the Stibnite Gold, Idaho

2023 Asset Handbook Page 52 Page 54

2023 Asset Handbook Page 52 Page 54