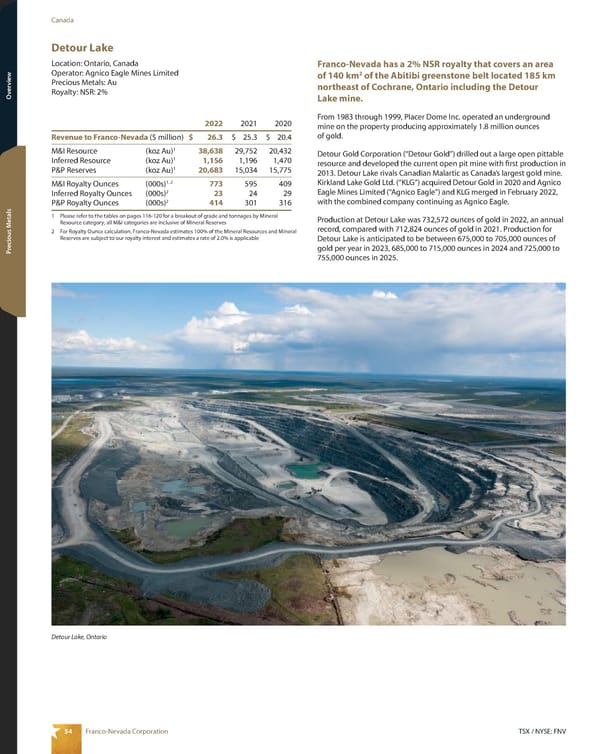

54 TSX / NYSE: FNV Franco-Nevada Corporation Canada Overview Overview Precious Metals Detour Lake Location: Ontario, Canada Operator: Agnico Eagle Mines Limited Precious Metals: Au Royalty: NSR: 2% Franco-Nevada has a 2% NSR royalty that covers an area of 140 km 2 of the Abitibi greenstone belt located 185 km northeast of Cochrane, Ontario including the Detour Lake mine. From 1983 through 1999, Placer Dome Inc. operated an underground mine on the property producing approximately 1.8 million ounces of gold. Detour Gold Corporation (“Detour Gold”) drilled out a large open pittable resource and developed the current open pit mine with first production in 2013. Detour Lake rivals Canadian Malartic as Canada’s largest gold mine. Kirkland Lake Gold Ltd. (“KLG”) acquired Detour Gold in 2020 and Agnico Eagle Mines Limited (“Agnico Eagle”) and KLG merged in February 2022, with the combined company continuing as Agnico Eagle. Production at Detour Lake was 732,572 ounces of gold in 2022, an annual record, compared with 712,824 ounces of gold in 2021. Production for Detour Lake is anticipated to be between 675,000 to 705,000 ounces of gold per year in 2023, 685,000 to 715,000 ounces in 2024 and 725,000 to 755,000 ounces in 2025. 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 26.3 $ 25.3 $ 20.4 M&I Resource (koz Au) 1 38,638 29,752 20,432 Inferred Resource (koz Au) 1 1,156 1,196 1,470 P&P Reserves (koz Au) 1 20,683 15,034 15,775 M&I Royalty Ounces (000s) 1, 2 773 595 409 Inferred Royalty Ounces (000s) 2 23 24 29 P&P Royalty Ounces (000s) 2 414 301 316 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 2.0% is applicable Detour Lake, Ontario

2023 Asset Handbook Page 55 Page 57

2023 Asset Handbook Page 55 Page 57