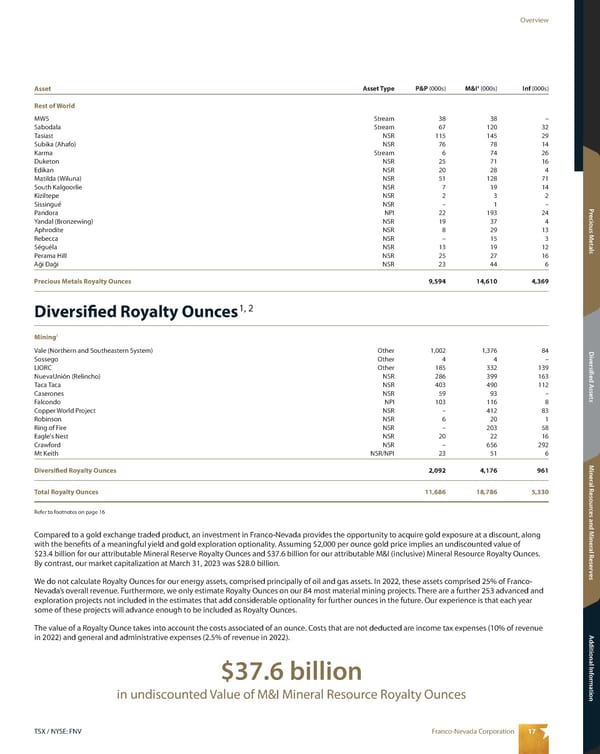

17 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals Asset Asset Type P&P (000s) M&I 4 (000s) Inf (000s) Rest of World MWS Stream 38 38 – Sabodala Stream 67 120 32 Tasiast NSR 115 145 29 Subika (Ahafo) NSR 76 78 14 Karma Stream 6 74 26 Duketon NSR 25 71 16 Edikan NSR 20 28 4 Matilda (Wiluna) NSR 51 128 71 South Kalgoorlie NSR 7 19 14 Kiziltepe NSR 2 3 2 Sissingué NSR – 1 – Pandora NPI 22 193 24 Yandal (Bronzewing) NSR 19 37 4 Aphrodite NSR 8 29 13 Rebecca NSR – 15 3 Séguéla NSR 13 19 12 Perama Hill NSR 25 27 16 Aği Daği NSR 23 44 6 Precious Metals Royalty Ounces 9,594 14,610 4,369 Diversified Royalty Ounces 1, 2 Mining 3 Vale (Northern and Southeastern System) Other 1,002 1,376 84 Sossego Other 4 4 – LIORC Other 185 332 139 NuevaUnión (Relincho) NSR 286 399 163 Taca Taca NSR 403 490 112 Caserones NSR 59 93 – Falcondo NPI 103 116 8 Copper World Project NSR – 412 83 Robinson NSR 6 20 1 Ring of Fire NSR – 203 58 Eagle's Nest NSR 20 22 16 Crawford NSR – 656 292 Mt Keith NSR/NPI 23 51 6 Diversified Royalty Ounces 2,092 4,176 961 Total Royalty Ounces 11,686 18,786 5,330 Refer to footnotes on page 16 Compared to a gold exchange traded product, an investment in Franco-Nevada provides the opportunity to acquire gold exposure at a discount, along with the benefits of a meaningful yield and gold exploration optionality. Assuming $2,000 per ounce gold price implies an undiscounted value of $23.4 billion for our attributable Mineral Reserve Royalty Ounces and $37.6 billion for our attributable M&I (inclusive) Mineral Resource Royalty Ounces. By contrast, our market capitalization at March 31, 2023 was $28.0 billion. We do not calculate Royalty Ounces for our energy assets, comprised principally of oil and gas assets. In 2022, these assets comprised 25% of Franco- Nevada’s overall revenue. Furthermore, we only estimate Royalty Ounces on our 84 most material mining projects. There are a further 253 advanced and exploration projects not included in the estimates that add considerable optionality for further ounces in the future. Our experience is that each year some of these projects will advance enough to be included as Royalty Ounces. The value of a Royalty Ounce takes into account the costs associated of an ounce. Costs that are not deducted are income tax expenses (10% of revenue in 2022) and general and administrative expenses (2.5% of revenue in 2022). $37.6 billion in undiscounted Value of M&I Mineral Resource Royalty Ounces

2023 Asset Handbook Page 18 Page 20

2023 Asset Handbook Page 18 Page 20