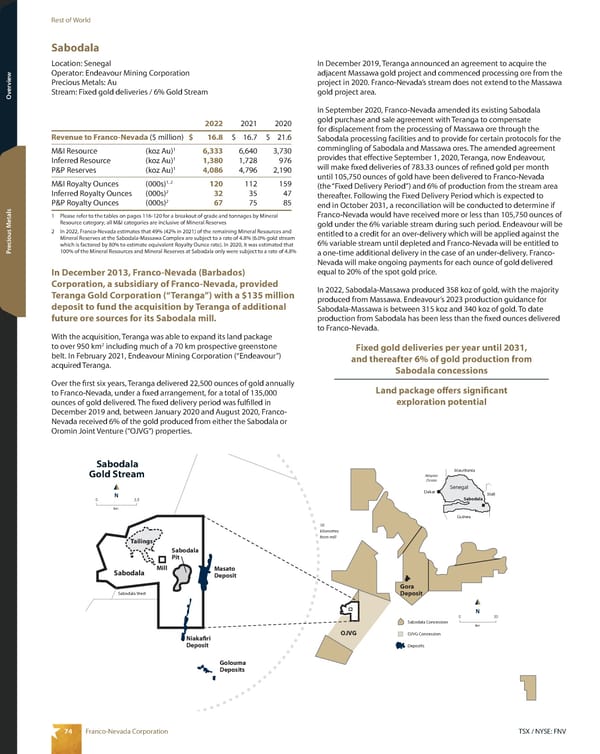

74 TSX / NYSE: FNV Franco-Nevada Corporation Rest of World Overview Overview Precious Metals Sabodala Location: Senegal Operator: Endeavour Mining Corporation Precious Metals: Au Stream: Fixed gold deliveries / 6% Gold Stream N km 0 20 Sabodala Gold Stream Sabodala Concession OJVG Concession Deposits N km 0 2.5 10 kilometres from mill Mill OJVG Sabodala Sabodala West Golouma Deposits Masato Deposit Niakafiri Deposit Sabodala Pit Tailings Gora Deposit Senegal Mali Mauritania Sabodala Dakar Guinea Atlantic Ocean In December 2019, Teranga announced an agreement to acquire the adjacent Massawa gold project and commenced processing ore from the project in 2020. Franco-Nevada’s stream does not extend to the Massawa gold project area. In September 2020, Franco-Nevada amended its existing Sabodala gold purchase and sale agreement with Teranga to compensate for displacement from the processing of Massawa ore through the Sabodala processing facilities and to provide for certain protocols for the commingling of Sabodala and Massawa ores. The amended agreement provides that effective September 1, 2020, Teranga, now Endeavour, will make fixed deliveries of 783.33 ounces of refined gold per month until 105,750 ounces of gold have been delivered to Franco-Nevada (the “Fixed Delivery Period”) and 6% of production from the stream area thereafter. Following the Fixed Delivery Period which is expected to end in October 2031, a reconciliation will be conducted to determine if Franco-Nevada would have received more or less than 105,750 ounces of gold under the 6% variable stream during such period. Endeavour will be entitled to a credit for an over-delivery which will be applied against the 6% variable stream until depleted and Franco-Nevada will be entitled to a one-time additional delivery in the case of an under-delivery. Franco- Nevada will make ongoing payments for each ounce of gold delivered equal to 20% of the spot gold price. In 2022, Sabodala-Massawa produced 358 koz of gold, with the majority produced from Massawa. Endeavour’s 2023 production guidance for Sabodala-Massawa is between 315 koz and 340 koz of gold. To date production from Sabodala has been less than the fixed ounces delivered to Franco-Nevada. Fixed gold deliveries per year until 2031, and thereafter 6% of gold production from Sabodala concessions Land package offers significant exploration potential 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 16.8 $ 16.7 $ 21.6 M&I Resource (koz Au) 1 6,333 6,640 3,730 Inferred Resource (koz Au) 1 1,380 1,728 976 P&P Reserves (koz Au) 1 4,086 4,796 2,190 M&I Royalty Ounces (000s) 1, 2 120 112 159 Inferred Royalty Ounces (000s) 2 32 35 47 P&P Royalty Ounces (000s) 2 67 75 85 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 In 2022, Franco-Nevada estimates that 49% (42% in 2021) of the remaining Mineral Resources and Mineral Reserves at the Sabodala-Massawa Complex are subject to a rate of 4.8% (6.0% gold stream which is factored by 80% to estimate equivalent Royalty Ounce rate). In 2020, it was estimated that 100% of the Mineral Resources and Mineral Reserves at Sabodala only were subject to a rate of 4.8% In December 2013, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, provided Teranga Gold Corporation (“Teranga”) with a $135 million deposit to fund the acquisition by Teranga of additional future ore sources for its Sabodala mill. With the acquisition, Teranga was able to expand its land package to over 950 km 2 including much of a 70 km prospective greenstone belt. In February 2021, Endeavour Mining Corporation (“Endeavour”) acquired Teranga. Over the first six years, Teranga delivered 22,500 ounces of gold annually to Franco-Nevada, under a fixed arrangement, for a total of 135,000 ounces of gold delivered. The fixed delivery period was fulfilled in December 2019 and, between January 2020 and August 2020, Franco- Nevada received 6% of the gold produced from either the Sabodala or Oromin Joint Venture (“OJVG”) properties.

2023 Asset Handbook Page 75 Page 77

2023 Asset Handbook Page 75 Page 77