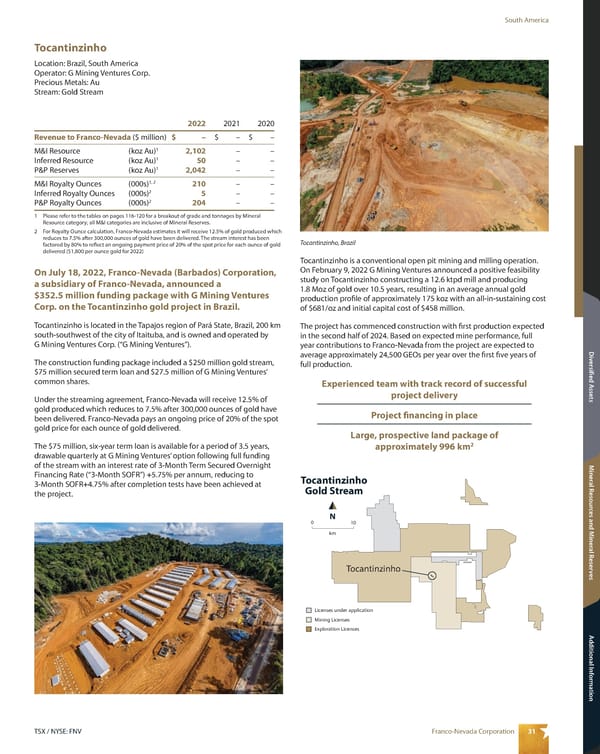

31 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Tocantinzinho Location: Brazil, South America Operator: G Mining Ventures Corp. Precious Metals: Au Stream: Gold Stream 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – M&I Resource (koz Au) 1 2,102 – – Inferred Resource (koz Au) 1 50 – – P&P Reserves (koz Au) 1 2,042 – – M&I Royalty Ounces (000s) 1, 2 210 – – Inferred Royalty Ounces (000s) 2 5 – – P&P Royalty Ounces (000s) 2 204 – – 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves. 2 For Royalty Ounce calculation, Franco-Nevada estimates it will receive 12.5% of gold produced which reduces to 7.5% after 300,000 ounces of gold have been delivered. The stream interest has been factored by 80% to reflect an ongoing payment price of 20% of the spot price for each ounce of gold delivered ($1,800 per ounce gold for 2022) On July 18, 2022, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, announced a $352.5 million funding package with G Mining Ventures Corp. on the Tocantinzinho gold project in Brazil. Tocantinzinho is located in the Tapajos region of Pará State, Brazil, 200 km south-southwest of the city of Itaituba, and is owned and operated by G Mining Ventures Corp. (“G Mining Ventures”). The construction funding package included a $250 million gold stream, $75 million secured term loan and $27.5 million of G Mining Ventures’ common shares. Under the streaming agreement, Franco-Nevada will receive 12.5% of gold produced which reduces to 7.5% after 300,000 ounces of gold have been delivered. Franco-Nevada pays an ongoing price of 20% of the spot gold price for each ounce of gold delivered. The $75 million, six-year term loan is available for a period of 3.5 years, drawable quarterly at G Mining Ventures’ option following full funding of the stream with an interest rate of 3-Month Term Secured Overnight Financing Rate (“3-Month SOFR”) +5.75% per annum, reducing to 3-Month SOFR+4.75% after completion tests have been achieved at the project. Tocantinzinho is a conventional open pit mining and milling operation. On February 9, 2022 G Mining Ventures announced a positive feasibility study on Tocantinzinho constructing a 12.6 ktpd mill and producing 1.8 Moz of gold over 10.5 years, resulting in an average annual gold production profile of approximately 175 koz with an all-in-sustaining cost of $681/oz and initial capital cost of $458 million. The project has commenced construction with first production expected in the second half of 2024. Based on expected mine performance, full year contributions to Franco-Nevada from the project are expected to average approximately 24,500 GEOs per year over the first five years of full production. Experienced team with track record of successful project delivery Project financing in place Large, prospective land package of approximately 996 km 2 N 0 10 Tocantinzinho Gold Stream Tocantinzinho km Mining Licenses Exploration Licenses Licenses under application Tocantinzinho, Brazil

2023 Asset Handbook Page 32 Page 34

2023 Asset Handbook Page 32 Page 34