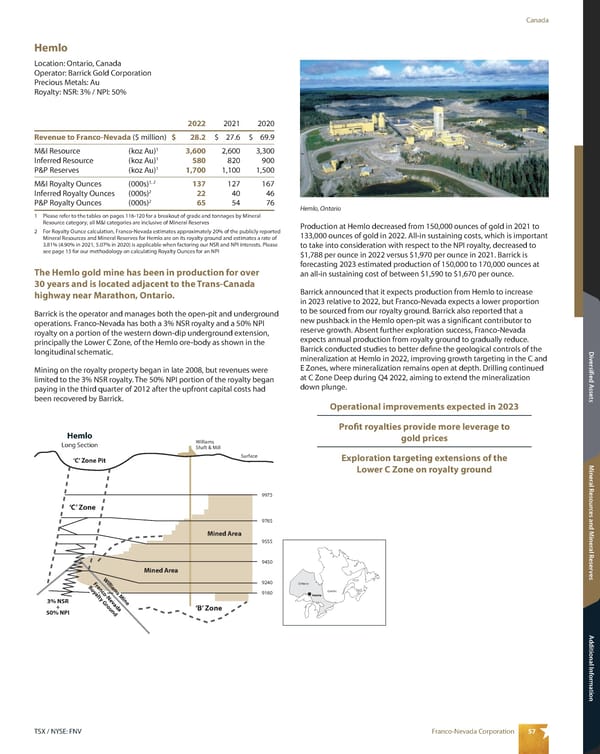

57 Franco-Nevada Corporation TSX / NYSE: FNV Canada Mineral Resources and Mineral Reserves Additional Information Diversified Assets Hemlo Long Section ‘C’ Zone Pit Williams Shaft & Mill Surface Mined Area 3% NSR + 50% NPI ‘C’ Zone ‘B’ Zone 9975 9765 9555 9450 9240 9160 Mined Area Williams Mine Franco-Nevada Royalty Ground Hemlo Location: Ontario, Canada Operator: Barrick Gold Corporation Precious Metals: Au Royalty: NSR: 3% / NPI: 50% Production at Hemlo decreased from 150,000 ounces of gold in 2021 to 133,000 ounces of gold in 2022. All-in sustaining costs, which is important to take into consideration with respect to the NPI royalty, decreased to $1,788 per ounce in 2022 versus $1,970 per ounce in 2021. Barrick is forecasting 2023 estimated production of 150,000 to 170,000 ounces at an all-in sustaining cost of between $1,590 to $1,670 per ounce. Barrick announced that it expects production from Hemlo to increase in 2023 relative to 2022, but Franco-Nevada expects a lower proportion to be sourced from our royalty ground. Barrick also reported that a new pushback in the Hemlo open-pit was a significant contributor to reserve growth. Absent further exploration success, Franco-Nevada expects annual production from royalty ground to gradually reduce. Barrick conducted studies to better define the geological controls of the mineralization at Hemlo in 2022, improving growth targeting in the C and E Zones, where mineralization remains open at depth. Drilling continued at C Zone Deep during Q4 2022, aiming to extend the mineralization down plunge. Operational improvements expected in 2023 Profit royalties provide more leverage to gold prices Exploration targeting extensions of the Lower C Zone on royalty ground 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 28.2 $ 27.6 $ 69.9 M&I Resource (koz Au) 1 3,600 2,600 3,300 Inferred Resource (koz Au) 1 580 820 900 P&P Reserves (koz Au) 1 1,700 1,100 1,500 M&I Royalty Ounces (000s) 1, 2 137 127 167 Inferred Royalty Ounces (000s) 2 22 40 46 P&P Royalty Ounces (000s) 2 65 54 76 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates approximately 20% of the publicly reported Mineral Resources and Mineral Reserves for Hemlo are on its royalty ground and estimates a rate of 3.81% (4.90% in 2021, 5.07% in 2020) is applicable when factoring our NSR and NPI interests. Please see page 15 for our methodology on calculating Royalty Ounces for an NPI The Hemlo gold mine has been in production for over 30 years and is located adjacent to the Trans-Canada highway near Marathon, Ontario. Barrick is the operator and manages both the open-pit and underground operations. Franco-Nevada has both a 3% NSR royalty and a 50% NPI royalty on a portion of the western down-dip underground extension, principally the Lower C Zone, of the Hemlo ore-body as shown in the longitudinal schematic. Mining on the royalty property began in late 2008, but revenues were limited to the 3% NSR royalty. The 50% NPI portion of the royalty began paying in the third quarter of 2012 after the upfront capital costs had been recovered by Barrick. Hemlo Quebec Ontario Hemlo, Ontario

2023 Asset Handbook Page 58 Page 60

2023 Asset Handbook Page 58 Page 60