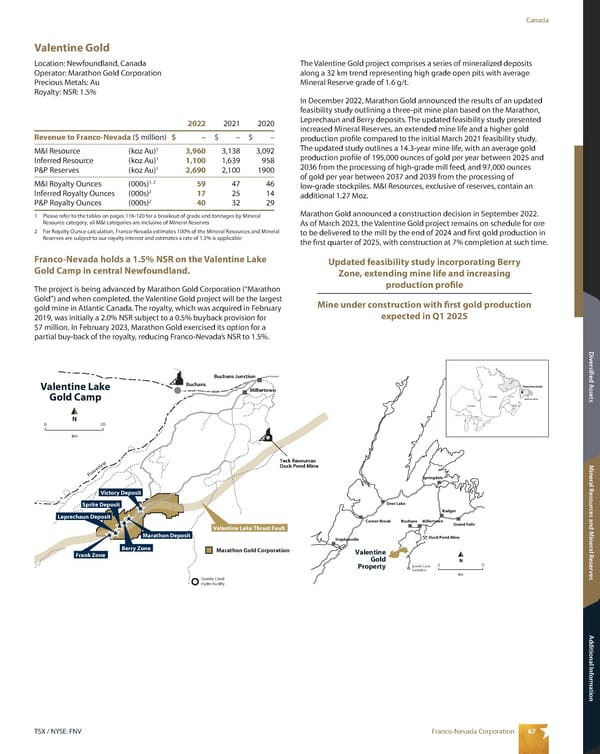

67 Franco-Nevada Corporation TSX / NYSE: FNV Canada Mineral Resources and Mineral Reserves Additional Information Diversified Assets Valentine Gold Location: Newfoundland, Canada Operator: Marathon Gold Corporation Precious Metals: Au Royalty: NSR: 1.5% Valentine Gold Property Teck Resources Duck Pond Mine Millertown Buchans Buchans Junction N km 0 75 Deer Lake Corner Brook Springdale Grand Falls Badger Stephenville Buchans Millertown Duck Pond Mine Granite Canal Substation Valentine Lake Thrust Fault Marathon Deposit Leprechaun Deposit Victory Deposit Sprite Deposit Frank Zone N km 0 20 Valentine Lake Gold Camp Powerline Granite Canal Hydro Facility Marathon Gold Corporation Berry Zone The Valentine Gold project comprises a series of mineralized deposits along a 32 km trend representing high grade open pits with average Mineral Reserve grade of 1.6 g/t. In December 2022, Marathon Gold announced the results of an updated feasibility study outlining a three-pit mine plan based on the Marathon, Leprechaun and Berry deposits. The updated feasibility study presented increased Mineral Reserves, an extended mine life and a higher gold production profile compared to the initial March 2021 feasibility study. The updated study outlines a 14.3-year mine life, with an average gold production profile of 195,000 ounces of gold per year between 2025 and 2036 from the processing of high-grade mill feed, and 97,000 ounces of gold per year between 2037 and 2039 from the processing of low-grade stockpiles. M&I Resources, exclusive of reserves, contain an additional 1.27 Moz. Marathon Gold announced a construction decision in September 2022. As of March 2023, the Valentine Gold project remains on schedule for ore to be delivered to the mill by the end of 2024 and first gold production in the first quarter of 2025, with construction at 7% completion at such time. Updated feasibility study incorporating Berry Zone, extending mine life and increasing production profile Mine under construction with first gold production expected in Q1 2025 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ – $ – $ – M&I Resource (koz Au) 1 3,960 3,138 3,092 Inferred Resource (koz Au) 1 1,100 1,639 958 P&P Reserves (koz Au) 1 2,690 2,100 1900 M&I Royalty Ounces (000s) 1, 2 59 47 46 Inferred Royalty Ounces (000s) 2 17 25 14 P&P Royalty Ounces (000s) 2 40 32 29 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.5% is applicable Franco-Nevada holds a 1.5% NSR on the Valentine Lake Gold Camp in central Newfoundland. The project is being advanced by Marathon Gold Corporation (“Marathon Gold”) and when completed, the Valentine Gold project will be the largest gold mine in Atlantic Canada. The royalty, which was acquired in February 2019, was initially a 2.0% NSR subject to a 0.5% buyback provision for $7 million. In February 2023, Marathon Gold exercised its option for a partial buy-back of the royalty, reducing Franco-Nevada’s NSR to 1.5%. Valentine Gold Quebec Ontario Newfoundland

2023 Asset Handbook Page 68 Page 70

2023 Asset Handbook Page 68 Page 70