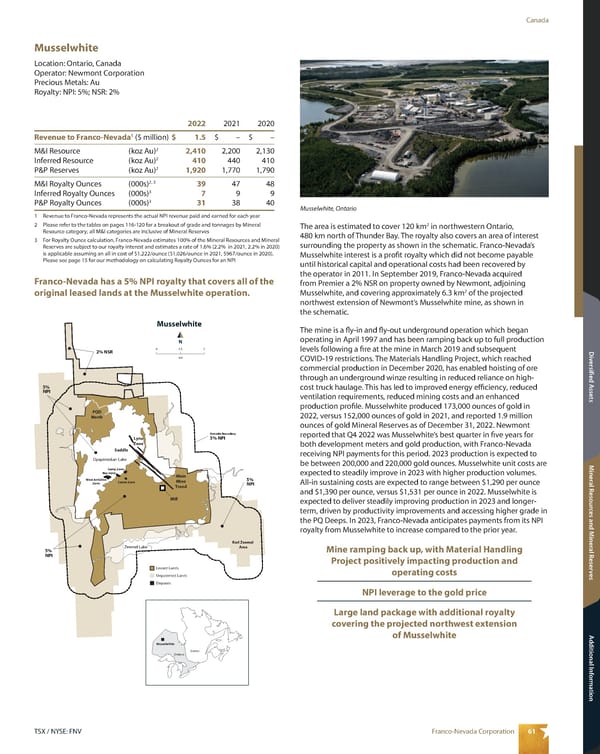

61 Franco-Nevada Corporation TSX / NYSE: FNV Canada Mineral Resources and Mineral Reserves Additional Information Diversified Assets Musselwhite Location: Ontario, Canada Operator: Newmont Corporation Precious Metals: Au Royalty: NPI: 5%; NSR: 2% Musselwhite Leased Lands Unpatented Lands Deposits N Main Mine Trend Mill Outside Boundary 5% NPI Opapimiskan Lake Zeemel Lake km 0 1.5 3 Karl Zeemal Area 2% NSR PQD North Saddle Lynx Zone 5% NPI 5% NPI 5% NPI Canoe Zone Camp Zone West Anticline Zone Bay Zone The area is estimated to cover 120 km 2 in northwestern Ontario, 480 km north of Thunder Bay. The royalty also covers an area of interest surrounding the property as shown in the schematic. Franco-Nevada’s Musselwhite interest is a profit royalty which did not become payable until historical capital and operational costs had been recovered by the operator in 2011. In September 2019, Franco-Nevada acquired from Premier a 2% NSR on property owned by Newmont, adjoining Musselwhite, and covering approximately 6.3 km 2 of the projected northwest extension of Newmont’s Musselwhite mine, as shown in the schematic. The mine is a fly-in and fly-out underground operation which began operating in April 1997 and has been ramping back up to full production levels following a fire at the mine in March 2019 and subsequent COVID-19 restrictions. The Materials Handling Project, which reached commercial production in December 2020, has enabled hoisting of ore through an underground winze resulting in reduced reliance on high- cost truck haulage. This has led to improved energy efficiency, reduced ventilation requirements, reduced mining costs and an enhanced production profile. Musselwhite produced 173,000 ounces of gold in 2022, versus 152,000 ounces of gold in 2021, and reported 1.9 million ounces of gold Mineral Reserves as of December 31, 2022. Newmont reported that Q4 2022 was Musselwhite’s best quarter in five years for both development meters and gold production, with Franco-Nevada receiving NPI payments for this period. 2023 production is expected to be between 200,000 and 220,000 gold ounces. Musselwhite unit costs are expected to steadily improve in 2023 with higher production volumes. All-in sustaining costs are expected to range between $1,290 per ounce and $1,390 per ounce, versus $1,531 per ounce in 2022. Musselwhite is expected to deliver steadily improving production in 2023 and longer- term, driven by productivity improvements and accessing higher grade in the PQ Deeps. In 2023, Franco-Nevada anticipates payments from its NPI royalty from Musselwhite to increase compared to the prior year. Mine ramping back up, with Material Handling Project positively impacting production and operating costs NPI leverage to the gold price Large land package with additional royalty covering the projected northwest extension of Musselwhite 2022 2021 2020 Revenue to Franco-Nevada 1 ($ million) $ 1.5 $ – $ – M&I Resource (koz Au) 2 2,410 2,200 2,130 Inferred Resource (koz Au) 2 410 440 410 P&P Reserves (koz Au) 2 1,920 1,770 1,790 M&I Royalty Ounces (000s) 2, 3 39 47 48 Inferred Royalty Ounces (000s) 3 7 9 9 P&P Royalty Ounces (000s) 3 31 38 40 1 Revenue to Franco-Nevada represents the actual NPI revenue paid and earned for each year 2 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 3 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.6% (2.2% in 2021, 2.2% in 2020) is applicable assuming an all in cost of $1,222/ounce ($1,026/ounce in 2021, $967/ounce in 2020). Please see page 15 for our methodology on calculating Royalty Ounces for an NPI Franco-Nevada has a 5% NPI royalty that covers all of the original leased lands at the Musselwhite operation. Musselwhite Quebec Ontario Musselwhite, Ontario

2023 Asset Handbook Page 62 Page 64

2023 Asset Handbook Page 62 Page 64