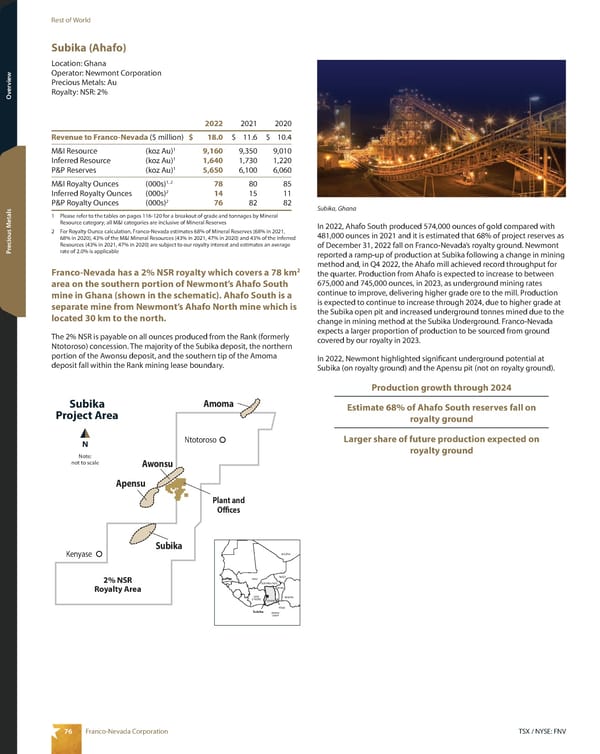

76 TSX / NYSE: FNV Franco-Nevada Corporation Rest of World Overview Overview Precious Metals Subika (Ahafo) Location: Ghana Operator: Newmont Corporation Precious Metals: Au Royalty: NSR: 2% N 2% NSR Royalty Area Awonsu Apensu Subika Plant and Offices Ntotoroso Amoma Kenyase Subika Project Area Note: not to scale In 2022, Ahafo South produced 574,000 ounces of gold compared with 481,000 ounces in 2021 and it is estimated that 68% of project reserves as of December 31, 2022 fall on Franco-Nevada’s royalty ground. Newmont reported a ramp-up of production at Subika following a change in mining method and, in Q4 2022, the Ahafo mill achieved record throughput for the quarter. Production from Ahafo is expected to increase to between 675,000 and 745,000 ounces, in 2023, as underground mining rates continue to improve, delivering higher grade ore to the mill. Production is expected to continue to increase through 2024, due to higher grade at the Subika open pit and increased underground tonnes mined due to the change in mining method at the Subika Underground. Franco-Nevada expects a larger proportion of production to be sourced from ground covered by our royalty in 2023. In 2022, Newmont highlighted significant underground potential at Subika (on royalty ground) and the Apensu pit (not on royalty ground). Production growth through 2024 Estimate 68% of Ahafo South reserves fall on royalty ground Larger share of future production expected on royalty ground 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 18.0 $ 11.6 $ 10.4 M&I Resource (koz Au) 1 9,160 9,350 9,010 Inferred Resource (koz Au) 1 1,640 1,730 1,220 P&P Reserves (koz Au) 1 5,650 6,100 6,060 M&I Royalty Ounces (000s) 1, 2 78 80 85 Inferred Royalty Ounces (000s) 2 14 15 11 P&P Royalty Ounces (000s) 2 76 82 82 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 68% of Mineral Reserves (68% in 2021, 68% in 2020), 43% of the M&I Mineral Resources (43% in 2021, 47% in 2020) and 43% of the Inferred Resources (43% in 2021, 47% in 2020) are subject to our royalty interest and estimates an average rate of 2.0% is applicable Franco-Nevada has a 2% NSR royalty which covers a 78 km 2 area on the southern portion of Newmont’s Ahafo South mine in Ghana (shown in the schematic). Ahafo South is a separate mine from Newmont’s Ahafo North mine which is located 30 km to the north. The 2% NSR is payable on all ounces produced from the Rank (formerly Ntotoroso) concession. The majority of the Subika deposit, the northern portion of the Awonsu deposit, and the southern tip of the Amoma deposit fall within the Rank mining lease boundary. Atlantic Ocean BURKINA FASO COTE D’IVOIRE GHANA TOGO BENIN NIGERIA NIGER MALI ALGERIA Subika Subika, Ghana

2023 Asset Handbook Page 77 Page 79

2023 Asset Handbook Page 77 Page 79