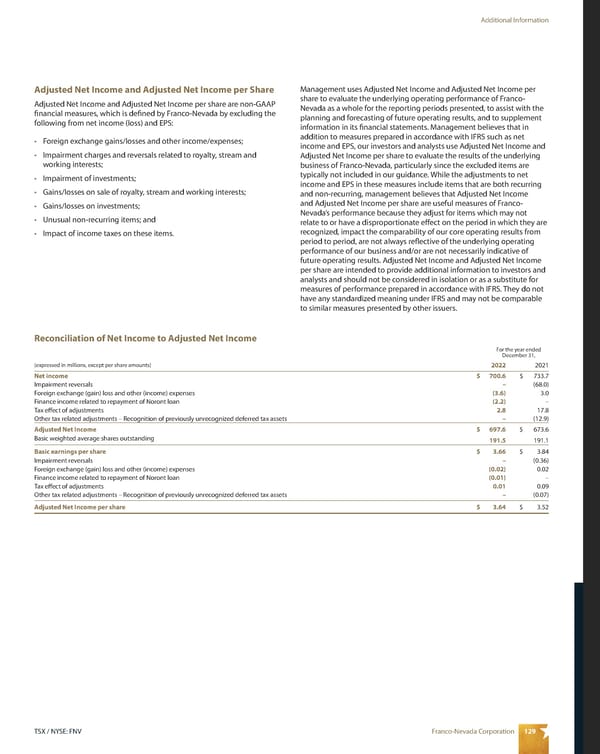

129 Franco-Nevada Corporation TSX / NYSE: FNV Additional Information Adjusted Net Income and Adjusted Net Income per Share Adjusted Net Income and Adjusted Net Income per share are non-GAAP financial measures, which is defined by Franco-Nevada by excluding the following from net income (loss) and EPS: • Foreign exchange gains/losses and other income/expenses; • Impairment charges and reversals related to royalty, stream and working interests; • Impairment of investments; • Gains/losses on sale of royalty, stream and working interests; • Gains/losses on investments; • Unusual non-recurring items; and • Impact of income taxes on these items. Management uses Adjusted Net Income and Adjusted Net Income per share to evaluate the underlying operating performance of Franco- Nevada as a whole for the reporting periods presented, to assist with the planning and forecasting of future operating results, and to supplement information in its financial statements. Management believes that in addition to measures prepared in accordance with IFRS such as net income and EPS, our investors and analysts use Adjusted Net Income and Adjusted Net Income per share to evaluate the results of the underlying business of Franco-Nevada, particularly since the excluded items are typically not included in our guidance. While the adjustments to net income and EPS in these measures include items that are both recurring and non-recurring, management believes that Adjusted Net Income and Adjusted Net Income per share are useful measures of Franco- Nevada’s performance because they adjust for items which may not relate to or have a disproportionate effect on the period in which they are recognized, impact the comparability of our core operating results from period to period, are not always reflective of the underlying operating performance of our business and/or are not necessarily indicative of future operating results. Adjusted Net Income and Adjusted Net Income per share are intended to provide additional information to investors and analysts and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. They do not have any standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Reconciliation of Net Income to Adjusted Net Income For the year ended December 31, (expressed in millions, except per share amounts) 2022 2021 Net income $ 700.6 $ 733.7 Impairment reversals – (68.0) Foreign exchange (gain) loss and other (income) expenses (3.6) 3.0 Finance income related to repayment of Noront loan (2.2) – Tax effect of adjustments 2.8 17.8 Other tax related adjustments – Recognition of previously unrecognized deferred tax assets – (12.9) Adjusted Net Income $ 697.6 $ 673.6 Basic weighted average shares outstanding 191.5 191.1 Basic earnings per share $ 3.66 $ 3.84 Impairment reversals – (0.36) Foreign exchange (gain) loss and other (income) expenses (0.02) 0.02 Finance income related to repayment of Noront loan (0.01) – Tax effect of adjustments 0.01 0.09 Other tax related adjustments – Recognition of previously unrecognized deferred tax assets – (0.07) Adjusted Net Income per share $ 3.64 $ 3.52

2023 Asset Handbook Page 130 Page 132

2023 Asset Handbook Page 130 Page 132