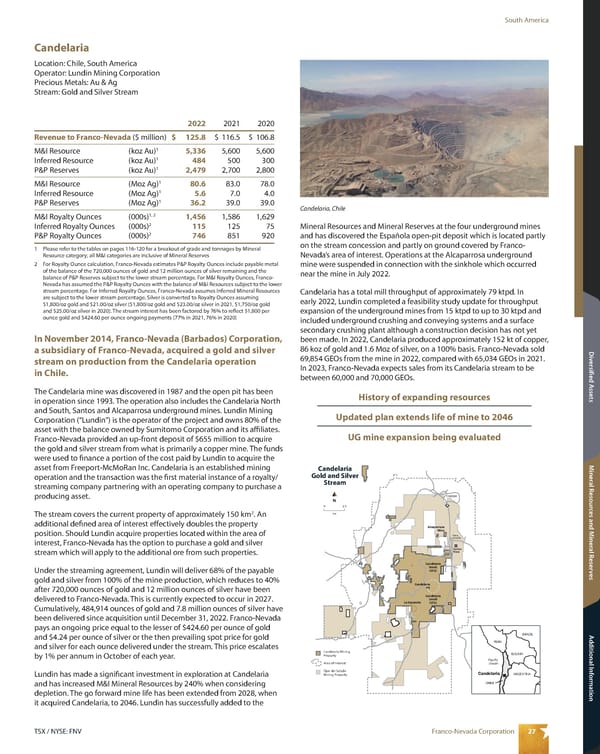

27 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Candelaria Location: Chile, South America Operator: Lundin Mining Corporation Precious Metals: Au & Ag Stream: Gold and Silver Stream N km 0 2.5 Candelaria Gold and Silver Stream Candelaria Mining Property Area of Interest Ojos del Salado Mining Property Tierra Amarilla Santos Mine Copiapo Candelaria North (U/G) Alcaparrosa Mine Candelaria Pit Candelaria South (U/G) La Espanola Pacific Ocean ARGENTINA BOLIVIA PERU BRAZIL CHILE Candelaria Mineral Resources and Mineral Reserves at the four underground mines and has discovered the Española open-pit deposit which is located partly on the stream concession and partly on ground covered by Franco- Nevada’s area of interest. Operations at the Alcaparrosa underground mine were suspended in connection with the sinkhole which occurred near the mine in July 2022. Candelaria has a total mill throughput of approximately 79 ktpd. In early 2022, Lundin completed a feasibility study update for throughput expansion of the underground mines from 15 ktpd to up to 30 ktpd and included underground crushing and conveying systems and a surface secondary crushing plant although a construction decision has not yet been made. In 2022, Candelaria produced approximately 152 kt of copper, 86 koz of gold and 1.6 Moz of silver, on a 100% basis. Franco-Nevada sold 69,854 GEOs from the mine in 2022, compared with 65,034 GEOs in 2021. In 2023, Franco-Nevada expects sales from its Candelaria stream to be between 60,000 and 70,000 GEOs. History of expanding resources Updated plan extends life of mine to 2046 UG mine expansion being evaluated 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 125.8 $ 116.5 $ 106.8 M&I Resource (koz Au) 1 5,336 5,600 5,600 Inferred Resource (koz Au) 1 484 500 300 P&P Reserves (koz Au) 1 2,479 2,700 2,800 M&I Resource (Moz Ag) 1 80.6 83.0 78.0 Inferred Resource (Moz Ag) 1 5.6 7.0 4.0 P&P Reserves (Moz Ag) 1 36.2 39.0 39.0 M&I Royalty Ounces (000s) 1, 2 1,456 1,586 1,629 Inferred Royalty Ounces (000s) 2 115 125 75 P&P Royalty Ounces (000s) 2 746 851 920 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates P&P Royalty Ounces include payable metal of the balance of the 720,000 ounces of gold and 12 million ounces of silver remaining and the balance of P&P Reserves subject to the lower stream percentage. For M&I Royalty Ounces, Franco- Nevada has assumed the P&P Royalty Ounces with the balance of M&I Resources subject to the lower stream percentage. For Inferred Royalty Ounces, Franco-Nevada assumes Inferred Mineral Resources are subject to the lower stream percentage. Silver is converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz silver ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz silver in 2020). The stream interest has been factored by 76% to reflect $1,800 per ounce gold and $424.60 per ounce ongoing payments (77% in 2021, 76% in 2020) In November 2014, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, acquired a gold and silver stream on production from the Candelaria operation in Chile. The Candelaria mine was discovered in 1987 and the open pit has been in operation since 1993. The operation also includes the Candelaria North and South, Santos and Alcaparrosa underground mines. Lundin Mining Corporation (“Lundin”) is the operator of the project and owns 80% of the asset with the balance owned by Sumitomo Corporation and its affiliates. Franco-Nevada provided an up-front deposit of $655 million to acquire the gold and silver stream from what is primarily a copper mine. The funds were used to finance a portion of the cost paid by Lundin to acquire the asset from Freeport-McMoRan Inc. Candelaria is an established mining operation and the transaction was the first material instance of a royalty/ streaming company partnering with an operating company to purchase a producing asset. The stream covers the current property of approximately 150 km 2 . An additional defined area of interest effectively doubles the property position. Should Lundin acquire properties located within the area of interest, Franco-Nevada has the option to purchase a gold and silver stream which will apply to the additional ore from such properties. Under the streaming agreement, Lundin will deliver 68% of the payable gold and silver from 100% of the mine production, which reduces to 40% after 720,000 ounces of gold and 12 million ounces of silver have been delivered to Franco-Nevada. This is currently expected to occur in 2027. Cumulatively, 484,914 ounces of gold and 7.8 million ounces of silver have been delivered since acquisition until December 31, 2022. Franco-Nevada pays an ongoing price equal to the lesser of $424.60 per ounce of gold and $4.24 per ounce of silver or the then prevailing spot price for gold and silver for each ounce delivered under the stream. This price escalates by 1% per annum in October of each year. Lundin has made a significant investment in exploration at Candelaria and has increased M&I Mineral Resources by 240% when considering depletion. The go forward mine life has been extended from 2028, when it acquired Candelaria, to 2046. Lundin has successfully added to the Candelaria, Chile

2023 Asset Handbook Page 28 Page 30

2023 Asset Handbook Page 28 Page 30