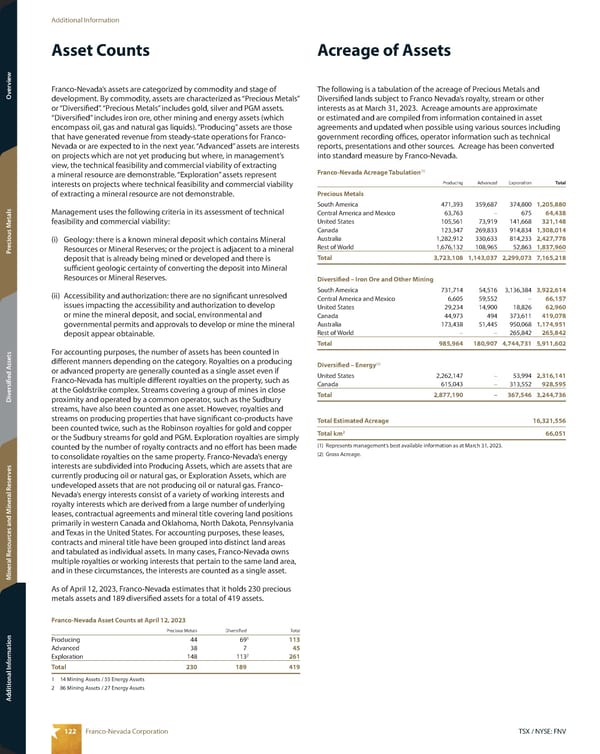

122 TSX / NYSE: FNV Franco-Nevada Corporation Overview Precious Metals Diversified Assets Mineral Resources and Mineral Reserves Additional Information 122 TSX / NYSE: FNV Franco-Nevada Corporation Additional Information Acreage of Assets Asset Counts Franco-Nevada’s assets are categorized by commodity and stage of development. By commodity, assets are characterized as “Precious Metals” or “Diversified”. “Precious Metals” includes gold, silver and PGM assets. “Diversified” includes iron ore, other mining and energy assets (which encompass oil, gas and natural gas liquids). “Producing” assets are those that have generated revenue from steady-state operations for Franco- Nevada or are expected to in the next year. “Advanced” assets are interests on projects which are not yet producing but where, in management’s view, the technical feasibility and commercial viability of extracting a mineral resource are demonstrable. “Exploration” assets represent interests on projects where technical feasibility and commercial viability of extracting a mineral resource are not demonstrable. Management uses the following criteria in its assessment of technical feasibility and commercial viability: (i) Geology: there is a known mineral deposit which contains Mineral Resources or Mineral Reserves; or the project is adjacent to a mineral deposit that is already being mined or developed and there is sufficient geologic certainty of converting the deposit into Mineral Resources or Mineral Reserves. (ii) Accessibility and authorization: there are no significant unresolved issues impacting the accessibility and authorization to develop or mine the mineral deposit, and social, environmental and governmental permits and approvals to develop or mine the mineral deposit appear obtainable. For accounting purposes, the number of assets has been counted in different manners depending on the category. Royalties on a producing or advanced property are generally counted as a single asset even if Franco-Nevada has multiple different royalties on the property, such as at the Goldstrike complex. Streams covering a group of mines in close proximity and operated by a common operator, such as the Sudbury streams, have also been counted as one asset. However, royalties and streams on producing properties that have significant co-products have been counted twice, such as the Robinson royalties for gold and copper or the Sudbury streams for gold and PGM. Exploration royalties are simply counted by the number of royalty contracts and no effort has been made to consolidate royalties on the same property. Franco-Nevada’s energy interests are subdivided into Producing Assets, which are assets that are currently producing oil or natural gas, or Exploration Assets, which are undeveloped assets that are not producing oil or natural gas. Franco- Nevada’s energy interests consist of a variety of working interests and royalty interests which are derived from a large number of underlying leases, contractual agreements and mineral title covering land positions primarily in western Canada and Oklahoma, North Dakota, Pennsylvania and Texas in the United States. For accounting purposes, these leases, contracts and mineral title have been grouped into distinct land areas and tabulated as individual assets. In many cases, Franco-Nevada owns multiple royalties or working interests that pertain to the same land area, and in these circumstances, the interests are counted as a single asset. As of April 12, 2023, Franco-Nevada estimates that it holds 230 precious metals assets and 189 diversified assets for a total of 419 assets. Franco-Nevada Asset Counts at April 12, 2023 Precious Metals Diversified Total Producing 44 69 1 113 Advanced 38 7 45 Exploration 148 113 2 261 Total 230 189 419 1 14 Mining Assets / 55 Energy Assets 2 86 Mining Assets / 27 Energy Assets The following is a tabulation of the acreage of Precious Metals and Diversified lands subject to Franco Nevada’s royalty, stream or other interests as at March 31, 2023. Acreage amounts are approximate or estimated and are compiled from information contained in asset agreements and updated when possible using various sources including government recording offices, operator information such as technical reports, presentations and other sources. Acreage has been converted into standard measure by Franco-Nevada. Franco-Nevada Acreage Tabulation (1) Producing Advanced Exploration Total Precious Metals South America 471,393 359,687 374,800 1,205,880 Central America and Mexico 63,763 – 675 64,438 United States 105,561 73,919 141,668 321,148 Canada 123,347 269,833 914,834 1,308,014 Australia 1,282,912 330,633 814,233 2,427,778 Rest of World 1,676,132 108,965 52,863 1,837,960 Total 3,723,108 1,143,037 2,299,073 7,165,218 Diversified – Iron Ore and Other Mining South America 731,714 54,516 3,136,384 3,922,614 Central America and Mexico 6,605 59,552 – 66,157 United States 29,234 14,900 18,826 62,960 Canada 44,973 494 373,611 419,078 Australia 173,438 51,445 950,068 1,174,951 Rest of World – – 265,842 265,842 Total 985,964 180,907 4,744,731 5,911,602 Diversified – Energy (2) United States 2,262,147 – 53,994 2,316,141 Canada 615,043 – 313,552 928,595 Total 2,877,190 – 367,546 3,244,736 Total Estimated Acreage 16,321,556 Total km 2 66,051 (1) Represents management’s best available information as at March 31, 2023. (2) Gross Acreage. Additional Information Additional Information

2023 Asset Handbook Page 123 Page 125

2023 Asset Handbook Page 123 Page 125