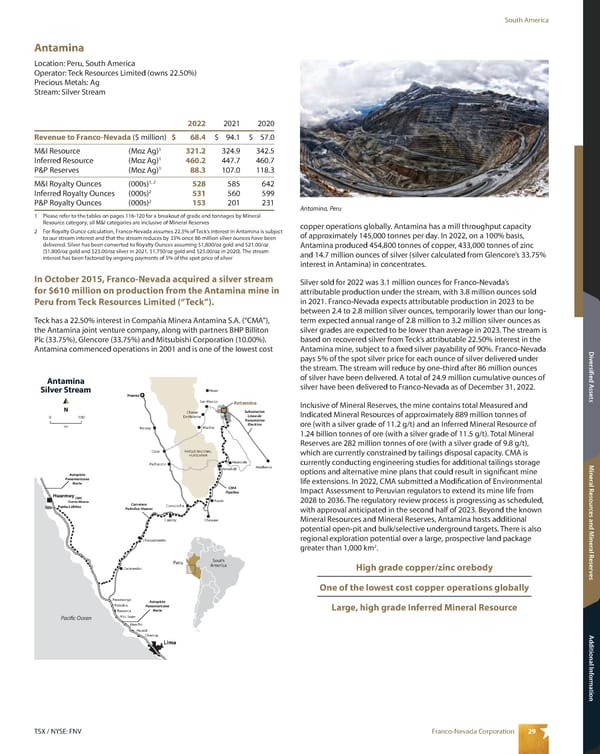

29 Franco-Nevada Corporation TSX / NYSE: FNV South America Mineral Resources and Mineral Reserves Additional Information Diversified Assets Antamina Location: Peru, South America Operator: Teck Resources Limited (owns 22.50%) Precious Metals: Ag Stream: Silver Stream South America Antamina Paramonga Pativilca Lima Barranca Huacho Huaral Chancay Pto. Supe Cutatambo Autopista Panamericana Norte Autopista Panamericana Norte Cajacay Chasquitambo Conococha Carretera Pativilca-Huarez Huarmey Punta Lobitos CMA Puerto Minero Aquia Chiquian Catac Pachacoto Recuay Huaraz Huallanca Huanzala Yanashall Machac Huari San Marcos Chavui De Huantar PARQUE NACIONAL HUASCARAN Subestacion Linea de Transmision Electrica CMA Pipeline Peru Pacific Ocean N km 0 100 Antamina Silver Stream copper operations globally. Antamina has a mill throughput capacity of approximately 145,000 tonnes per day. In 2022, on a 100% basis, Antamina produced 454,800 tonnes of copper, 433,000 tonnes of zinc and 14.7 million ounces of silver (silver calculated from Glencore’s 33.75% interest in Antamina) in concentrates. Silver sold for 2022 was 3.1 million ounces for Franco-Nevada’s attributable production under the stream, with 3.8 million ounces sold in 2021. Franco-Nevada expects attributable production in 2023 to be between 2.4 to 2.8 million silver ounces, temporarily lower than our long- term expected annual range of 2.8 million to 3.2 million silver ounces as silver grades are expected to be lower than average in 2023. The stream is based on recovered silver from Teck’s attributable 22.50% interest in the Antamina mine, subject to a fixed silver payability of 90%. Franco-Nevada pays 5% of the spot silver price for each ounce of silver delivered under the stream. The stream will reduce by one-third after 86 million ounces of silver have been delivered. A total of 24.9 million cumulative ounces of silver have been delivered to Franco-Nevada as of December 31, 2022. Inclusive of Mineral Reserves, the mine contains total Measured and Indicated Mineral Resources of approximately 889 million tonnes of ore (with a silver grade of 11.2 g/t) and an Inferred Mineral Resource of 1.24 billion tonnes of ore (with a silver grade of 11.5 g/t). Total Mineral Reserves are 282 million tonnes of ore (with a silver grade of 9.8 g/t), which are currently constrained by tailings disposal capacity. CMA is currently conducting engineering studies for additional tailings storage options and alternative mine plans that could result in significant mine life extensions. In 2022, CMA submitted a Modification of Environmental Impact Assessment to Peruvian regulators to extend its mine life from 2028 to 2036. The regulatory review process is progressing as scheduled, with approval anticipated in the second half of 2023. Beyond the known Mineral Resources and Mineral Reserves, Antamina hosts additional potential open-pit and bulk/selective underground targets. There is also regional exploration potential over a large, prospective land package greater than 1,000 km 2 . High grade copper/zinc orebody One of the lowest cost copper operations globally Large, high grade Inferred Mineral Resource 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 68.4 $ 94.1 $ 57.0 M&I Resource (Moz Ag) 1 321.2 324.9 342.5 Inferred Resource (Moz Ag) 1 460.2 447.7 460.7 P&P Reserves (Moz Ag) 1 88.3 107.0 118.3 M&I Royalty Ounces (000s) 1, 2 528 585 642 Inferred Royalty Ounces (000s) 2 531 560 599 P&P Royalty Ounces (000s) 2 153 201 231 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada assumes 22.5% of Teck’s interest in Antamina is subject to our stream interest and that the stream reduces by 33% once 86 million silver ounces have been delivered. Silver has been converted to Royalty Ounces assuming $1,800/oz gold and $21.00/oz ($1,800/oz gold and $23.00/oz silver in 2021, $1,750/oz gold and $25.00/oz in 2020). The stream interest has been factored by ongoing payments of 5% of the spot price of silver In October 2015, Franco-Nevada acquired a silver stream for $610 million on production from the Antamina mine in Peru from Teck Resources Limited (“Teck”). Teck has a 22.50% interest in Compañía Minera Antamina S.A. (“CMA”), the Antamina joint venture company, along with partners BHP Billiton Plc (33.75%), Glencore (33.75%) and Mitsubishi Corporation (10.00%). Antamina commenced operations in 2001 and is one of the lowest cost Antamina, Peru

2023 Asset Handbook Page 30 Page 32

2023 Asset Handbook Page 30 Page 32