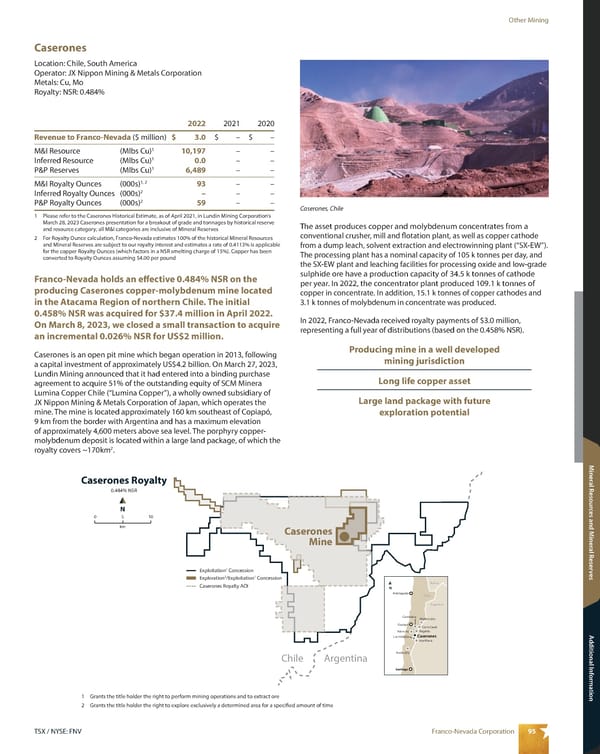

95 Franco-Nevada Corporation TSX / NYSE: FNV Other Mining Mineral Resources and Mineral Reserves Additional Information Caserones, Chile Caserones Location: Chile, South America Operator: JX Nippon Mining & Metals Corporation Metals: Cu, Mo Royalty: NSR: 0.484% 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 3.0 $ – $ – M&I Resource (Mlbs Cu) 1 10,197 – – Inferred Resource (Mlbs Cu) 1 0.0 – – P&P Reserves (Mlbs Cu) 1 6,489 – – M&I Royalty Ounces (000s) 1, 2 93 – – Inferred Royalty Ounces (000s) 2 – – – P&P Royalty Ounces (000s) 2 59 – – 1 Please refer to the Caserones Historical Estimate, as of April 2021, in Lundin Mining Corporation’s March 28, 2023 Caserones presentation for a breakout of grade and tonnages by historical reserve and resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the historical Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 0.4113% is applicable for the copper Royalty Ounces (which factors in a NSR smelting charge of 15%). Copper has been converted to Royalty Ounces assuming $4.00 per pound Franco-Nevada holds an effective 0.484% NSR on the producing Caserones copper-molybdenum mine located in the Atacama Region of northern Chile. The initial 0.458% NSR was acquired for $37.4 million in April 2022. On March 8, 2023, we closed a small transaction to acquire an incremental 0.026% NSR for US$2 million. Caserones is an open pit mine which began operation in 2013, following a capital investment of approximately US$4.2 billion. On March 27, 2023, Lundin Mining announced that it had entered into a binding purchase agreement to acquire 51% of the outstanding equity of SCM Minera Lumina Copper Chile (“Lumina Copper”), a wholly owned subsidiary of JX Nippon Mining & Metals Corporation of Japan, which operates the mine. The mine is located approximately 160 km southeast of Copiapó, 9 km from the border with Argentina and has a maximum elevation of approximately 4,600 meters above sea level. The porphyry copper- molybdenum deposit is located within a large land package, of which the royalty covers ~170km 2 . The asset produces copper and molybdenum concentrates from a conventional crusher, mill and flotation plant, as well as copper cathode from a dump leach, solvent extraction and electrowinning plant (“SX - EW”). The processing plant has a nominal capacity of 105 k tonnes per day, and the SX-EW plant and leaching facilities for processing oxide and low-grade sulphide ore have a production capacity of 34.5 k tonnes of cathode per year. In 2022, the concentrator plant produced 109.1 k tonnes of copper in concentrate. In addition, 15.1 k tonnes of copper cathodes and 3.1 k tonnes of molybdenum in concentrate was produced. In 2022, Franco-Nevada received royalty payments of $3.0 million, representing a full year of distributions (based on the 0.458% NSR). Producing mine in a well developed mining jurisdiction Long life copper asset Large land package with future exploration potential Chile Caserones Mine Argentina Caserones Royalty 0.484% NSR N km 0 5 10 Exploration 2 /Exploitation 1 Concession Exploitation 1 Concession Caserones Royalty AOI N Iquique Antofagasta Santiago Copiapo Relincho Chile Argentina Bolivia Candelaria Marte-Lobo Jose Maria Los Helados Cerro Casali Andacollo Regalito Caserones 1 Grants the title holder the right to perform mining operations and to extract ore 2 Grants the title holder the right to explore exclusively a determined area for a specified amount of time

2023 Asset Handbook Page 96 Page 98

2023 Asset Handbook Page 96 Page 98