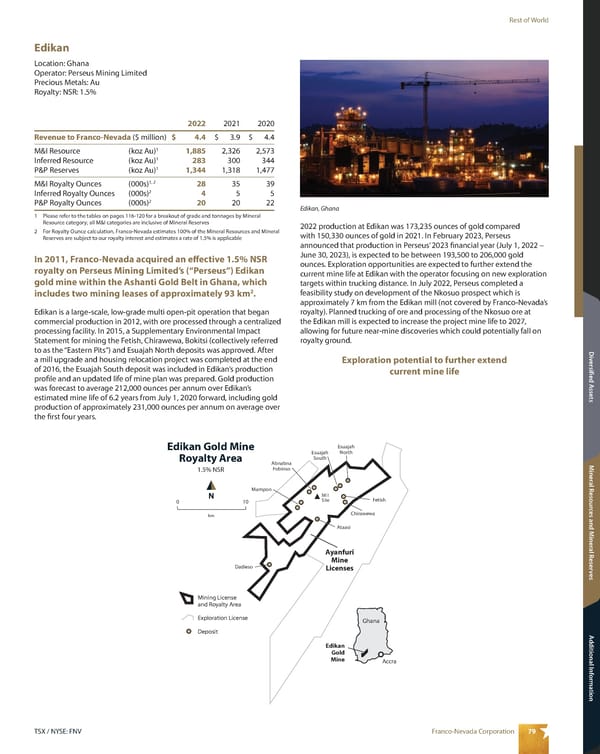

79 Franco-Nevada Corporation TSX / NYSE: FNV Rest of World Mineral Resources and Mineral Reserves Additional Information Diversified Assets Edikan Location: Ghana Operator: Perseus Mining Limited Precious Metals: Au Royalty: NSR: 1.5% N Edikan Gold Mine Royalty Area 1.5% NSR km 0 10 Mining License and Royalty Area Exploration License Deposit Ayanfuri Mine Licenses Accra Edikan Gold Mine Mill Site Esuajah South Esuajah North Fetish Chirawewa Ataasi Mampon Abnabna Fobinso Dadieso Ghana 2022 production at Edikan was 173,235 ounces of gold compared with 150,330 ounces of gold in 2021. In February 2023, Perseus announced that production in Perseus’ 2023 financial year (July 1, 2022 – June 30, 2023), is expected to be between 193,500 to 206,000 gold ounces. Exploration opportunities are expected to further extend the current mine life at Edikan with the operator focusing on new exploration targets within trucking distance. In July 2022, Perseus completed a feasibility study on development of the Nkosuo prospect which is approximately 7 km from the Edikan mill (not covered by Franco-Nevada’s royalty). Planned trucking of ore and processing of the Nkosuo ore at the Edikan mill is expected to increase the project mine life to 2027, allowing for future near-mine discoveries which could potentially fall on royalty ground. Exploration potential to further extend current mine life 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 4.4 $ 3.9 $ 4.4 M&I Resource (koz Au) 1 1,885 2,326 2,573 Inferred Resource (koz Au) 1 283 300 344 P&P Reserves (koz Au) 1 1,344 1,318 1,477 M&I Royalty Ounces (000s) 1, 2 28 35 39 Inferred Royalty Ounces (000s) 2 4 5 5 P&P Royalty Ounces (000s) 2 20 20 22 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.5% is applicable In 2011, Franco-Nevada acquired an effective 1.5% NSR royalty on Perseus Mining Limited’s (“Perseus”) Edikan gold mine within the Ashanti Gold Belt in Ghana, which includes two mining leases of approximately 93 km 2 . Edikan is a large-scale, low-grade multi open-pit operation that began commercial production in 2012, with ore processed through a centralized processing facility. In 2015, a Supplementary Environmental Impact Statement for mining the Fetish, Chirawewa, Bokitsi (collectively referred to as the “Eastern Pits”) and Esuajah North deposits was approved. After a mill upgrade and housing relocation project was completed at the end of 2016, the Esuajah South deposit was included in Edikan’s production profile and an updated life of mine plan was prepared. Gold production was forecast to average 212,000 ounces per annum over Edikan’s estimated mine life of 6.2 years from July 1, 2020 forward, including gold production of approximately 231,000 ounces per annum on average over the first four years. Edikan, Ghana

2023 Asset Handbook Page 80 Page 82

2023 Asset Handbook Page 80 Page 82