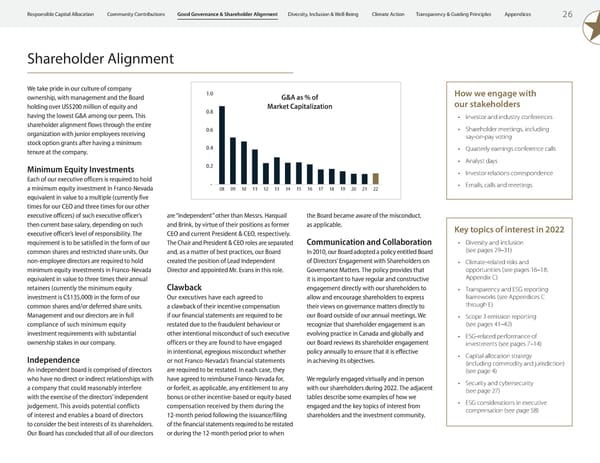

2 6 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation - 0.2 0.4 0.6 0.8 1.0 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 Shareholder Alignment are “independent” other than Messrs. Harquail and Brink, by virtue of their positions as former CEO and current President & CEO, respectively. The Chair and President & CEO roles are separated and, as a matter of best practices, our Board created the position of Lead Independent Director and appointed Mr. Evans in this role. Clawback Our executives have each agreed to a clawback of their incentive compensation if our financial statements are required to be restated due to the fraudulent behaviour or other intentional misconduct of such executive officers or they are found to have engaged in intentional, egregious misconduct whether or not Franco-Nevada’s financial statements are required to be restated. In each case, they have agreed to reimburse Franco-Nevada for, or forfeit, as applicable, any entitlement to any bonus or other incentive-based or equity-based compensation received by them during the 12-month period following the issuance/filing of the financial statements required to be restated or during the 12-month period prior to when the Board became aware of the misconduct, as applicable. Communication and Collaboration In 2010, our Board adopted a policy entitled Board of Directors’ Engagement with Shareholders on Governance Matters. The policy provides that it is important to have regular and constructive engagement directly with our shareholders to allow and encourage shareholders to express their views on governance matters directly to our Board outside of our annual meetings. We recognize that shareholder engagement is an evolving practice in Canada and globally and our Board reviews its shareholder engagement policy annually to ensure that it is effective in achieving its objectives. We regularly engaged virtually and in person with our shareholders during 2022. The adjacent tables describe some examples of how we engaged and the key topics of interest from shareholders and the investment community. How we engage with our stakeholders • Investor and industry conferences • Shareholder meetings, including say-on-pay voting • Quarterly earnings conference calls • Analyst days • Investor relations correspondence • Emails, calls and meetings Key topics of interest in 2022 • Diversity and inclusion ( see pages 29–31 ) • Climate-related risks and opportunities ( see pages 16–18; Appendix C ) • Transparency and ESG reporting frameworks ( see Appendices C through E ) • Scope 3 emission reporting ( see pages 41–42 ) • ESG-related performance of investments ( see pages 7–14 ) • Capital allocation strategy (including commodity and jurisdiction) ( see page 4 ) • Security and cybersecurity ( see page 27 ) • ESG considerations in executive compensation ( see page 58 ) We take pride in our culture of company ownership, with management and the Board holding over US$200 million of equity and having the lowest G&A among our peers. This shareholder alignment flows through the entire organization with junior employees receiving stock option grants after having a minimum tenure at the company. Minimum Equity Investments Each of our executive officers is required to hold a minimum equity investment in Franco-Nevada equivalent in value to a multiple (currently five times for our CEO and three times for our other executive officers) of such executive officer’s then current base salary, depending on such executive officer’s level of responsibility. The requirement is to be satisfied in the form of our common shares and restricted share units. Our non-employee directors are required to hold minimum equity investments in Franco-Nevada equivalent in value to three times their annual retainers (currently the minimum equity investment is C$135,000) in the form of our common shares and/or deferred share units. Management and our directors are in full compliance of such minimum equity investment requirements with substantial ownership stakes in our company. Independence An independent board is comprised of directors who have no direct or indirect relationships with a company that could reasonably interfere with the exercise of the directors’ independent judgement. This avoids potential conflicts of interest and enables a board of directors to consider the best interests of its shareholders. Our Board has concluded that all of our directors G&A as % of Market Capitalization

ESG Report 2023 Page 27 Page 29

ESG Report 2023 Page 27 Page 29