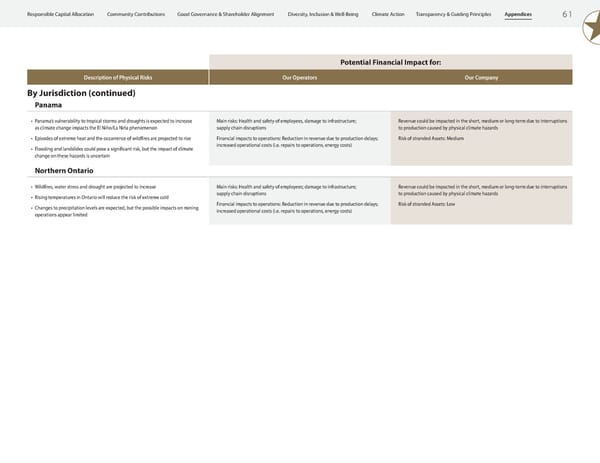

6 1 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Potential Financial Impact for: Description of Physical Risks Our Operators Our Company By Jurisdiction (continued) Panama • Panama’s vulnerability to tropical storms and droughts is expected to increase as climate change impacts the El Niño/La Niña phenomenon • Episodes of extreme heat and the occurrence of wildfires are projected to rise • Flooding and landslides could pose a significant risk, but the impact of climate change on these hazards is uncertain Main risks: Health and safety of employees, damage to infrastructure; supply chain disruptions Financial impacts to operations: Reduction in revenue due to production delays; increased operational costs (i.e. repairs to operations, energy costs) Revenue could be impacted in the short, medium or long-term due to interruptions to production caused by physical climate hazards Risk of stranded Assets: Medium Northern Ontario • Wildfires, water stress and drought are projected to increase • Rising temperatures in Ontario will reduce the risk of extreme cold • Changes to precipitation levels are expected, but the possible impacts on mining operations appear limited Main risks: Health and safety of employees; damage to infrastructure; supply chain disruptions Financial impacts to operations: Reduction in revenue due to production delays; increased operational costs (i.e. repairs to operations, energy costs) Revenue could be impacted in the short, medium or long-term due to interruptions to production caused by physical climate hazards Risk of stranded Assets: Low

ESG Report 2023 Page 62 Page 64

ESG Report 2023 Page 62 Page 64