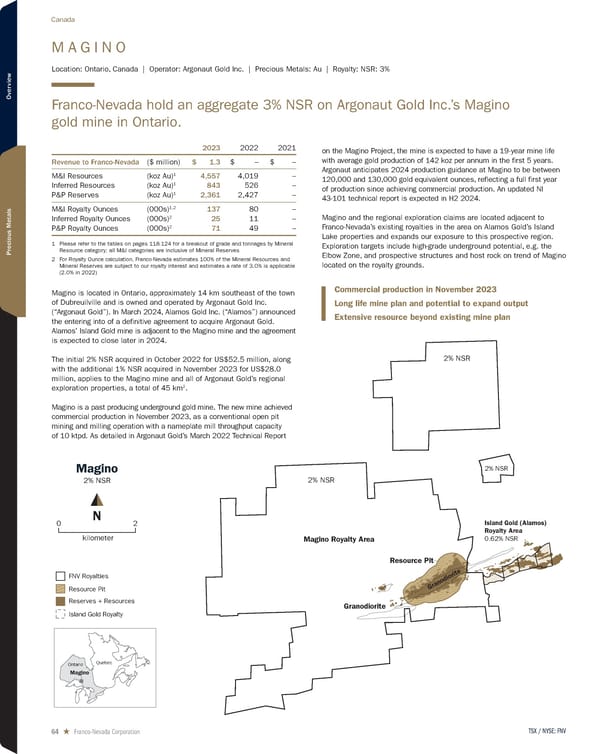

FNV Royalties Island Gold Royalty Resource Pit Reserves + Resources Magino 2% NSR kilometer 2 0 N Granodiorite Resource Pit Magino Royalty Area 2% NSR 2% NSR 0.62% NSR Granodiorite 2% NSR Island Gold (Alamos) Royalty Area Quebec Ontario Magino M A G I N O Location: Ontario, Canada | Operator: Argonaut Gold Inc. | Precious Metals: Au | Royalty: NSR: 3% Franco-Nevada hold an aggregate 3% NSR on Argonaut Gold Inc.’s Magino gold mine in Ontario. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 1.3 $ – $ – M&I Resources (koz Au) 1 4,557 4,019 – Inferred Resources (koz Au) 1 843 526 – P&P Reserves (koz Au) 1 2,361 2,427 – M&I Royalty Ounces (000s) 1,2 137 80 – Inferred Royalty Ounces (000s) 2 25 11 – P&P Royalty Ounces (000s) 2 71 49 – 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 3.0% is applicable (2.0% in 2022) Magino is located in Ontario, approximately 14 km southeast of the town of Dubreuilville and is owned and operated by Argonaut Gold Inc. (“Argonaut Gold”). In March 2024, Alamos Gold Inc. (“Alamos”) announced the entering into of a definitive agreement to acquire Argonaut Gold. Alamos’ Island Gold mine is adjacent to the Magino mine and the agreement is expected to close later in 2024. The initial 2% NSR acquired in October 2022 for US$52.5 million, along with the additional 1% NSR acquired in November 2023 for US$28.0 million, applies to the Magino mine and all of Argonaut Gold’s regional exploration properties, a total of 45 km 2 . Magino is a past producing underground gold mine. The new mine achieved commercial production in November 2023, as a conventional open pit mining and milling operation with a nameplate mill throughput capacity of 10 ktpd. As detailed in Argonaut Gold’s March 2022 Technical Report on the Magino Project, the mine is expected to have a 19-year mine life with average gold production of 142 koz per annum in the first 5 years. Argonaut anticipates 2024 production guidance at Magino to be between 120,000 and 130,000 gold equivalent ounces, reflecting a full first year of production since achieving commercial production. An updated NI 43-101 technical report is expected in H2 2024. Magino and the regional exploration claims are located adjacent to Franco-Nevada’s existing royalties in the area on Alamos Gold’s Island Lake properties and expands our exposure to this prospective region. Exploration targets include high-grade underground potential, e.g. the Elbow Zone, and prospective structures and host rock on trend of Magino located on the royalty grounds. Commercial production in November 2023 Long life mine plan and potential to expand output Extensive resource beyond existing mine plan TSX / NYSE: FNV 64 ★ Franco-Nevada Corporation Canada

2024 Asset Handbook Page 63 Page 65

2024 Asset Handbook Page 63 Page 65