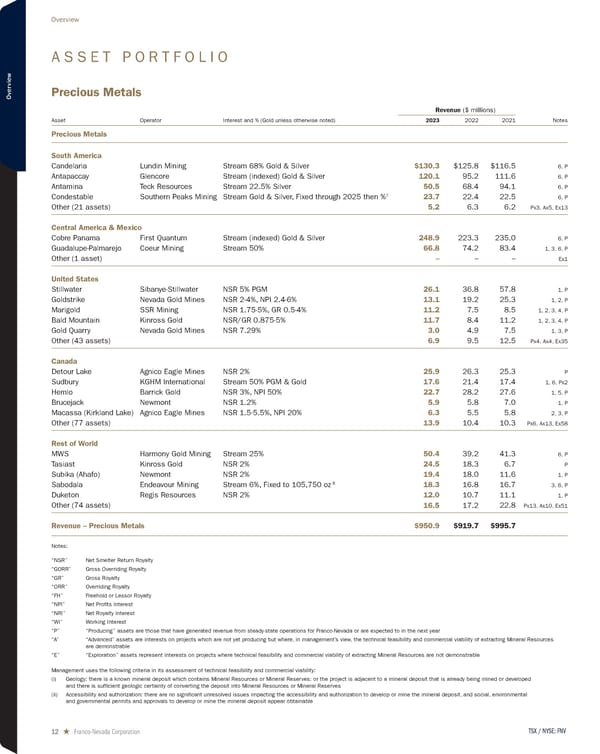

A S S E T P O R T F O L I O Precious Metals Revenue ($ millions) Asset Operator Interest and % (Gold unless otherwise noted) 2023 2022 2021 Notes Precious Metals South America Candelaria Lundin Mining Stream 68% Gold & Silver $130.3 $125.8 $116.5 6, P Antapaccay Glencore Stream (indexed) Gold & Silver 120.1 95.2 111.6 6, P Antamina Teck Resources Stream 22.5% Silver 50.5 68.4 94.1 6, P Condestable Southern Peaks Mining Stream Gold & Silver, Fixed through 2025 then % 7 23.7 22.4 22.5 6, P Other (21 assets) 5.2 6.3 6.2 Px3, Ax5, Ex13 Central America & Mexico Cobre Panama First Quantum Stream (indexed) Gold & Silver 248.9 223.3 235.0 6, P Guadalupe-Palmarejo Coeur Mining Stream 50% 66.8 74.2 83.4 1, 3, 6, P Other (1 asset) – – – Ex1 United States Stillwater Sibanye-Stillwater NSR 5% PGM 26.1 36.8 57.8 1, P Goldstrike Nevada Gold Mines NSR 2-4%, NPI 2.4-6% 13.1 19.2 25.3 1, 2, P Marigold SSR Mining NSR 1.75-5%, GR 0.5-4% 11.2 7.5 8.5 1, 2, 3, 4, P Bald Mountain Kinross Gold NSR/GR 0.875-5% 11.7 8.4 11.2 1, 2, 3, 4, P Gold Quarry Nevada Gold Mines NSR 7.29% 3.0 4.9 7.5 1, 3, P Other (43 assets) 6.9 9.5 12.5 Px4, Ax4, Ex35 Canada Detour Lake Agnico Eagle Mines NSR 2% 25.9 26.3 25.3 P Sudbury KGHM International Stream 50% PGM & Gold 17.6 21.4 17.4 1, 6, Px2 Hemlo Barrick Gold NSR 3%, NPI 50% 22.7 28.2 27.6 1, 5, P Brucejack Newmont NSR 1.2% 5.9 5.8 7.0 1, P Macassa (Kirkland Lake) Agnico Eagle Mines NSR 1.5-5.5%, NPI 20% 6.3 5.5 5.8 2, 3, P Other (77 assets) 13.9 10.4 10.3 Px6, Ax13, Ex58 Rest of World MWS Harmony Gold Mining Stream 25% 50.4 39.2 41.3 6, P Tasiast Kinross Gold NSR 2% 24.5 18.3 6.7 P Subika (Ahafo) Newmont NSR 2% 19.4 18.0 11.6 1, P Sabodala Endeavour Mining Stream 6%, Fixed to 105,750 oz 8 18.3 16.8 16.7 3, 6, P Duketon Regis Resources NSR 2% 12.0 10.7 11.1 1, P Other (74 assets) 16.5 17.2 22.8 Px13, Ax10, Ex51 Revenue – Precious Metals $950.9 $919.7 $995.7 Notes: “NSR” Net Smelter Return Royalty “GORR” Gross Overriding Royalty “GR” Gross Royalty “ORR” Overriding Royalty “FH” Freehold or Lessor Royalty “NPI” Net Profits Interest “NRI” Net Royalty Interest “WI” Working Interest “P” “Producing” assets are those that have generated revenue from steady-state operations for Franco - Nevada or are expected to in the next year “A” “Advanced” assets are interests on projects which are not yet producing but where, in management’s view, the technical feasibility and commercial viability of extracting Mineral Resources are demonstrable “E” “Exploration” assets represent interests on projects where technical feasibility and commercial viability of extracting Mineral Resources are not demonstrable Management uses the following criteria in its assessment of technical feasibility and commercial viability: (i) Geology: there is a known mineral deposit which contains Mineral Resources or Mineral Reserves; or the project is adjacent to a mineral deposit that is already being mined or developed and there is sufficient geologic certainty of converting the deposit into Mineral Resources or Mineral Reserves (ii) Accessibility and authorization: there are no significant unresolved issues impacting the accessibility and authorization to develop or mine the mineral deposit, and social, environmental and governmental permits and approvals to develop or mine the mineral deposit appear obtainable TSX / NYSE: FNV 12 ★ Franco-Nevada Corporation Overview

2024 Asset Handbook Page 11 Page 13

2024 Asset Handbook Page 11 Page 13