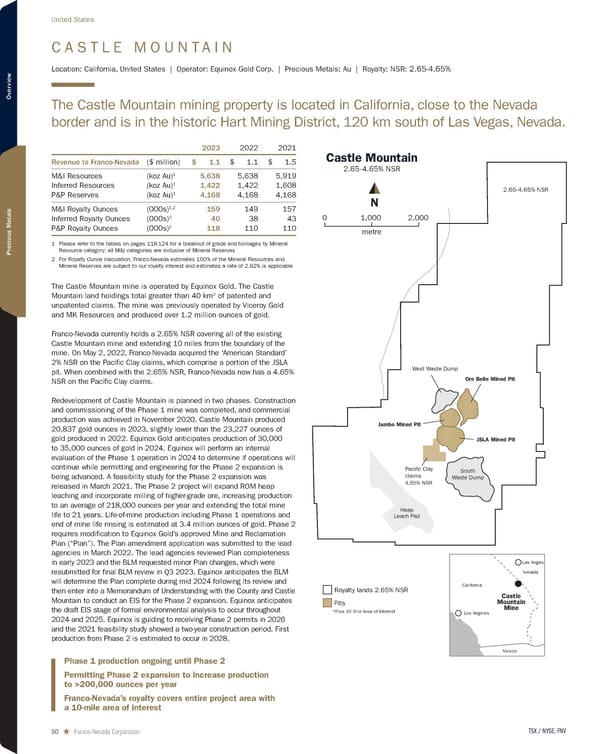

C A S T L E M O U N T A I N Location: California, United States | Operator: Equinox Gold Corp. | Precious Metals: Au | Royalty: NSR: 2.65-4.65% The Castle Mountain mining property is located in California, close to the Nevada border and is in the historic Hart Mining District, 120 km south of Las Vegas, Nevada. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 1.1 $ 1.1 $ 1.5 M&I Resources (koz Au) 1 5,638 5,638 5,919 Inferred Resources (koz Au) 1 1,422 1,422 1,608 P&P Reserves (koz Au) 1 4,168 4,168 4,168 M&I Royalty Ounces (000s) 1,2 159 149 157 Inferred Royalty Ounces (000s) 2 40 38 43 P&P Royalty Ounces (000s) 2 118 110 110 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 2.82% is applicable The Castle Mountain mine is operated by Equinox Gold. The Castle Mountain land holdings total greater than 40 km 2 of patented and unpatented claims. The mine was previously operated by Viceroy Gold and MK Resources and produced over 1.2 million ounces of gold. Franco-Nevada currently holds a 2.65% NSR covering all of the existing Castle Mountain mine and extending 10 miles from the boundary of the mine. On May 2, 2022, Franco-Nevada acquired the ‘American Standard’ 2% NSR on the Pacific Clay claims, which comprise a portion of the JSLA pit. When combined with the 2.65% NSR, Franco-Nevada now has a 4.65% NSR on the Pacific Clay claims. Redevelopment of Castle Mountain is planned in two phases. Construction and commissioning of the Phase 1 mine was completed, and commercial production was achieved in November 2020. Castle Mountain produced 20,837 gold ounces in 2023, slightly lower than the 23,227 ounces of gold produced in 2022. Equinox Gold anticipates production of 30,000 to 35,000 ounces of gold in 2024. Equinox will perform an internal evaluation of the Phase 1 operation in 2024 to determine if operations will continue while permitting and engineering for the Phase 2 expansion is being advanced. A feasibility study for the Phase 2 expansion was released in March 2021. The Phase 2 project will expand ROM heap leaching and incorporate milling of higher-grade ore, increasing production to an average of 218,000 ounces per year and extending the total mine life to 21 years. Life-of-mine production including Phase 1 operations and end of mine life rinsing is estimated at 3.4 million ounces of gold. Phase 2 requires modification to Equinox Gold’s approved Mine and Reclamation Plan (“Plan”). The Plan amendment application was submitted to the lead agencies in March 2022. The lead agencies reviewed Plan completeness in early 2023 and the BLM requested minor Plan changes, which were resubmitted for final BLM review in Q3 2023. Equinox anticipates the BLM will determine the Plan complete during mid 2024 following its review and then enter into a Memorandum of Understanding with the County and Castle Mountain to conduct an EIS for the Phase 2 expansion. Equinox anticipates the draft EIS stage of formal environmental analysis to occur throughout 2024 and 2025. Equinox is guiding to receiving Phase 2 permits in 2026 and the 2021 feasibility study showed a two-year construction period. First production from Phase 2 is estimated to occur in 2028. Castle Mountain Mine Las Vegas Los Angeles Mexico California Nevada Oro Belle Mined Pit Jumbo Mined Pit JSLA Mined Pit South Waste Dump West Waste Dump Pacific Clay claims 4.65% NSR Heap Leach Pad 2.65-4.65% NSR Castle Mountain 2.65-4.65% NSR *Plus 10 Mile Area of Interest Royalty lands 2.65% NSR Pits 1,000 metre 0 2,000 N Phase 1 production ongoing until Phase 2 Permitting Phase 2 expansion to increase production to >200,000 ounces per year Franco-Nevada’s royalty covers entire project area with a 10-mile area of interest TSX / NYSE: FNV 50 ★ Franco-Nevada Corporation United States

2024 Asset Handbook Page 49 Page 51

2024 Asset Handbook Page 49 Page 51