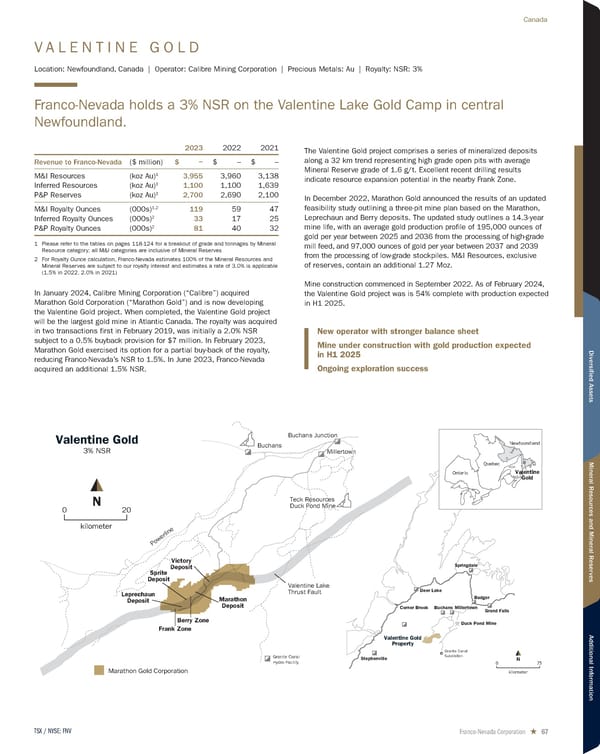

V A L E N T I N E G O L D Location: Newfoundland, Canada | Operator: Calibre Mining Corporation | Precious Metals: Au | Royalty: NSR: 3% Franco-Nevada holds a 3% NSR on the Valentine Lake Gold Camp in central Newfoundland. 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ − $ – $ – M&I Resources (koz Au) 1 3,955 3,960 3,138 Inferred Resources (koz Au) 1 1,100 1,100 1,639 P&P Reserves (koz Au) 1 2,700 2,690 2,100 M&I Royalty Ounces (000s) 1,2 119 59 47 Inferred Royalty Ounces (000s) 2 33 17 25 P&P Royalty Ounces (000s) 2 81 40 32 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 3.0% is applicable (1.5% in 2022, 2.0% in 2021) In January 2024, Calibre Mining Corporation (“Calibre”) acquired Marathon Gold Corporation (“Marathon Gold”) and is now developing the Valentine Gold project. When completed, the Valentine Gold project will be the largest gold mine in Atlantic Canada. The royalty was acquired in two transactions first in February 2019, was initially a 2.0% NSR subject to a 0.5% buyback provision for $7 million. In February 2023, Marathon Gold exercised its option for a partial buy-back of the royalty, reducing Franco-Nevada’s NSR to 1.5%. In June 2023, Franco-Nevada acquired an additional 1.5% NSR. The Valentine Gold project comprises a series of mineralized deposits along a 32 km trend representing high grade open pits with average Mineral Reserve grade of 1.6 g/t. Excellent recent drilling results indicate resource expansion potential in the nearby Frank Zone. In December 2022, Marathon Gold announced the results of an updated feasibility study outlining a three-pit mine plan based on the Marathon, Leprechaun and Berry deposits. The updated study outlines a 14.3-year mine life, with an average gold production profile of 195,000 ounces of gold per year between 2025 and 2036 from the processing of high-grade mill feed, and 97,000 ounces of gold per year between 2037 and 2039 from the processing of low-grade stockpiles. M&I Resources, exclusive of reserves, contain an additional 1.27 Moz. Mine construction commenced in September 2022. As of February 2024, the Valentine Gold project was is 54% complete with production expected in H1 2025. New operator with stronger balance sheet Mine under construction with gold production expected in H1 2025 Ongoing exploration success Valentine Gold Property Teck Resources Duck Pond Mine Millertown Buchans Buchans Junction Deer Lake Corner Brook Springdale Grand Falls Badger Stephenville Buchans Millertown Duck Pond Mine Granite Canal Substation Valentine Lake Thrust Fault Marathon Deposit Leprechaun Deposit Victory Deposit Sprite Deposit Frank Zone Powerline Granite Canal Hydro Facility Berry Zone Quebec Ontario Valentine Gold Newfoundland Valentine Gold 3% NSR kilometer 20 0 N Marathon Gold Corporation N kilometer 0 75 Franco-Nevada Corporation ★ 67 TSX / NYSE: FNV Canada

2024 Asset Handbook Page 66 Page 68

2024 Asset Handbook Page 66 Page 68