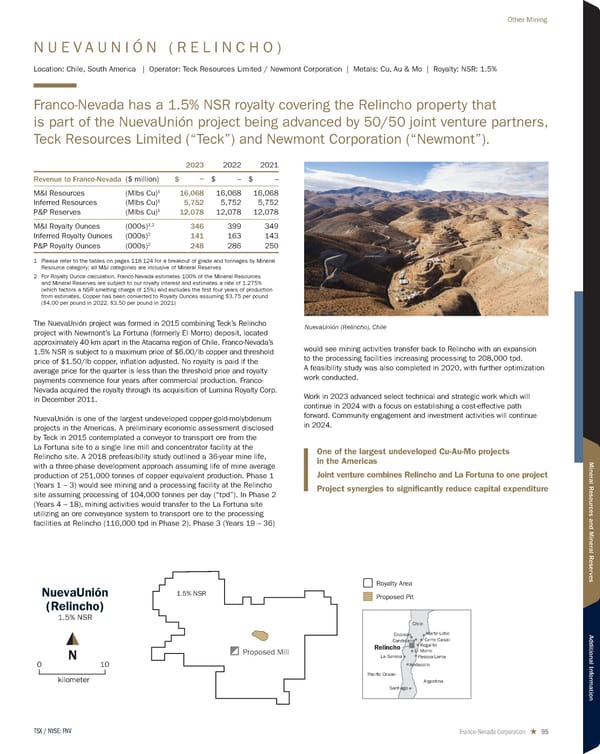

N U E V A U N I Ó N ( R E L I N C H O ) Location: Chile, South America | Operator: Teck Resources Limited / Newmont Corporation | Metals: Cu, Au & Mo | Royalty: NSR: 1.5% Franco-Nevada has a 1.5% NSR royalty covering the Relincho property that is part of the NuevaUnión project being advanced by 50/50 joint venture partners, Teck Resources Limited (“Teck”) and Newmont Corporation (“Newmont”). 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ − $ – $ – M&I Resources (Mlbs Cu) 1 16,068 16,068 16,068 Inferred Resources (Mlbs Cu) 1 5,752 5,752 5,752 P&P Reserves (Mlbs Cu) 1 12,078 12,078 12,078 M&I Royalty Ounces (000s) 1,2 346 399 349 Inferred Royalty Ounces (000s) 2 141 163 143 P&P Royalty Ounces (000s) 2 248 286 250 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.275% (which factors a NSR smelting charge of 15%) and excludes the first four years of production from estimates. Copper has been converted to Royalty Ounces assuming $3.75 per pound ($4.00 per pound in 2022, $3.50 per pound in 2021) The NuevaUnión project was formed in 2015 combining Teck’s Relincho project with Newmont’s La Fortuna (formerly El Morro) deposit, located approximately 40 km apart in the Atacama region of Chile. Franco-Nevada’s 1.5% NSR is subject to a maximum price of $6.00/lb copper and threshold price of $1.50/lb copper, inflation adjusted. No royalty is paid if the average price for the quarter is less than the threshold price and royalty payments commence four years after commercial production. Franco- Nevada acquired the royalty through its acquisition of Lumina Royalty Corp. in December 2011. NuevaUnión is one of the largest undeveloped copper-gold-molybdenum projects in the Americas. A preliminary economic assessment disclosed by Teck in 2015 contemplated a conveyor to transport ore from the La Fortuna site to a single line mill and concentrator facility at the Relincho site. A 2018 prefeasibility study outlined a 36-year mine life, with a three-phase development approach assuming life of mine average production of 251,000 tonnes of copper equivalent production. Phase 1 (Years 1 – 3) would see mining and a processing facility at the Relincho site assuming processing of 104,000 tonnes per day (“tpd”). In Phase 2 (Years 4 – 18), mining activities would transfer to the La Fortuna site utilizing an ore conveyance system to transport ore to the processing facilities at Relincho (116,000 tpd in Phase 2). Phase 3 (Years 19 – 36) would see mining activities transfer back to Relincho with an expansion to the processing facilities increasing processing to 208,000 tpd. A feasibility study was also completed in 2020, with further optimization work conducted. Work in 2023 advanced select technical and strategic work which will continue in 2024 with a focus on establishing a cost-effective path forward. Community engagement and investment activities will continue in 2024. One of the largest undeveloped Cu-Au-Mo projects in the Americas Joint venture combines Relincho and La Fortuna to one project Project synergies to significantly reduce capital expenditure NuevaUnión (Relincho), Chile Royalty Area Proposed Pit Iquique Antofagasta La Serena Santiago Copiapo Relincho Chile Argentina Chile Bolivia Candelaria Marte-Lobo El Morro Pascua-Lama Cerro Casali Andacollo Regalito Pacific Ocean Proposed Mill NuevaUnión (Relincho) 1.5% NSR kilometer 10 0 N 1.5% NSR Franco-Nevada Corporation ★ 95 TSX / NYSE: FNV Other Mining

2024 Asset Handbook Page 94 Page 96

2024 Asset Handbook Page 94 Page 96