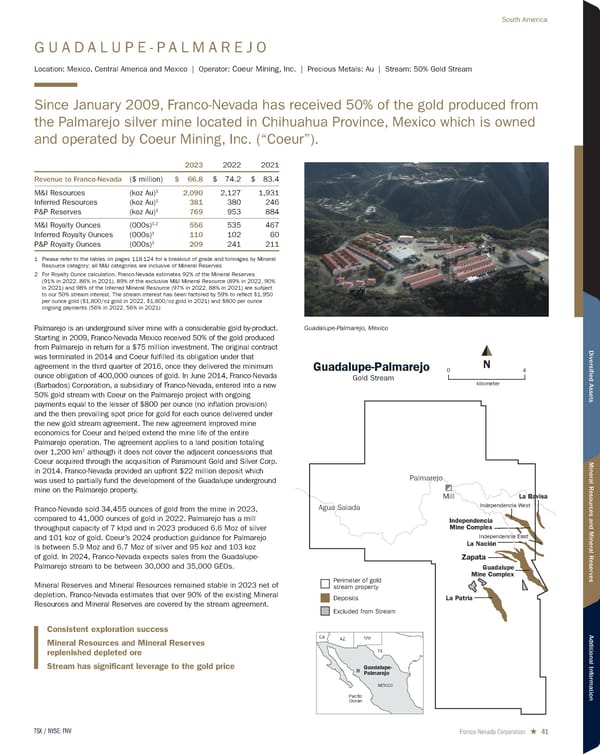

G U A D A L U P E - P A L M A R E J O Location: Mexico, Central America and Mexico | Operator: Coeur Mining, Inc. | Precious Metals: Au | Stream: 50% Gold Stream Since January 2009, Franco-Nevada has received 50% of the gold produced from the Palmarejo silver mine located in Chihuahua Province, Mexico which is owned and operated by Coeur Mining, Inc. (“Coeur”). 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ 66.8 $ 74.2 $ 83.4 M&I Resources (koz Au) 1 2,090 2,127 1,931 Inferred Resources (koz Au) 1 381 380 246 P&P Reserves (koz Au) 1 769 953 884 M&I Royalty Ounces (000s) 1,2 556 535 467 Inferred Royalty Ounces (000s) 1 110 102 60 P&P Royalty Ounces (000s) 1 209 241 211 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 92% of the Mineral Reserves (91% in 2022, 86% in 2021), 89% of the exclusive M&I Mineral Resource (89% in 2022, 90% in 2021) and 98% of the Inferred Mineral Resource (97% in 2022, 88% in 2021) are subject to our 50% stream interest. The stream interest has been factored by 59% to reflect $1,950 per ounce gold ($1,800/oz gold in 2022, $1,800/oz gold in 2021) and $800 per ounce ongoing payments (56% in 2022, 56% in 2021) Palmarejo is an underground silver mine with a considerable gold by-product. Starting in 2009, Franco-Nevada Mexico received 50% of the gold produced from Palmarejo in return for a $75 million investment. The original contract was terminated in 2014 and Coeur fulfilled its obligation under that agreement in the third quarter of 2016, once they delivered the minimum ounce obligation of 400,000 ounces of gold. In June 2014, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, entered into a new 50% gold stream with Coeur on the Palmarejo project with ongoing payments equal to the lesser of $800 per ounce (no inflation provision) and the then prevailing spot price for gold for each ounce delivered under the new gold stream agreement. The new agreement improved mine economics for Coeur and helped extend the mine life of the entire Palmarejo operation. The agreement applies to a land position totaling over 1,200 km 2 although it does not cover the adjacent concessions that Coeur acquired through the acquisition of Paramount Gold and Silver Corp. in 2014. Franco-Nevada provided an upfront $22 million deposit which was used to partially fund the development of the Guadalupe underground mine on the Palmarejo property. Franco-Nevada sold 34,455 ounces of gold from the mine in 2023, compared to 41,000 ounces of gold in 2022. Palmarejo has a mill throughput capacity of 7 ktpd and in 2023 produced 6.6 Moz of silver and 101 koz of gold. Coeur’s 2024 production guidance for Palmarejo is between 5.9 Moz and 6.7 Moz of silver and 95 koz and 103 koz of gold. In 2024, Franco-Nevada expects sales from the Guadalupe- Palmarejo stream to be between 30,000 and 35,000 GEOs. Mineral Reserves and Mineral Resources remained stable in 2023 net of depletion. Franco-Nevada estimates that over 90% of the existing Mineral Resources and Mineral Reserves are covered by the stream agreement. Consistent exploration success Mineral Resources and Mineral Reserves replenished depleted ore Stream has significant leverage to the gold price Palmarejo Agua Salada Mill Guadalupe Mine Complex La Nación La Bavisa Zapata La Patria Independencia Mine Complex Independencia West Pacific Ocean NM TX CA AZ MEXICO Guadalupe-Palmarejo Gold Stream Perimeter of gold stream property Excluded from Stream Deposits Guadalupe- Palmarejo kilometer 4 0 N Independencia East Guadalupe-Palmarejo, Mexico Franco-Nevada Corporation ★ 41 TSX / NYSE: FNV South America

2024 Asset Handbook Page 40 Page 42

2024 Asset Handbook Page 40 Page 42