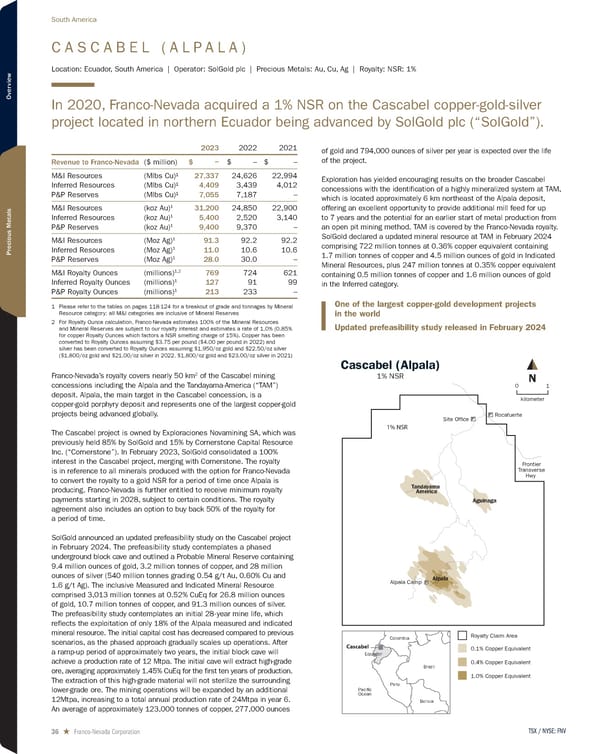

C A S C A B E L ( A L P A L A ) Location: Ecuador, South America | Operator: SolGold plc | Precious Metals: Au, Cu, Ag | Royalty: NSR: 1% In 2020, Franco-Nevada acquired a 1% NSR on the Cascabel copper-gold-silver project located in northern Ecuador being advanced by SolGold plc (“SolGold”). 2023 2022 2021 Revenue to Franco-Nevada ($ million) $ − $ – $ – M&I Resources (Mlbs Cu)¹ 27,337 24,626 22,994 Inferred Resources (Mlbs Cu)¹ 4,409 3,439 4,012 P&P Reserves (Mlbs Cu)¹ 7,055 7,187 – M&I Resources (koz Au) 1 31,200 24,850 22,900 Inferred Resources (koz Au) 1 5,400 2,520 3,140 P&P Reserves (koz Au) 1 9,400 9,370 – M&I Resources (Moz Ag) 1 91.3 92.2 92.2 Inferred Resources (Moz Ag) 1 11.0 10.6 10.6 P&P Reserves (Moz Ag) 1 28.0 30.0 – M&I Royalty Ounces (millions) 1,2 769 724 621 Inferred Royalty Ounces (millions) 1 127 91 99 P&P Royalty Ounces (millions) 1 213 233 – 1 Please refer to the tables on pages 118-124 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 1.0% (0.85% for copper Royalty Ounces which factors a NSR smelting charge of 15%). Copper has been converted to Royalty Ounces assuming $3.75 per pound ($4.00 per pound in 2022) and silver has been converted to Royalty Ounces assuming $1,950/oz gold and $22.50/oz silver ($1,800/oz gold and $21.00/oz silver in 2022, $1,800/oz gold and $23.00/oz silver in 2021) Franco-Nevada’s royalty covers nearly 50 km 2 of the Cascabel mining concessions including the Alpala and the Tandayama-America (“TAM”) deposit. Alpala, the main target in the Cascabel concession, is a copper-gold porphyry deposit and represents one of the largest copper-gold projects being advanced globally. The Cascabel project is owned by Exploraciones Novamining SA, which was previously held 85% by SolGold and 15% by Cornerstone Capital Resource Inc. (“Cornerstone”). In February 2023, SolGold consolidated a 100% interest in the Cascabel project, merging with Cornerstone. The royalty is in reference to all minerals produced with the option for Franco-Nevada to convert the royalty to a gold NSR for a period of time once Alpala is producing. Franco-Nevada is further entitled to receive minimum royalty payments starting in 2028, subject to certain conditions. The royalty agreement also includes an option to buy back 50% of the royalty for a period of time. SolGold announced an updated prefeasibility study on the Cascabel project in February 2024. The prefeasibility study contemplates a phased underground block cave and outlined a Probable Mineral Reserve containing 9.4 million ounces of gold, 3.2 million tonnes of copper, and 28 million ounces of silver (540 million tonnes grading 0.54 g/t Au, 0.60% Cu and 1.6 g/t Ag). The inclusive Measured and Indicated Mineral Resource comprised 3,013 million tonnes at 0.52% CuEq for 26.8 million ounces of gold, 10.7 million tonnes of copper, and 91.3 million ounces of silver. The prefeasibility study contemplates an initial 28-year mine life, which reflects the exploitation of only 18% of the Alpala measured and indicated mineral resource. The initial capital cost has decreased compared to previous scenarios, as the phased approach gradually scales up operations. After a ramp-up period of approximately two years, the initial block cave will achieve a production rate of 12 Mtpa. The initial cave will extract high-grade ore, averaging approximately 1.45% CuEq for the first ten years of production. The extraction of this high-grade material will not sterilize the surrounding lower-grade ore. The mining operations will be expanded by an additional 12Mtpa, increasing to a total annual production rate of 24Mtpa in year 6. An average of approximately 123,000 tonnes of copper, 277,000 ounces of gold and 794,000 ounces of silver per year is expected over the life of the project. Exploration has yielded encouraging results on the broader Cascabel concessions with the identification of a highly mineralized system at TAM, which is located approximately 6 km northeast of the Alpala deposit, offering an excellent opportunity to provide additional mill feed for up to 7 years and the potential for an earlier start of metal production from an open pit mining method. TAM is covered by the Franco-Nevada royalty. SolGold declared a updated mineral resource at TAM in February 2024 comprising 722 million tonnes at 0.36% copper equivalent containing 1.7 million tonnes of copper and 4.5 million ounces of gold in Indicated Mineral Resources, plus 247 million tonnes at 0.35% copper equivalent containing 0.5 million tonnes of copper and 1.6 million ounces of gold in the Inferred category. One of the largest copper-gold development projects in the world Updated prefeasibility study released in February 2024 0.4% Copper Equivalent 1.0% Copper Equivalent Royalty Claim Area 0.1% Copper Equivalent Pacific Ocean Argentina Bolivia Peru Brazil Colombia Chile Cascabel Equador Alpala Rocafuerte Alpala Camp Tandayama America Frontier Transverse Hwy Aguinaga Site Office 1% NSR Cascabel (Alpala) 1% NSR kilometer 1 0 N TSX / NYSE: FNV 36 ★ Franco-Nevada Corporation South America

2024 Asset Handbook Page 35 Page 37

2024 Asset Handbook Page 35 Page 37