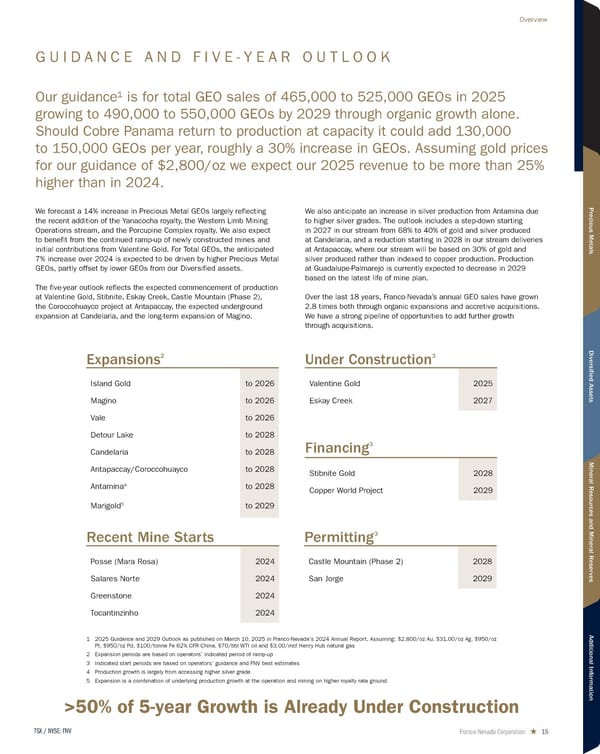

>50% of 5-year Growth is Already Under Construction 1 2025 Guidance and 2029 Outlook as published on March 10, 2025 in Franco-Nevada's 2024 Annual Report. Assuming: $2,800/oz Au, $31.00/oz Ag, $950/oz Pt, $950/oz Pd, $100/tonne Fe 62% CFR China, $70/bbl WTI oil and $3.00/mcf Henry Hub natural gas 2 Expansion periods are based on operators’ indicated period of ramp-up 3 Indicated start periods are based on operators’ guidance and FNV best estimates 4 Production growth is largely from accessing higher silver grade 5 Expansion is a combination of underlying production growth at the operation and mining on higher royalty rate ground Expansions 2 Island Gold to 2026 Magino to 2026 Vale to 2026 Detour Lake to 2028 Candelaria to 2028 Antapaccay/Coroccohuayco to 2028 Antamina 4 to 2028 Marigold 5 to 2029 Under Construction 3 Valentine Gold 2025 Eskay Creek 2027 Recent Mine Starts Posse (Mara Rosa) 2024 Salares Norte 2024 Greenstone 2024 Tocantinzinho 2024 Permitting 3 Castle Mountain (Phase 2) 2028 San Jorge 2029 Financing 3 Stibnite Gold 2028 Copper World Project 2029 G U I D A N C E A N D F I V E - Y E A R O U T L O O K Our guidance¹ is for total GEO sales of 465,000 to 525,000 GEOs in 2025 growing to 490,000 to 550,000 GEOs by 2029 through organic growth alone. Should Cobre Panama return to production at capacity it could add 130,000 to 150,000 GEOs per year, roughly a 30% increase in GEOs. Assuming gold prices for our guidance of $2,800/oz we expect our 2025 revenue to be more than 25% higher than in 2024. We forecast a 14% increase in Precious Metal GEOs largely reflecting the recent addition of the Yanacocha royalty, the Western Limb Mining Operations stream, and the Porcupine Complex royalty. We also expect to benefit from the continued ramp-up of newly constructed mines and initial contributions from Valentine Gold. For Total GEOs, the anticipated 7% increase over 2024 is expected to be driven by higher Precious Metal GEOs, partly offset by lower GEOs from our Diversified assets. The five-year outlook reflects the expected commencement of production at Valentine Gold, Stibnite, Eskay Creek, Castle Mountain (Phase 2), the Coroccohuayco project at Antapaccay, the expected underground expansion at Candelaria, and the long-term expansion of Magino. We also anticipate an increase in silver production from Antamina due to higher silver grades. The outlook includes a step-down starting in 2027 in our stream from 68% to 40% of gold and silver produced at Candelaria, and a reduction starting in 2028 in our stream deliveries at Antapaccay, where our stream will be based on 30% of gold and silver produced rather than indexed to copper production. Production at Guadalupe-Palmarejo is currently expected to decrease in 2029 based on the latest life of mine plan. Over the last 18 years, Franco-Nevada’s annual GEO sales have grown 2.8 times both through organic expansions and accretive acquisitions. We have a strong pipeline of opportunities to add further growth through acquisitions. Franco-Nevada Corporation ★ 15 TSX / NYSE: FNV Overview

2025 Asset Handbook Page 14 Page 16

2025 Asset Handbook Page 14 Page 16