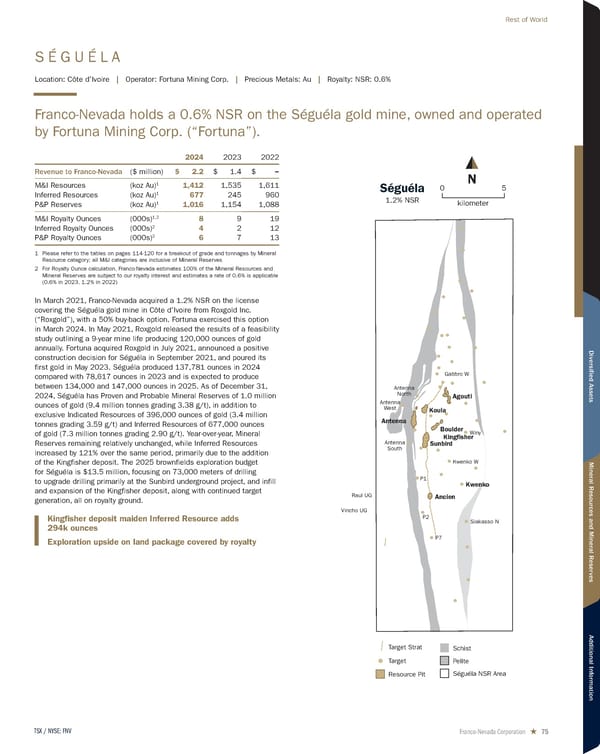

S É G U É L A Location: Côte d’Ivoire | Operator: Fortuna Mining Corp. | Precious Metals: Au | Royalty: NSR: 0.6% Franco-Nevada holds a 0.6% NSR on the Séguéla gold mine, owned and operated by Fortuna Mining Corp. (“Fortuna”). 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 2.2 $ 1.4 $ − M&I Resources (koz Au) 1 1,412 1,535 1,611 Inferred Resources (koz Au) 1 677 245 960 P&P Reserves (koz Au) 1 1,016 1,154 1,088 M&I Royalty Ounces (000s) 1,2 8 9 19 Inferred Royalty Ounces (000s) 2 4 2 12 P&P Royalty Ounces (000s) 2 6 7 13 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 0.6% is applicable (0.6% in 2023, 1.2% in 2022) In March 2021, Franco-Nevada acquired a 1.2% NSR on the license covering the Séguéla gold mine in Côte d’Ivoire from Roxgold Inc. (“Roxgold”), with a 50% buy-back option. Fortuna exercised this option in March 2024. In May 2021, Roxgold released the results of a feasibility study outlining a 9-year mine life producing 120,000 ounces of gold annually. Fortuna acquired Roxgold in July 2021, announced a positive construction decision for Séguéla in September 2021, and poured its first gold in May 2023. Séguéla produced 137,781 ounces in 2024 compared with 78,617 ounces in 2023 and is expected to produce between 134,000 and 147,000 ounces in 2025. As of December 31, 2024, Séguéla has Proven and Probable Mineral Reserves of 1.0 million ounces of gold (9.4 million tonnes grading 3.38 g/t), in addition to exclusive Indicated Resources of 396,000 ounces of gold (3.4 million tonnes grading 3.59 g/t) and Inferred Resources of 677,000 ounces of gold (7.3 million tonnes grading 2.90 g/t). Year-over-year, Mineral Reserves remaining relatively unchanged, while Inferred Resources increased by 121% over the same period, primarily due to the addition of the Kingfisher deposit. The 2025 brownfields exploration budget for Séguéla is $13.5 million, focusing on 73,000 meters of drilling to upgrade drilling primarily at the Sunbird underground project, and infill and expansion of the Kingfisher deposit, along with continued target generation, all on royalty ground. Séguéla 1.2% NSR kilometer 5 0 N Vincho UG Raul UG Ancien Agouti Boulder Winy Gabbro W Antenna South Antenna North Antenna West P1 Kwenko Siakasso N P7 P2 Kwenko W Koula Antenna Sunbird Schist Resource Pit Target Target Strat Séguéla NSR Area Pelite Kingfisher Kingfisher deposit maiden Inferred Resource adds 294k ounces Exploration upside on land package covered by royalty Franco-Nevada Corporation ★ 75 TSX / NYSE: FNV Rest of World

2025 Asset Handbook Page 74 Page 76

2025 Asset Handbook Page 74 Page 76