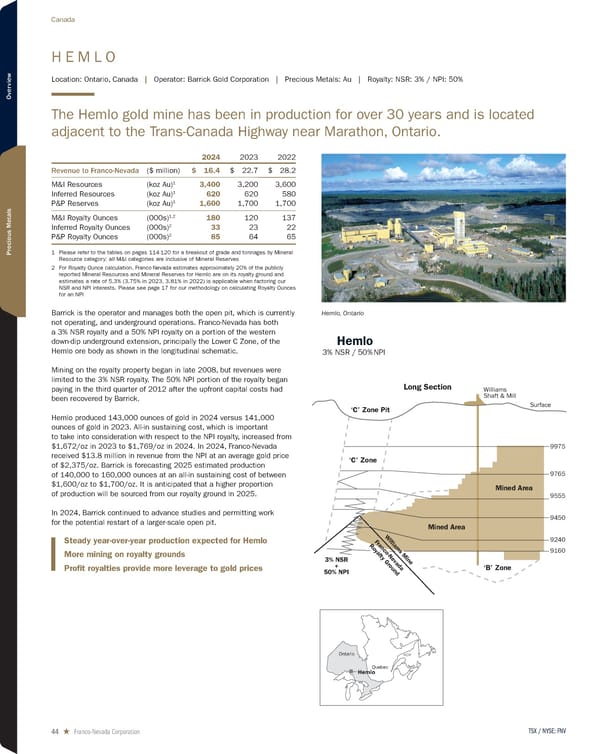

H E M L O Location: Ontario, Canada | Operator: Barrick Gold Corporation | Precious Metals: Au | Royalty: NSR: 3% / NPI: 50% The Hemlo gold mine has been in production for over 30 years and is located adjacent to the Trans-Canada Highway near Marathon, Ontario. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 16.4 $ 22.7 $ 28.2 M&I Resources (koz Au) 1 3,400 3,200 3,600 Inferred Resources (koz Au) 1 620 620 580 P&P Reserves (koz Au) 1 1,600 1,700 1,700 M&I Royalty Ounces (000s) 1,2 180 120 137 Inferred Royalty Ounces (000s) 2 33 23 22 P&P Royalty Ounces (000s) 2 85 64 65 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates approximately 20% of the publicly reported Mineral Resources and Mineral Reserves for Hemlo are on its royalty ground and estimates a rate of 5.3% (3.75% in 2023, 3.81% in 2022) is applicable when factoring our NSR and NPI interests. Please see page 17 for our methodology on calculating Royalty Ounces for an NPI Barrick is the operator and manages both the open pit, which is currently not operating, and underground operations. Franco-Nevada has both a 3% NSR royalty and a 50% NPI royalty on a portion of the western down-dip underground extension, principally the Lower C Zone, of the Hemlo ore body as shown in the longitudinal schematic. Mining on the royalty property began in late 2008, but revenues were limited to the 3% NSR royalty. The 50% NPI portion of the royalty began paying in the third quarter of 2012 after the upfront capital costs had been recovered by Barrick. Hemlo produced 143,000 ounces of gold in 2024 versus 141,000 ounces of gold in 2023. All-in sustaining cost, which is important to take into consideration with respect to the NPI royalty, increased from $1,672/oz in 2023 to $1,769/oz in 2024. In 2024, Franco-Nevada received $13.8 million in revenue from the NPI at an average gold price of $2,375/oz. Barrick is forecasting 2025 estimated production of 140,000 to 160,000 ounces at an all-in sustaining cost of between $1,600/oz to $1,700/oz. It is anticipated that a higher proportion of production will be sourced from our royalty ground in 2025. In 2024, Barrick continued to advance studies and permitting work for the potential restart of a larger-scale open pit. Hemlo, Ontario Quebec Ontario Hemlo Hemlo 3% NSR / 50% NPI Long Section ‘C’ Zone Pit Williams Shaft & Mill Surface Mined Area 3% NSR + 50% NPI ‘C’ Zone ‘B’ Zone 9975 9765 9555 9450 9240 9160 Mined Area Williams Mine Franco-Nevada Royalty Ground Steady year-over-year production expected for Hemlo More mining on royalty grounds Profit royalties provide more leverage to gold prices TSX / NYSE: FNV 44 ★ Franco-Nevada Corporation Canada

2025 Asset Handbook Page 43 Page 45

2025 Asset Handbook Page 43 Page 45