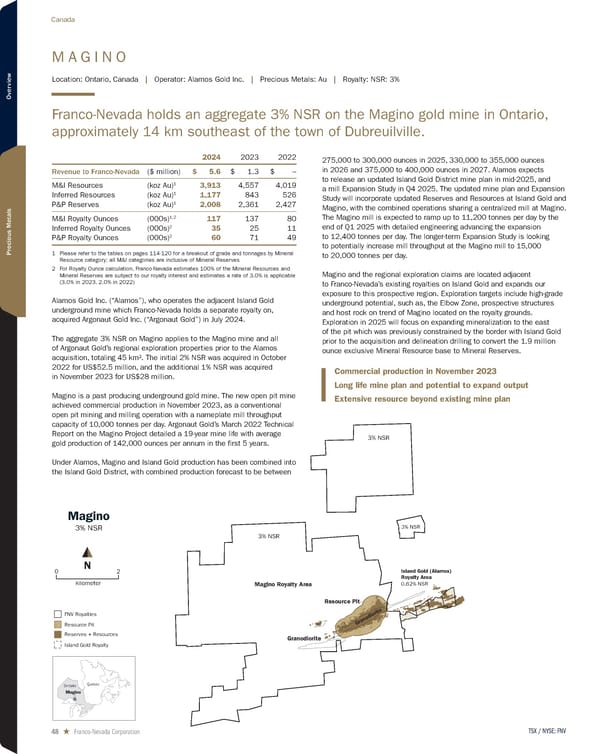

FNV Royalties Island Gold Royalty Resource Pit Reserves + Resources Magino 3% NSR kilometer 2 0 N Granodiorite Resource Pit Magino Royalty Area 3% NSR 3% NSR 0.62% NSR Granodiorite 3% NSR Island Gold (Alamos) Royalty Area Quebec Ontario Magino M A G I N O Location: Ontario, Canada | Operator: Alamos Gold Inc. | Precious Metals: Au | Royalty: NSR: 3% Franco-Nevada holds an aggregate 3% NSR on the Magino gold mine in Ontario, approximately 14 km southeast of the town of Dubreuilville. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 5.6 $ 1.3 $ – M&I Resources (koz Au) 1 3,913 4,557 4,019 Inferred Resources (koz Au) 1 1,177 843 526 P&P Reserves (koz Au) 1 2,008 2,361 2,427 M&I Royalty Ounces (000s) 1,2 117 137 80 Inferred Royalty Ounces (000s) 2 35 25 11 P&P Royalty Ounces (000s) 2 60 71 49 1 Please refer to the tables on pages 114-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Resources and Mineral Reserves are subject to our royalty interest and estimates a rate of 3.0% is applicable (3.0% in 2023, 2.0% in 2022) Alamos Gold Inc. (“Alamos”), who operates the adjacent Island Gold underground mine which Franco-Nevada holds a separate royalty on, acquired Argonaut Gold Inc. (“Argonaut Gold”) in July 2024. The aggregate 3% NSR on Magino applies to the Magino mine and all of Argonaut Gold’s regional exploration properties prior to the Alamos acquisition, totaling 45 km 2 . The initial 2% NSR was acquired in October 2022 for US$52.5 million, and the additional 1% NSR was acquired in November 2023 for US$28 million. Magino is a past producing underground gold mine. The new open pit mine achieved commercial production in November 2023, as a conventional open pit mining and milling operation with a nameplate mill throughput capacity of 10,000 tonnes per day. Argonaut Gold’s March 2022 Technical Report on the Magino Project detailed a 19-year mine life with average gold production of 142,000 ounces per annum in the first 5 years. Under Alamos, Magino and Island Gold production has been combined into the Island Gold District, with combined production forecast to be between 275,000 to 300,000 ounces in 2025, 330,000 to 355,000 ounces in 2026 and 375,000 to 400,000 ounces in 2027. Alamos expects to release an updated Island Gold District mine plan in mid-2025, and a mill Expansion Study in Q4 2025. The updated mine plan and Expansion Study will incorporate updated Reserves and Resources at Island Gold and Magino, with the combined operations sharing a centralized mill at Magino. The Magino mill is expected to ramp up to 11,200 tonnes per day by the end of Q1 2025 with detailed engineering advancing the expansion to 12,400 tonnes per day. The longer-term Expansion Study is looking to potentially increase mill throughput at the Magino mill to 15,000 to 20,000 tonnes per day. Magino and the regional exploration claims are located adjacent to Franco-Nevada’s existing royalties on Island Gold and expands our exposure to this prospective region. Exploration targets include high-grade underground potential, such as, the Elbow Zone, prospective structures and host rock on trend of Magino located on the royalty grounds. Exploration in 2025 will focus on expanding mineralization to the east of the pit which was previously constrained by the border with Island Gold prior to the acquisition and delineation drilling to convert the 1.9 million ounce exclusive Mineral Resource base to Mineral Reserves. FNV Royalties Island Gold Royalty Resource Pit Reserves + Resources Magino 3% NSR kilometer 2 0 N Granodiorite Resource Pit Magino Royalty Area 3% NSR 3% NSR 0.62% NSR Granodiorite 3% NSR Island Gold (Alamos) Royalty Area Quebec Ontario Magino Commercial production in November 2023 Long life mine plan and potential to expand output Extensive resource beyond existing mine plan TSX / NYSE: FNV 48 ★ Franco-Nevada Corporation Canada

2025 Asset Handbook Page 47 Page 49

2025 Asset Handbook Page 47 Page 49