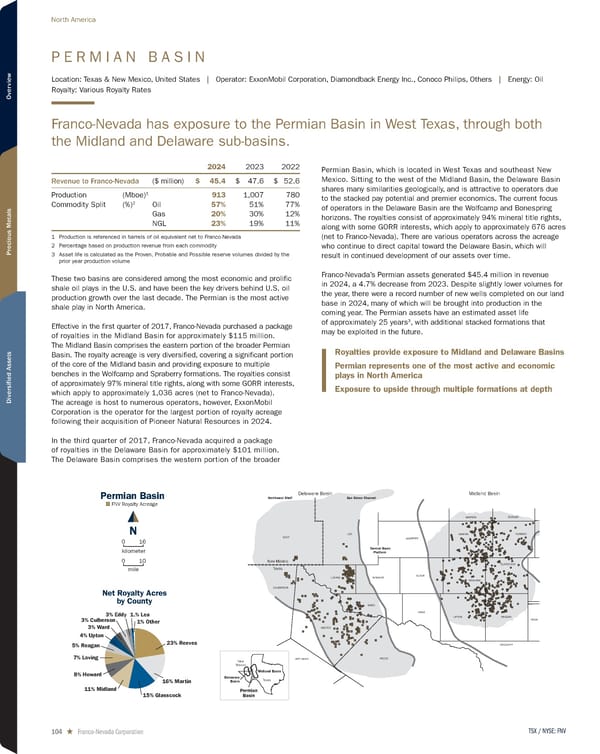

P E R M I A N B A S I N Location: Texas & New Mexico, United States | Operator: ExxonMobil Corporation, Diamondback Energy Inc., Conoco Philips, Others | Energy: Oil Royalty: Various Royalty Rates Franco-Nevada has exposure to the Permian Basin in West Texas, through both the Midland and Delaware sub-basins. 2024 2023 2022 Revenue to Franco-Nevada ($ million) $ 45.4 $ 47.6 $ 52.6 Production (Mboe) 1 913 1,007 780 Commodity Split (%) 2 Oil 57% 51% 77% Gas 20% 30% 12% NGL 23% 19% 11% 1 Production is referenced in barrels of oil equivalent net to Franco-Nevada 2 Percentage based on production revenue from each commodity 3 Asset life is calculated as the Proven, Probable and Possible reserve volumes divided by the prior year production volume These two basins are considered among the most economic and prolific shale oil plays in the U.S. and have been the key drivers behind U.S. oil production growth over the last decade. The Permian is the most active shale play in North America. Effective in the first quarter of 2017, Franco-Nevada purchased a package of royalties in the Midland Basin for approximately $115 million. The Midland Basin comprises the eastern portion of the broader Permian Basin. The royalty acreage is very diversified, covering a significant portion of the core of the Midland basin and providing exposure to multiple benches in the Wolfcamp and Spraberry formations. The royalties consist of approximately 97% mineral title rights, along with some GORR interests, which apply to approximately 1,036 acres (net to Franco-Nevada). The acreage is host to numerous operators, however, ExxonMobil Corporation is the operator for the largest portion of royalty acreage following their acquisition of Pioneer Natural Resources in 2024. In the third quarter of 2017, Franco-Nevada acquired a package of royalties in the Delaware Basin for approximately $101 million. The Delaware Basin comprises the western portion of the broader Permian Basin, which is located in West Texas and southeast New Mexico. Sitting to the west of the Midland Basin, the Delaware Basin shares many similarities geologically, and is attractive to operators due to the stacked pay potential and premier economics. The current focus of operators in the Delaware Basin are the Wolfcamp and Bonespring horizons. The royalties consist of approximately 94% mineral title rights, along with some GORR interests, which apply to approximately 676 acres (net to Franco-Nevada). There are various operators across the acreage who continue to direct capital toward the Delaware Basin, which will result in continued development of our assets over time. Franco-Nevada’s Permian assets generated $45.4 million in revenue in 2024, a 4.7% decrease from 2023. Despite slightly lower volumes for the year, there were a record number of new wells completed on our land base in 2024, many of which will be brought into production in the coming year. The Permian assets have an estimated asset life of approximately 25 years 3, with additional stacked formations that may be exploited in the future. REAGAN GLASSCOCK MIDLAND ECTOR UPTON CRANE HOWARD MARTIN ANDREWS BORDEN DAWSON CROCKETT IRION Midland Basin WINKLER PECOS REEVES WARD CULBERSON LOVING LEA EDDY JEFF DAVIS New Mexico Texas San Simon Channel Northwest Shelf Central Basin Platform Delaware Basin Net Royalty Acres by County 23% Reeves 16% Martin 15% Glasscock 11% Midland 8% Howard 7% Loving 5% Reagan 4% Upton 3% Ward 3% Culberson 3% Eddy 1.% Lea 1% Other Permian Basin FNV Royalty Acreage Texas Midland Basin Delaware Basin New Mexico Permian Basin N 16 mile 10 0 0 kilometer Royalties provide exposure to Midland and Delaware Basins Permian represents one of the most active and economic plays in North America Exposure to upside through multiple formations at depth TSX / NYSE: FNV 104 ★ Franco-Nevada Corporation North America

2025 Asset Handbook Page 103 Page 105

2025 Asset Handbook Page 103 Page 105