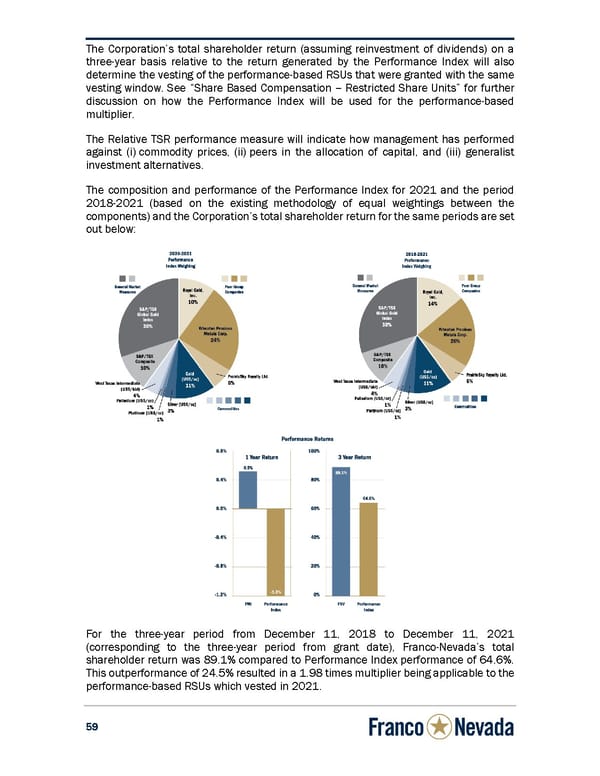

5 5 9 The Corporation’s total shareholder return (a ssuming reinvestment of dividends) on a three-year basis relative to the return generated by the Performance Index will also determine the vesting of the performance-based RSUs that were granted with the same vesting window. See “Share Based Compensati on – Restricted Share Units” for further discussion on how the Performance Index will be used for the performance-based multiplier. The Relative TSR performance measure will indicate how management has performed against (i) commodity prices, (ii) peers in the allocation of capital, and (iii) generalist investment alternatives. The composition and performance of the Performance Index for 2021 and the period 2018-2021 (based on the existing method ology of equal weig htings between the components) and the Corporation’s total shareh older return for the same periods are set out below: For the three-year period from December 11, 2018 to December 11, 2021 (corresponding to the three-year period from grant date), Franco-Nevada’s total shareholder return was 89.1% compared to Performance Index performance of 64.6%. This outperformance of 24.5% resulted in a 1.98 times multiplier being applicable to the performance-based RSUs which vested in 2021.

Circular Page 66 Page 68

Circular Page 66 Page 68