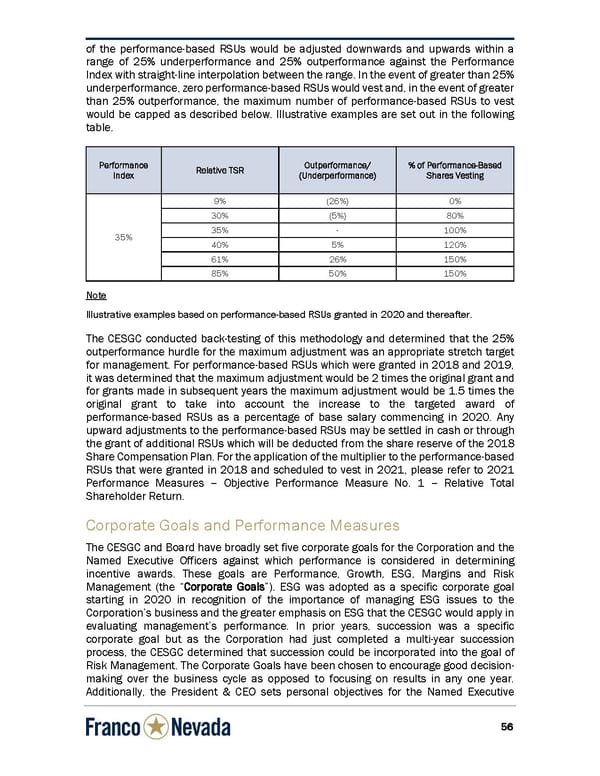

5 5 6 of the performance-based RSUs would be adjusted downwards and upwards within a range of 25% underperformance and 25% outperformance against the Performance Index with straight-line interpolation between the range. In the event of greater than 25% underperformance, zero performance-based RSUs would vest and, in the event of greater than 25% outperformance, the maximum numb er of performance-based RSUs to vest would be capped as described below. Illustrative examples are set out in the following table. P P e r f o r m a n c e I n d e x R e l a t i v e T S R O u t p e r f o r m a n c e / ( U n d e r p e r f o r m a n c e ) % o f P e r f o r m a n c e - B a s e d S h a r e s V e s t i n g 35% 9% (26%) 0% 30% (5%) 80% 35% - 100% 40% 5% 120% 61% 26% 150% 85% 50% 150% Note Illustrative examples based on performance-based RSUs granted in 2020 and thereafter. The CESGC conducted back-testing of this methodology and determined that the 25% outperformance hurdle for the maximum adjustment was an appropriate stretch target for management. For performance-based RSUs which were granted in 2018 and 2019, it was determined that the maximum adjustment would be 2 times the original grant and for grants made in subsequent years the maximum adjustment would be 1.5 times the original grant to take into account the increase to the targeted award of performance-based RSUs as a percentage of base salary commencing in 2020. Any upward adjustments to the performance-based RSUs may be settled in cash or through the grant of additional RSUs which will be deducted from the share reserve of the 2018 Share Compensation Plan. For the application of the multiplier to the performance-based RSUs that were granted in 2018 and scheduled to vest in 2021, please refer to 2021 Performance Measures – Objective Perfor mance Measure No. 1 – Relative Total Shareholder Return. Corporate Goals and Performance Measures The CESGC and Board have broadly set five corporate goals for the Corporation and the Named Executive Officers against which performance is considered in determining incentive awards. These goals are Perfor mance, Growth, ESG, Margins and Risk Management (the “ C o r p o r a t e G o a l s ”). ESG was adopted as a specific corporate goal starting in 2020 in recognition of the importance of managing ESG issues to the Corporation’s business and the greater emphasis on ESG that the CESGC would apply in evaluating management’s performance. In prior years, succession was a specific corporate goal but as the Corporation ha d just completed a multi-year succession process, the CESGC determined that succession could be incorporated into the goal of Risk Management. The Corporate Goals have been chosen to encourage good decision- making over the business cycle as opposed to focusing on results in any one year. Additionally, the President & CEO sets pers onal objectives for the Named Executive

Circular Page 63 Page 65

Circular Page 63 Page 65