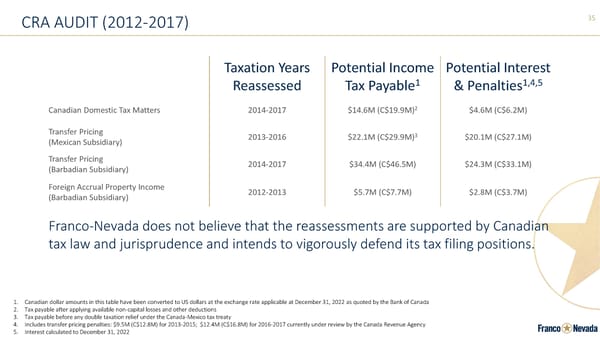

35 CRA AUDIT (2012 - 2017) Taxation Years Reassessed Potential Income Tax Payable 1 Potential Interest & Penalties 1,4,5 Canadian Domestic Tax Matters 2014 - 2017 $14.6M (C$19.9M) 2 $4.6M (C$6.2M) Transfer Pricing (Mexican Subsidiary) 2013 - 2016 $22.1M (C$29.9M) 3 $20.1M (C$27.1M) Transfer Pricing (Barbadian Subsidiary) 2014 - 2017 $34.4M (C$46.5M) $24.3M (C$33.1M) Foreign Accrual Property Income (Barbadian Subsidiary) 2012 - 2013 $5.7M (C$7.7M) $2.8M (C$3.7M) Franco - Nevada does not believe that the reassessments are supported by Canadian tax law and jurisprudence and intends to vigorously defend its tax filing positions. 1. Canadian dollar amounts in this table have been converted to US dollars at the exchange rate applicable at December 31, 2022 as quoted by the Bank of Canada 2. Tax payable after applying available non - capital losses and other deductions 3. Tax payable before any double taxation relief under the Canada - Mexico tax treaty 4. Includes transfer pricing penalties: $9.5M (C$12.8M) for 2013 - 2015; $12.4M (C$16.8M) for 2016 - 2017 currently under review by th e Canada Revenue Agency 5. Interest calculated to December 31, 2022

Corporate Presentation | Franco-Nevada Page 34

Corporate Presentation | Franco-Nevada Page 34