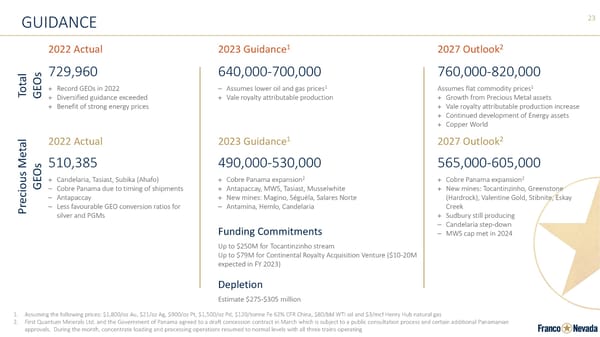

23 GUIDANCE Total GEOs 2022 Actual 2023 Guidance 1 2027 Outlook 2 729,960 + Record GEOs in 2022 + Diversified guidance exceeded + Benefit of strong energy prices 640,000 - 700,000 Assumes lower oil and gas prices 1 + Vale royalty attributable production 760,000 - 820,000 Assumes flat commodity prices 1 + Growth from Precious Metal assets + Vale royalty attributable production increase + Continued development of Energy assets + Copper World Precious Metal GEOs 2022 Actual 2023 Guidance 1 2027 Outlook 2 510,385 + Candelaria, Tasiast, Subika (Ahafo) Cobre Panama due to timing of shipments Antapaccay Less favourable GEO conversion ratios for silver and PGMs 490,000 - 530,000 + Cobre Panama expansion 2 + Antapaccay, MWS, Tasiast, Musselwhite + New mines: Magino, Sgula , Salares Norte Antamina, Hemlo, Candelaria 565,000 - 605,000 + Cobre Panama expansion 2 + New mines: Tocantinzinho, Greenstone (Hardrock), Valentine Gold, Stibnite, Eskay Creek + Sudbury still producing Candelaria step - down MWS cap met in 2024 F unding Commitments Up to $250M for Tocantinzinho stream Up to $79M for Continental Royalty Acquisition Venture ($10 - 20M expected in FY 2023) Depletion Estimate $275 - $305 million 1. Assuming the following prices: $1,800/oz Au, $21/oz Ag, $900/oz Pt, $1,500/oz Pd, $120/ tonne Fe 62% CFR China, $80/ bbl WTI oil and $3/mcf Henry Hub natural gas 2. First Quantum Minerals Ltd. and the Government of Panama agreed to a draft concession contract in March which is subject to a pu blic consultation process and certain additional Panamanian approvals. During the month, concentrate loading and processing operations resumed to normal levels with all three trains op era ting

Corporate Presentation | Franco-Nevada Page 22 Page 24

Corporate Presentation | Franco-Nevada Page 22 Page 24