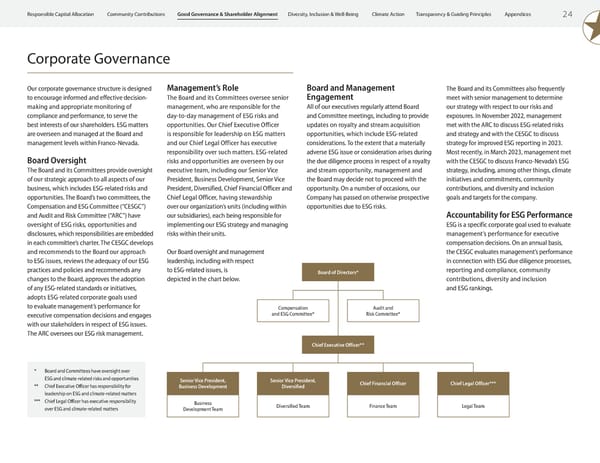

2 4 Appendices Transparency & Guiding Principles Climate Action Diversity, Inclusion & Well-Being Good Governance & Shareholder Alignment Community Contributions Responsible Capital Allocation Corporate Governance Our corporate governance structure is designed to encourage informed and effective decision- making and appropriate monitoring of compliance and performance, to serve the best interests of our shareholders. ESG matters are overseen and managed at the Board and management levels within Franco-Nevada. Board Oversight The Board and its Committees provide oversight of our strategic approach to all aspects of our business, which includes ESG-related risks and opportunities. The Board’s two committees, the Compensation and ESG Committee (“CESGC”) and Audit and Risk Committee (“ARC”) have oversight of ESG risks, opportunities and disclosures, which responsibilities are embedded in each committee’s charter. The CESGC develops and recommends to the Board our approach to ESG issues, reviews the adequacy of our ESG practices and policies and recommends any changes to the Board, approves the adoption of any ESG-related standards or initiatives, adopts ESG-related corporate goals used to evaluate management’s performance for executive compensation decisions and engages with our stakeholders in respect of ESG issues. The ARC oversees our ESG risk management. Management’s Role The Board and its Committees oversee senior management, who are responsible for the day-to-day management of ESG risks and opportunities. Our Chief Executive Officer is responsible for leadership on ESG matters and our Chief Legal Officer has executive responsibility over such matters. ESG-related risks and opportunities are overseen by our executive team, including our Senior Vice President, Business Development, Senior Vice President, Diversified, Chief Financial Officer and Chief Legal Officer, having stewardship over our organization’s units (including within our subsidiaries), each being responsible for implementing our ESG strategy and managing risks within their units. Our Board oversight and management leadership, including with respect to ESG-related issues, is depicted in the chart below. Board and Management Engagement All of our executives regularly attend Board and Committee meetings, including to provide updates on royalty and stream acquisition opportunities, which include ESG-related considerations. To the extent that a materially adverse ESG issue or consideration arises during the due diligence process in respect of a royalty and stream opportunity, management and the Board may decide not to proceed with the opportunity. On a number of occasions, our Company has passed on otherwise prospective opportunities due to ESG risks. The Board and its Committees also frequently meet with senior management to determine our strategy with respect to our risks and exposures. In November 2022, management met with the ARC to discuss ESG-related risks and strategy and with the CESGC to discuss strategy for improved ESG reporting in 2023. Most recently, in March 2023, management met with the CESGC to discuss Franco-Nevada’s ESG strategy, including, among other things, climate initiatives and commitments, community contributions, and diversity and inclusion goals and targets for the company. Accountability for ESG Performance ESG is a specific corporate goal used to evaluate management’s performance for executive compensation decisions. On an annual basis, the CESGC evaluates management’s performance in connection with ESG due diligence processes, reporting and compliance, community contributions, diversity and inclusion and ESG rankings. Business Development Team Senior Vice President, Business Development Diversified Team Senior Vice President, Diversified Compensation and ESG Committee* Finance Team Chief Financial Officer Audit and Risk Committee* Chief Executive Officer** Board of Directors* Legal Team Chief Legal Officer*** * Board and Committees have oversight over ESG and climate-related risks and opportunities ** Chief Executive Officer has responsibility for leadership on ESG and climate-related matters *** Chief Legal Officer has executive responsibility over ESG and climate-related matters

ESG Report 2023 Page 25 Page 27

ESG Report 2023 Page 25 Page 27