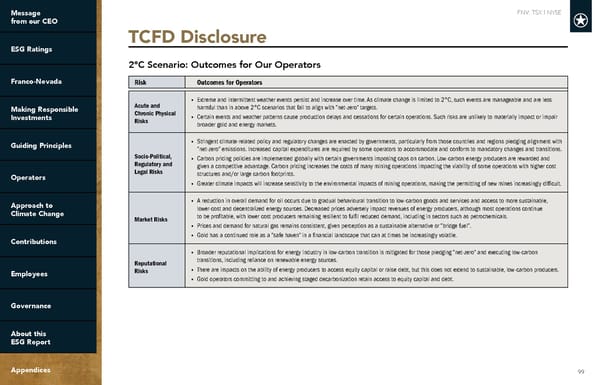

FNV: TSX | NYSE 99 TCFD Disclosure TCFD Disclosure 2°C Scenario: Outcomes for Our Operators Risk Outcomes for Operators Acute and Chronic Physical Risks • Extreme and intermittent weather events persist and increase over time. As climate change is limited to 2°C, such events are manageable and are less harmful than in above 2°C scenarios that fail to align with “net-zero” targets. • Certain events and weather patterns cause production delays and cessations for certain operations. Such risks are unlikely to materially impact or impair broader gold and energy markets. Socio-Political, Regulatory and Legal Risks • Stringent climate-related policy and regulatory changes are enacted by governments, particularly from those countries and regions pledging alignment with “net-zero” emissions. Increased capital expenditures are required by some operators to accommodate and conform to mandatory changes and transitions. • Carbon pricing policies are implemented globally with certain governments imposing caps on carbon. Low-carbon energy producers are rewarded and given a competitive advantage. Carbon pricing increases the costs of many mining operations impacting the viability of some operations with higher cost structures and/or large carbon footprints. • Greater climate impacts will increase sensitivity to the environmental impacts of mining operations, making the permitting of new mines increasingly difficult. Market Risks • A reduction in overall demand for oil occurs due to gradual behavioural transition to low-carbon goods and services and access to more sustainable, lower-cost and decentralized energy sources. Decreased prices adversely impact revenues of energy producers, although most operations continue to be profitable, with lower cost producers remaining resilient to fulfil reduced demand, including in sectors such as petrochemicals. • Prices and demand for natural gas remains consistent, given perception as a sustainable alternative or “bridge fuel”. • Gold has a continued role as a “safe haven” in a financial landscape that can at times be increasingly volatile. Reputational Risks • Broader reputational implications for energy industry in low-carbon transition is mitigated for those pledging “net-zero” and executing low-carbon transitions, including reliance on renewable energy sources. • There are impacts on the ability of energy producers to access equity capital or raise debt, but this does not extend to sustainable, low-carbon producers. • Gold operators committing to and achieving staged decarbonization retain access to equity capital and debt.

Simple Demo Page 98 Page 100

Simple Demo Page 98 Page 100