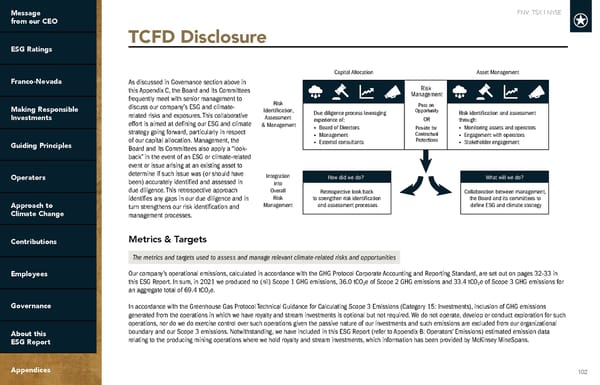

FNV: TSX | NYSE 102 TCFD Disclosure Metrics & Targets Our company’s operational emissions, calculated in accordance with the GHG Protocol Corporate Accounting and Reporting Standard, are set out on pages 32-33 in this ESG Report. In sum, in 2021 we produced no (nil) Scope 1 GHG emissions, 36.0 tCO 2 e of Scope 2 GHG emissions and 33.4 tCO 2 e of Scope 3 GHG emissions for an aggregate total of 69.4 tCO 2 e. In accordance with the Greenhouse Gas Protocol Technical Guidance for Calculating Scope 3 Emissions (Category 15: Investments), inclusion of GHG emissions generated from the operations in which we have royalty and stream investments is optional but not required. We do not operate, develop or conduct exploration for such operations, nor do we do exercise control over such operations given the passive nature of our investments and such emissions are excluded from our organizational boundary and our Scope 3 emissions. Notwithstanding, we have included in this ESG Report (refer to Appendix B: Operators’ Emissions) estimated emission data relating to the producing mining operations where we hold royalty and stream investments, which information has been provided by McKinsey MineSpans. The metrics and targets used to assess and manage relevant climate-related risks and opportunities Risk Manag ement Pass on Oppor tunity OR Pro vide for Contractual Protections Retrospective look back to strengthen risk identi cation and assessment processes Due dilig ence process le veraging experience of: • Board of Directors • Manag ement • Exter nal consultants How did we do? What will we do? Collaboration between management, the Board and its committees to de ne ESG and climate strategy Risk identi cation and assessment through: • Monitoring assets and operators • Eng ag ement with operators • Stak eholder eng ag ement Capital Allocation Risk Identi cation, Assessment & Management Integration into Overall Risk Management Asset Manag ement As discussed in Governance section above in this Appendix C, the Board and its Committees frequently meet with senior management to discuss our company’s ESG and climate- related risks and exposures. This collaborative effort is aimed at defining our ESG and climate strategy going forward, particularly in respect of our capital allocation. Management, the Board and its Committees also apply a “look- back” in the event of an ESG or climate-related event or issue arising at an existing asset to determine if such issue was (or should have been) accurately identified and assessed in due diligence. This retrospective approach identifies any gaps in our due diligence and in turn strengthens our risk identification and management processes.

Simple Demo Page 101 Page 103

Simple Demo Page 101 Page 103