Corporate Governance

Franco-Nevada integrates ESG into governance, with Board and management oversight, linking executive performance and compensation to ESG and climate goals.

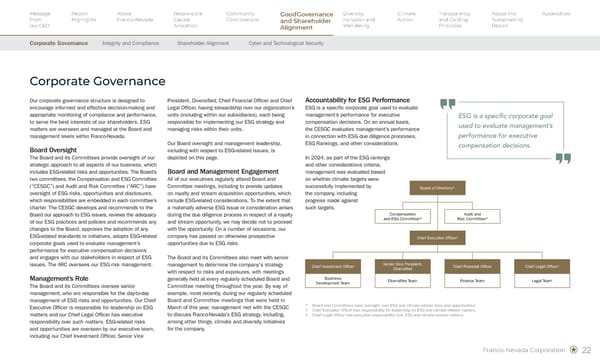

Franco-Nevada Corporation 22 Our corporate governance structure is designed to encourage informed and effective decision-making and appropriate monitoring of compliance and performance, to serve the best interests of our shareholders. ESG matters are overseen and managed at the Board and management levels within Franco-Nevada. Board Oversight The Board and its Committees provide oversight of our strategic approach to all aspects of our business, which includes ESG-related risks and opportunities. The Board’s two committees, the Compensation and ESG Committee (“CESGC”) and Audit and Risk Committee (“ARC”) have oversight of ESG risks, opportunities and disclosures, which responsibilities are embedded in each committee’s charter. The CESGC develops and recommends to the Board our approach to ESG issues, reviews the adequacy of our ESG practices and policies and recommends any changes to the Board, approves the adoption of any ESG-related standards or initiatives, adopts ESG-related corporate goals used to evaluate management’s performance for executive compensation decisions and engages with our stakeholders in respect of ESG issues. The ARC oversees our ESG risk management. Management’s Role The Board and its Committees oversee senior management, who are responsible for the day-to-day management of ESG risks and opportunities. Our Chief Executive Officer is responsible for leadership on ESG matters and our Chief Legal Officer has executive responsibility over such matters. ESG-related risks and opportunities are overseen by our executive team, including our Chief Investment Officer, Senior Vice President, Diversified, Chief Financial Officer and Chief Legal Officer, having stewardship over our organization’s units (including within our subsidiaries), each being responsible for implementing our ESG strategy and managing risks within their units. Our Board oversight and management leadership, including with respect to ESG-related issues, is depicted on this page. Board and Management Engagement All of our executives regularly attend Board and Committee meetings, including to provide updates on royalty and stream acquisition opportunities, which include ESG-related considerations. To the extent that a materially adverse ESG issue or consideration arises during the due diligence process in respect of a royalty and stream opportunity, we may decide not to proceed with the opportunity. On a number of occasions, our company has passed on otherwise prospective opportunities due to ESG risks. The Board and its Committees also meet with senior management to determine the company's strategy with respect to risks and exposures, with meetings generally held at every regularly scheduled Board and Committee meeting throughout the year. By way of example, most recently, during our regularly scheduled Board and Committee meetings that were held in March of this year, management met with the CESGC to discuss Franco-Nevada’s ESG strategy, including, among other things, climate and diversity initiatives for the company. Corporate Governance Accountability for ESG Performance ESG is a specific corporate goal used to evaluate management’s performance for executive compensation decisions. On an annual basis, the CESGC evaluates management’s performance in connection with ESG due diligence processes, ESG Rankings, and other considerations. In 2024, as part of the ESG rankings and other considerations criteria, management was evaluated based on whether climate targets were successfully implemented by the company, including progress made against such targets. * Board and Committees have oversight over ESG and climate-related risks and opportunities. † Chief Executive Officer has responsibility for leadership on ESG and climate-related matters. ◊ Chief Legal Officer has executive responsibility over ESG and climate-related matters. ESG is a specific corporate goal used to evaluate management’s performance for executive compensation decisions. Business Development Team Chief Investment Officer Diversified Team Senior Vice President, Diversified Compensation and ESG Committee* Finance Team Chief Financial Officer Audit and Risk Committee* Chief Executive Officer† Board of Directors* Legal Team Chief Legal Officer◊ Message from our CEO Report Highlights About Franco-Nevada Responsible Capital Allocation Community Contributions Diversity, Inclusion and Well-Being Climate Action Transparency and Guiding Principles About this Sustainability Report Appendices Good Governance and Shareholder Alignment Integrity and Compliance Shareholder Alignment Cyber and Technological Security Corporate Governance

Sustainability Report 2025 Page 23 Page 25

Sustainability Report 2025 Page 23 Page 25