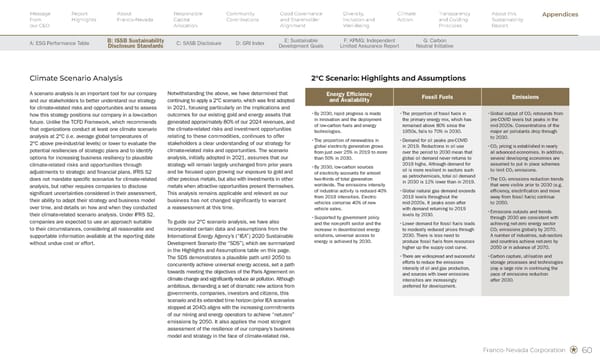

Franco-Nevada Corporation 60 A scenario analysis is an important tool for our company and our stakeholders to better understand our strategy for climate-related risks and opportunities and to assess how this strategy positions our company in a low-carbon future. Unlike the TCFD Framework, which recommends that organizations conduct at least one climate scenario analysis at 2°C (i.e. average global temperatures of 2°C above pre-industrial levels) or lower to evaluate the potential resiliencies of strategic plans and to identify options for increasing business resiliency to plausible climate-related risks and opportunities through adjustments to strategic and financial plans, IFRS S2 does not mandate specific scenarios for climate-related analysis, but rather requires companies to disclose significant uncertainties considered in their assessment, their ability to adapt their strategy and business model over time, and details on how and when they conducted their climate-related scenario analysis. Under IFRS S2, companies are expected to use an approach suitable to their circumstances, considering all reasonable and supportable information available at the reporting date without undue cost or effort. Notwithstanding the above, we have determined that continuing to apply a 2°C scenario, which was first adopted in 2021, focusing particularly on the implications and outcomes for our existing gold and energy assets that generated approximately 80% of our 2024 revenues, and the climate-related risks and investment opportunities relating to these commodities, continues to offer stakeholders a clear understanding of our strategy for climate-related risks and opportunities. The scenario analysis, initially adopted in 2021, assumes that our strategy will remain largely unchanged from prior years and be focused upon growing our exposure to gold and other precious metals, but also with investments in other metals when attractive opportunities present themselves. This analysis remains applicable and relevant as our business has not changed significantly to warrant a reassessment at this time. To guide our 2°C scenario analysis, we have also incorporated certain data and assumptions from the International Energy Agency’s (“IEA”) 2020 Sustainable Development Scenario (the “SDS”), which are summarized in the Highlights and Assumptions table on this page. The SDS demonstrates a plausible path until 2050 to concurrently achieve universal energy access, set a path towards meeting the objectives of the Paris Agreement on climate change and significantly reduce air pollution. Although ambitious, demanding a set of dramatic new actions from governments, companies, investors and citizens, this scenario and its extended time horizon (prior IEA scenarios stopped at 2040) aligns with the increasing commitments of our mining and energy operators to achieve “net-zero” emissions by 2050. It also applies the most stringent assessment of the resilience of our company’s business model and strategy in the face of climate-related risk. 2°C Scenario: Highlights and Assumptions Energy Efficiency and Availability Fossil Fuels Emissions • By 2030, rapid progress is made in innovation and the deployment of low-carbon fuels and energy technologies. • The proportion of renewables in global electricity generation grows from just over 25% in 2019 to more than 50% in 2030. • By 2030, low-carbon sources of electricity accounts for almost two-thirds of total generation worldwide. The emissions intensity of industrial activity is reduced 40% from 2019 intensities. Electric vehicles comprise 40% of new vehicle sales. • Supported by government policy and the non-profit sector and the increase in decentralized energy solutions, universal access to energy is achieved by 2030. • The proportion of fossil fuels in the primary energy mix, which has remained above 80% since the 1950s, falls to 70% in 2030. • Demand for oil peaks pre-COVID in 2019. Reductions in oil use over the period to 2030 mean that global oil demand never returns to 2019 highs. Although demand for oil is more resilient in sectors such as petrochemicals, total oil demand in 2030 is 12% lower than in 2019. • Global natural gas demand exceeds 2019 levels throughout the mid-2020s. It peaks soon after with demand returning to 2019 levels by 2030. • Lower demand for fossil fuels leads to modestly reduced prices through 2030. There is less need to produce fossil fuels from resources higher up the supply cost curve. • There are widespread and successful efforts to reduce the emissions intensity of oil and gas production, and sources with lower emissions intensities are increasingly preferred for development. • Global output of CO2 rebounds from pre-COVID levels but peaks in the mid-2020s. Concentrations of the major air pollutants drop through to 2030. • CO2 pricing is established in nearly all advanced economies. In addition, several developing economies are assumed to put in place schemes to limit CO2 emissions. • The CO2 emissions reduction trends that were visible prior to 2030 (e.g. efficiency, electrification and move away from fossil fuels) continue to 2050. • Emissions outputs and trends through 2030 are consistent with achieving net-zero energy sector CO2 emissions globally by 2070. A number of industries, sub-sectors and countries achieve net-zero by 2050 or in advance of 2070. • Carbon capture, utilisation and storage processes and technologies play a large role in continuing the pace of emissions reduction after 2030. Climate Scenario Analysis Message from our CEO Report Highlights About Franco-Nevada Responsible Capital Allocation Community Contributions Good Governance and Shareholder Alignment Diversity, Inclusion and Well-Being Climate Action Transparency and Guiding Principles About this Sustainability Report Appendices Appendices A: ESG Performance Table B: ISSB Sustainability Disclosure Standards C: SASB Disclosure D: GRI Index E: Sustainable Development Goals F: KPMG: Independent Limited Assurance Report G: Carbon Neutral Initiative

Sustainability Report 2025 Page 61 Page 63

Sustainability Report 2025 Page 61 Page 63