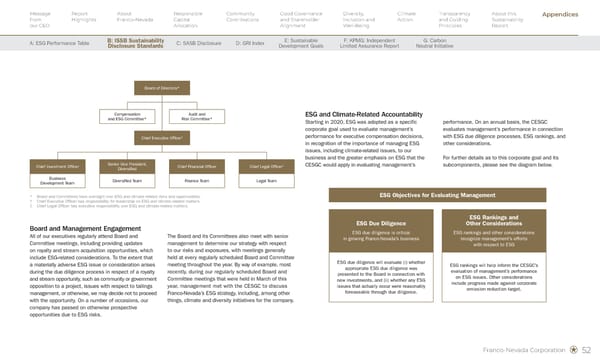

Franco-Nevada Corporation 52 ESG and Climate-Related Accountability Starting in 2020, ESG was adopted as a specific corporate goal used to evaluate management’s performance for executive compensation decisions, in recognition of the importance of managing ESG issues, including climate-related issues, to our business and the greater emphasis on ESG that the CESGC would apply in evaluating management’s performance. On an annual basis, the CESGC evaluates management’s performance in connection with ESG due diligence processes, ESG rankings, and other considerations. For further details as to this corporate goal and its subcomponents, please see the diagram below. ESG Objectives for Evaluating Management ESG Due Diligence ESG due diligence is critical in growing Franco-Nevada’s business ESG Rankings and Other Considerations ESG rankings and other considerations recognize management’s efforts with respect to ESG ESG due diligence will evaluate (i) whether appropriate ESG due diligence was presented to the Board in connection with new investments, and (ii) whether any ESG issues that actually occur were reasonably foreseeable through due diligence. ESG rankings will help inform the CESGC’s evaluation of management’s performance on ESG issues. Other considerations include progress made against corporate emission reduction target. Board and Management Engagement All of our executives regularly attend Board and Committee meetings, including providing updates on royalty and stream acquisition opportunities, which include ESG-related considerations. To the extent that a materially adverse ESG issue or consideration arises during the due diligence process in respect of a royalty and stream opportunity, such as community or government opposition to a project, issues with respect to tailings management, or otherwise, we may decide not to proceed with the opportunity. On a number of occasions, our company has passed on otherwise prospective opportunities due to ESG risks. The Board and its Committees also meet with senior management to determine our strategy with respect to our risks and exposures, with meetings generally held at every regularly scheduled Board and Committee meeting throughout the year. By way of example, most recently, during our regularly scheduled Board and Committee meetings that were held in March of this year, management met with the CESGC to discuss Franco-Nevada’s ESG strategy, including, among other things, climate and diversity initiatives for the company. Business Development Team Chief Investment Officer Diversified Team Senior Vice President, Diversified Compensation and ESG Committee* Finance Team Chief Financial Officer Audit and Risk Committee* Chief Executive Officer† Board of Directors* Legal Team Chief Legal Officer◊ * Board and Committees have oversight over ESG and climate-related risks and opportunities. † Chief Executive Officer has responsibility for leadership on ESG and climate-related matters. ◊ Chief Legal Officer has executive responsibility over ESG and climate-related matters. Message from our CEO Report Highlights About Franco-Nevada Responsible Capital Allocation Community Contributions Good Governance and Shareholder Alignment Diversity, Inclusion and Well-Being Climate Action Transparency and Guiding Principles About this Sustainability Report Appendices Appendices A: ESG Performance Table B: ISSB Sustainability Disclosure Standards C: SASB Disclosure D: GRI Index E: Sustainable Development Goals F: KPMG: Independent Limited Assurance Report G: Carbon Neutral Initiative

Sustainability Report 2025 Page 53 Page 55

Sustainability Report 2025 Page 53 Page 55