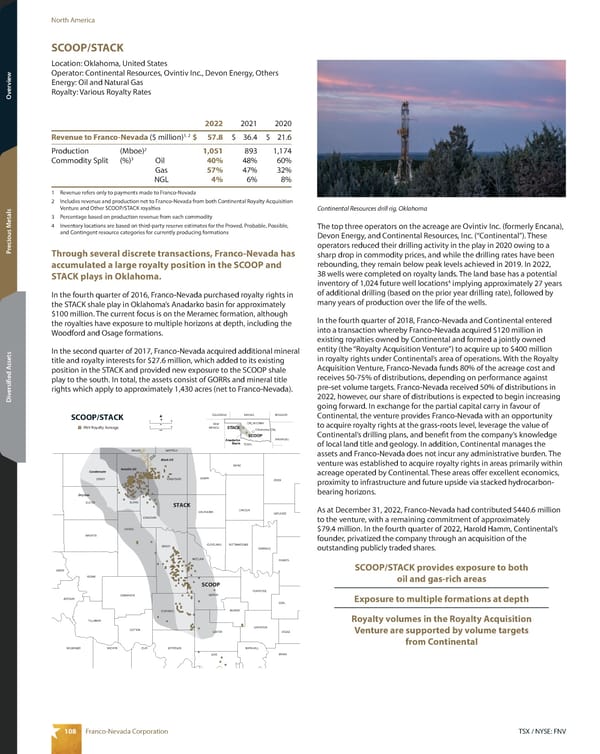

108 TSX / NYSE: FNV Franco-Nevada Corporation North America Overview Precious Metals Diversified Assets SCOOP/STACK Location: Oklahoma, United States Operator: Continental Resources, Ovintiv Inc., Devon Energy, Others Energy: Oil and Natural Gas Royalty: Various Royalty Rates GARFIELD N km 0 40 Black Oil Volatile Oil Condensate Dry Gas DEWEY BLAINE KINGFISHER MAJOR CANADIAN OKLAHOMA LINCOLN CREEK OKFUSKEE HUGHES COAL ATOKA BRYAN MARSHALL JOHNSTON PONTOTOC SEMINOLE POTTAWATOMIE CLEVELAND MCCLAIN GARVIN MURRAY CARTER LOVE JEFFERSON STEPHENS CLAY COTTON WICHITA WILBARGER TILLAMAN JACKSON KIOWA GRADY GREER WASHITA COMANCHE LOGAN PAYNE CADDO CUSTER Pressure Transition miles 0 25 SCOOP/STACK STACK FNV Royalty Acreage Oklahoma City OKLAHOMA SCOOP TEXAS KANSAS ARKANSAS NEW MEXICO MISSOURI COLORADO Anadarko Basin STACK SCOOP The top three operators on the acreage are Ovintiv Inc. (formerly Encana), Devon Energy, and Continental Resources, Inc. (“Continental”). These operators reduced their drilling activity in the play in 2020 owing to a sharp drop in commodity prices, and while the drilling rates have been rebounding, they remain below peak levels achieved in 2019. In 2022, 38 wells were completed on royalty lands. The land base has a potential inventory of 1,024 future well locations 4 implying approximately 27 years of additional drilling (based on the prior year drilling rate), followed by many years of production over the life of the wells. In the fourth quarter of 2018, Franco-Nevada and Continental entered into a transaction whereby Franco-Nevada acquired $120 million in existing royalties owned by Continental and formed a jointly owned entity (the “Royalty Acquisition Venture”) to acquire up to $400 million in royalty rights under Continental’s area of operations. With the Royalty Acquisition Venture, Franco-Nevada funds 80% of the acreage cost and receives 50-75% of distributions, depending on performance against pre-set volume targets. Franco-Nevada received 50% of distributions in 2022, however, our share of distributions is expected to begin increasing going forward. In exchange for the partial capital carry in favour of Continental, the venture provides Franco-Nevada with an opportunity to acquire royalty rights at the grass-roots level, leverage the value of Continental’s drilling plans, and benefit from the company’s knowledge of local land title and geology. In addition, Continental manages the assets and Franco-Nevada does not incur any administrative burden. The venture was established to acquire royalty rights in areas primarily within acreage operated by Continental. These areas offer excellent economics, proximity to infrastructure and future upside via stacked hydrocarbon- bearing horizons. As at December 31, 2022, Franco-Nevada had contributed $440.6 million to the venture, with a remaining commitment of approximately $79.4 million. In the fourth quarter of 2022, Harold Hamm, Continental’s founder, privatized the company through an acquisition of the outstanding publicly traded shares. SCOOP/STACK provides exposure to both oil and gas-rich areas Exposure to multiple formations at depth Royalty volumes in the Royalty Acquisition Venture are supported by volume targets from Continental 2022 2021 2020 Revenue to Franco-Nevada ($ million) 1, 2 $ 57.8 $ 36.4 $ 21.6 Production (Mboe) 2 1,051 893 1,174 Commodity Split (%) 3 Oil 40% 48% 60% Gas 57% 47% 32% NGL 4% 6% 8% 1 Revenue refers only to payments made to Franco-Nevada 2 Includes revenue and production net to Franco-Nevada from both Continental Royalty Acquisition Venture and Other SCOOP/STACK royalties 3 Percentage based on production revenue from each commodity 4 Inventory locations are based on third-party reserve estimates for the Proved, Probable, Possible, and Contingent resource categories for currently producing formations Through several discrete transactions, Franco-Nevada has accumulated a large royalty position in the SCOOP and STACK plays in Oklahoma. In the fourth quarter of 2016, Franco-Nevada purchased royalty rights in the STACK shale play in Oklahoma’s Anadarko basin for approximately $100 million. The current focus is on the Meramec formation, although the royalties have exposure to multiple horizons at depth, including the Woodford and Osage formations. In the second quarter of 2017, Franco-Nevada acquired additional mineral title and royalty interests for $27.6 million, which added to its existing position in the STACK and provided new exposure to the SCOOP shale play to the south. In total, the assets consist of GORRs and mineral title rights which apply to approximately 1,430 acres (net to Franco-Nevada). Continental Resources drill rig, Oklahoma

2023 Asset Handbook Page 109 Page 111

2023 Asset Handbook Page 109 Page 111