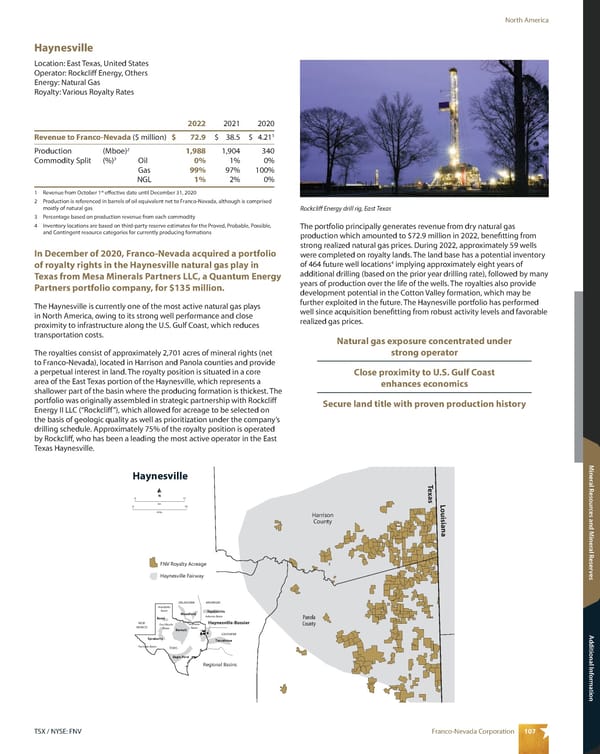

107 Franco-Nevada Corporation TSX / NYSE: FNV North America Mineral Resources and Mineral Reserves Additional Information Haynesville Location: East Texas, United States Operator: Rockcliff Energy, Others Energy: Natural Gas Royalty: Various Royalty Rates Harrison County Panola County Texas Haynesville FNV Royalty Acreage Haynesville Fairway Louisiana TEXAS Eagle Ford Barnett Haynesville-Bossier NEW MEXICO LOUISIANA OKLAHOMA ARKANSAS Regional Basins Tuscaloosa Fayetteville Woodford Spraberry Bend Permian Basin Anadarko Basin Ardmore Basin Arkomo Basin Fort Worth Basin km 0 15 N miles 0 10 The portfolio principally generates revenue from dry natural gas production which amounted to $72.9 million in 2022, benefitting from strong realized natural gas prices. During 2022, approximately 59 wells were completed on royalty lands. The land base has a potential inventory of 464 future well locations 4 implying approximately eight years of additional drilling (based on the prior year drilling rate), followed by many years of production over the life of the wells. The royalties also provide development potential in the Cotton Valley formation, which may be further exploited in the future. The Haynesville portfolio has performed well since acquisition benefitting from robust activity levels and favorable realized gas prices. Natural gas exposure concentrated under strong operator Close proximity to U.S. Gulf Coast enhances economics Secure land title with proven production history 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 72.9 $ 38.5 $ 4.21 1 Production (Mboe) 2 1,988 1,904 340 Commodity Split (%) 3 Oil 0% 1% 0% Gas 99% 97% 100% NGL 1% 2% 0% 1 Revenue from October 1 st effective date until December 31, 2020 2 Production is referenced in barrels of oil equivalent net to Franco-Nevada, although is comprised mostly of natural gas 3 Percentage based on production revenue from each commodity 4 Inventory locations are based on third-party reserve estimates for the Proved, Probable, Possible, and Contingent resource categories for currently producing formations In December of 2020, Franco-Nevada acquired a portfolio of royalty rights in the Haynesville natural gas play in Texas from Mesa Minerals Partners LLC, a Quantum Energy Partners portfolio company, for $135 million. The Haynesville is currently one of the most active natural gas plays in North America, owing to its strong well performance and close proximity to infrastructure along the U.S. Gulf Coast, which reduces transportation costs. The royalties consist of approximately 2,701 acres of mineral rights (net to Franco-Nevada), located in Harrison and Panola counties and provide a perpetual interest in land. The royalty position is situated in a core area of the East Texas portion of the Haynesville, which represents a shallower part of the basin where the producing formation is thickest. The portfolio was originally assembled in strategic partnership with Rockcliff Energy II LLC (“Rockcliff”), which allowed for acreage to be selected on the basis of geologic quality as well as prioritization under the company’s drilling schedule. Approximately 75% of the royalty position is operated by Rockcliff, who has been a leading the most active operator in the East Texas Haynesville. Rockcliff Energy drill rig, East Texas

2023 Asset Handbook Page 108 Page 110

2023 Asset Handbook Page 108 Page 110