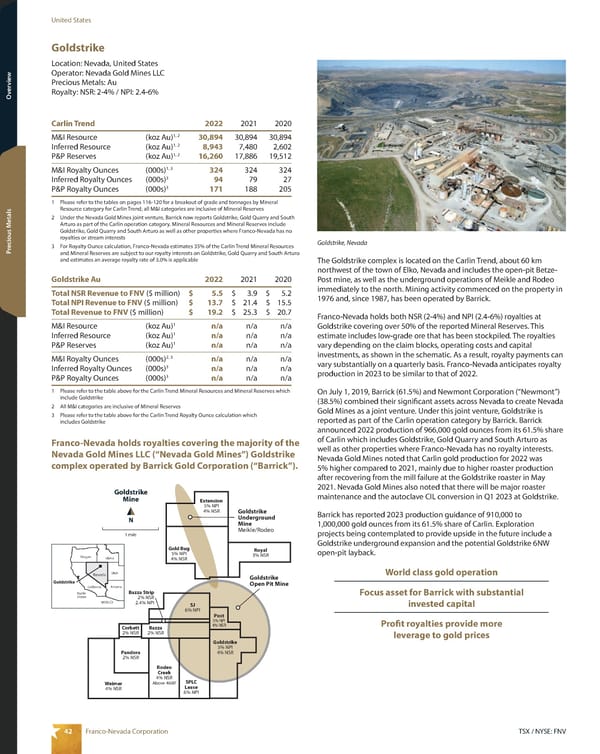

42 TSX / NYSE: FNV Franco-Nevada Corporation United States Overview Overview Precious Metals Goldstrike Location: Nevada, United States Operator: Nevada Gold Mines LLC Precious Metals: Au Royalty: NSR: 2-4% / NPI: 2.4-6% N Goldstrike Mine Goldstrike Open Pit Mine Goldstrike Underground Mine Meikle/Rodeo SJ 6% NPI SPLC Lease 6% NPI Post 5% NPI 4% NSR Goldstrike 5% NPI 4% NSR Bazza 2% NSR Bazza Strip 2% NSR 2.4% NPI Royal 3% NSR Extension 5% NPI 4% NSR Gold Bug 5% NPI 4% NSR Corbett 2% NSR Pandora 2% NSR Weimer 4% NSR Rodeo Creek 4% NSR Above 4600’ 1 mile Goldstrike Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO The Goldstrike complex is located on the Carlin Trend, about 60 km northwest of the town of Elko, Nevada and includes the open-pit Betze- Post mine, as well as the underground operations of Meikle and Rodeo immediately to the north. Mining activity commenced on the property in 1976 and, since 1987, has been operated by Barrick. Franco-Nevada holds both NSR (2-4%) and NPI (2.4-6%) royalties at Goldstrike covering over 50% of the reported Mineral Reserves. This estimate includes low-grade ore that has been stockpiled. The royalties vary depending on the claim blocks, operating costs and capital investments, as shown in the schematic. As a result, royalty payments can vary substantially on a quarterly basis. Franco-Nevada anticipates royalty production in 2023 to be similar to that of 2022. On July 1, 2019, Barrick (61.5%) and Newmont Corporation (“Newmont”) (38.5%) combined their significant assets across Nevada to create Nevada Gold Mines as a joint venture. Under this joint venture, Goldstrike is reported as part of the Carlin operation category by Barrick. Barrick announced 2022 production of 966,000 gold ounces from its 61.5% share of Carlin which includes Goldstrike, Gold Quarry and South Arturo as well as other properties where Franco-Nevada has no royalty interests. Nevada Gold Mines noted that Carlin gold production for 2022 was 5% higher compared to 2021, mainly due to higher roaster production after recovering from the mill failure at the Goldstrike roaster in May 2021. Nevada Gold Mines also noted that there will be major roaster maintenance and the autoclave CIL conversion in Q1 2023 at Goldstrike. Barrick has reported 2023 production guidance of 910,000 to 1,000,000 gold ounces from its 61.5% share of Carlin. Exploration projects being contemplated to provide upside in the future include a Goldstrike underground expansion and the potential Goldstrike 6NW open-pit layback. World class gold operation Focus asset for Barrick with substantial invested capital Profit royalties provide more leverage to gold prices Carlin Trend 2022 2021 2020 M&I Resource (koz Au) 1, 2 30,894 30,894 30,894 Inferred Resource (koz Au) 1, 2 8,943 7,480 2,602 P&P Reserves (koz Au) 1, 2 16,260 17,886 19,512 M&I Royalty Ounces (000s) 1, 3 324 324 324 Inferred Royalty Ounces (000s) 3 94 79 27 P&P Royalty Ounces (000s) 3 171 188 205 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category for Carlin Trend; all M&I categories are inclusive of Mineral Reserves 2 Under the Nevada Gold Mines joint venture, Barrick now reports Goldstrike, Gold Quarry and South Arturo as part of the Carlin operation category. Mineral Resources and Mineral Reserves include Goldstrike, Gold Quarry and South Arturo as well as other properties where Franco-Nevada has no royalties or stream interests 3 For Royalty Ounce calculation, Franco-Nevada estimates 35% of the Carlin Trend Mineral Resources and Mineral Reserves are subject to our royalty interests on Goldstrike, Gold Quarry and South Arturo and estimates an average royalty rate of 3.0% is applicable Goldstrike Au 2022 2021 2020 Total NSR Revenue to FNV ($ million) $ 5.5 $ 3.9 $ 5.2 Total NPI Revenue to FNV ($ million) $ 13.7 $ 21.4 $ 15.5 Total Revenue to FNV ($ million) $ 19.2 $ 25.3 $ 20.7 M&I Resource (koz Au) 1 n/a n/a n/a Inferred Resource (koz Au) 1 n/a n/a n/a P&P Reserves (koz Au) 1 n/a n/a n/a M&I Royalty Ounces (000s) 2, 3 n/a n/a n/a Inferred Royalty Ounces (000s) 3 n/a n/a n/a P&P Royalty Ounces (000s) 3 n/a n/a n/a 1 Please refer to the table above for the Carlin Trend Mineral Resources and Mineral Reserves which include Goldstrike 2 All M&I categories are inclusive of Mineral Reserves 3 Please refer to the table above for the Carlin Trend Royalty Ounce calculation which includes Goldstrike Franco-Nevada holds royalties covering the majority of the Nevada Gold Mines LLC (“Nevada Gold Mines”) Goldstrike complex operated by Barrick Gold Corporation (“Barrick”). Goldstrike, Nevada

2023 Asset Handbook Page 43 Page 45

2023 Asset Handbook Page 43 Page 45