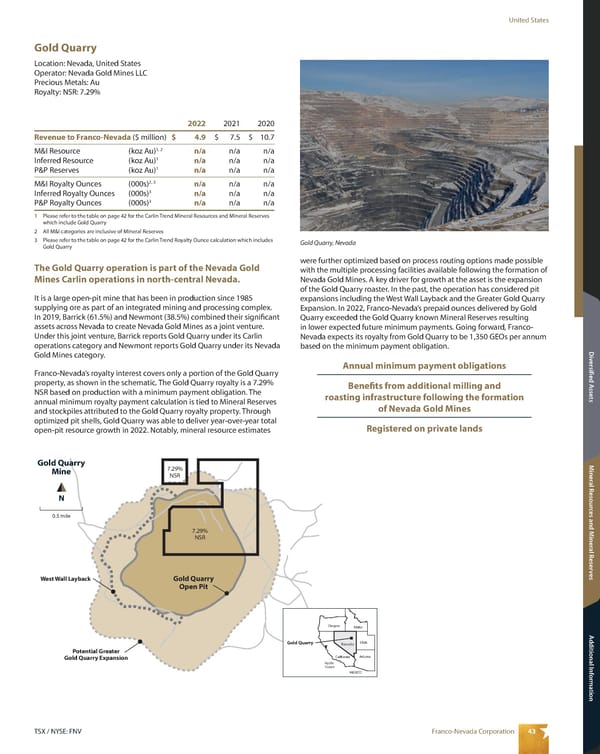

43 Franco-Nevada Corporation TSX / NYSE: FNV United States Mineral Resources and Mineral Reserves Additional Information Diversified Assets Gold Quarry Location: Nevada, United States Operator: Nevada Gold Mines LLC Precious Metals: Au Royalty: NSR: 7.29% N Gold Quarry Mine 7.29% NSR Gold Quarry Open Pit 0.5 mile Potential Greater Gold Quarry Expansion West Wall Layback 7.29% NSR Gold Quarry Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO were further optimized based on process routing options made possible with the multiple processing facilities available following the formation of Nevada Gold Mines. A key driver for growth at the asset is the expansion of the Gold Quarry roaster. In the past, the operation has considered pit expansions including the West Wall Layback and the Greater Gold Quarry Expansion. In 2022, Franco-Nevada’s prepaid ounces delivered by Gold Quarry exceeded the Gold Quarry known Mineral Reserves resulting in lower expected future minimum payments. Going forward, Franco- Nevada expects its royalty from Gold Quarry to be 1,350 GEOs per annum based on the minimum payment obligation. Annual minimum payment obligations Benefits from additional milling and roasting infrastructure following the formation of Nevada Gold Mines Registered on private lands 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 4.9 $ 7.5 $ 10.7 M&I Resource (koz Au) 1, 2 n/a n/a n/a Inferred Resource (koz Au) 1 n/a n/a n/a P&P Reserves (koz Au) 1 n/a n/a n/a M&I Royalty Ounces (000s) 2, 3 n/a n/a n/a Inferred Royalty Ounces (000s) 3 n/a n/a n/a P&P Royalty Ounces (000s) 3 n/a n/a n/a 1 Please refer to the table on page 42 for the Carlin Trend Mineral Resources and Mineral Reserves which include Gold Quarry 2 All M&I categories are inclusive of Mineral Reserves 3 Please refer to the table on page 42 for the Carlin Trend Royalty Ounce calculation which includes Gold Quarry The Gold Quarry operation is part of the Nevada Gold Mines Carlin operations in north-central Nevada. It is a large open-pit mine that has been in production since 1985 supplying ore as part of an integrated mining and processing complex. In 2019, Barrick (61.5%) and Newmont (38.5%) combined their significant assets across Nevada to create Nevada Gold Mines as a joint venture. Under this joint venture, Barrick reports Gold Quarry under its Carlin operations category and Newmont reports Gold Quarry under its Nevada Gold Mines category. Franco-Nevada’s royalty interest covers only a portion of the Gold Quarry property, as shown in the schematic. The Gold Quarry royalty is a 7.29% NSR based on production with a minimum payment obligation. The annual minimum royalty payment calculation is tied to Mineral Reserves and stockpiles attributed to the Gold Quarry royalty property. Through optimized pit shells, Gold Quarry was able to deliver year-over-year total open-pit resource growth in 2022. Notably, mineral resource estimates Gold Quarry, Nevada

2023 Asset Handbook Page 44 Page 46

2023 Asset Handbook Page 44 Page 46