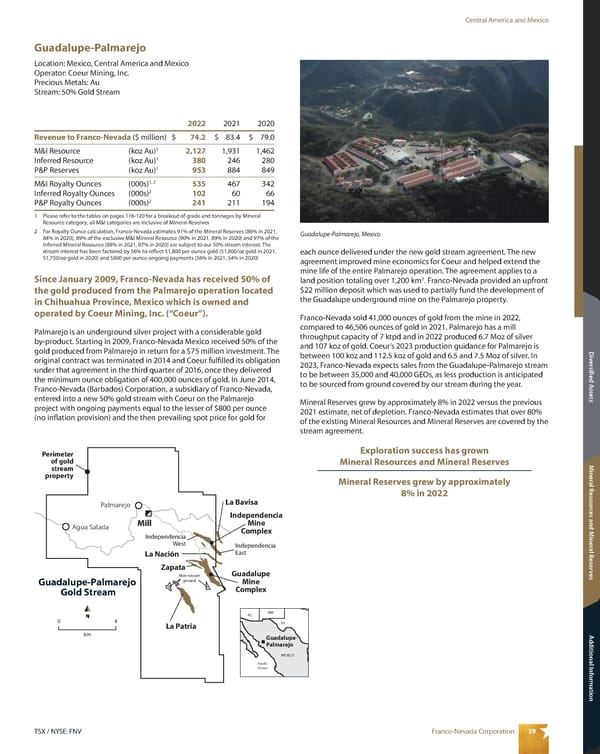

Central America and Mexico 39 Franco-Nevada Corporation TSX / NYSE: FNV Mineral Resources and Mineral Reserves Additional Information Diversified Assets Guadalupe-Palmarejo Location: Mexico, Central America and Mexico Operator: Coeur Mining, Inc. Precious Metals: Au Stream: 50% Gold Stream Guadalupe-Palmarejo Gold Stream Palmarejo Agua Salada Mill Guadalupe Mine Complex Independencia East km 0 4 Perimeter of gold stream property La Nación La Bavisa Independencia West Zapata La Patria Independencia Mine Complex Non-stream ground Pacific Ocean NM TX CA AZ MEXICO Guadalupe- Palmarejo each ounce delivered under the new gold stream agreement. The new agreement improved mine economics for Coeur and helped extend the mine life of the entire Palmarejo operation. The agreement applies to a land position totaling over 1,200 km 2 . Franco-Nevada provided an upfront $22 million deposit which was used to partially fund the development of the Guadalupe underground mine on the Palmarejo property. Franco-Nevada sold 41,000 ounces of gold from the mine in 2022, compared to 46,506 ounces of gold in 2021. Palmarejo has a mill throughput capacity of 7 ktpd and in 2022 produced 6.7 Moz of silver and 107 koz of gold. Coeur’s 2023 production guidance for Palmarejo is between 100 koz and 112.5 koz of gold and 6.5 and 7.5 Moz of silver. In 2023, Franco-Nevada expects sales from the Guadalupe-Palmarejo stream to be between 35,000 and 40,000 GEOs, as less production is anticipated to be sourced from ground covered by our stream during the year. Mineral Reserves grew by approximately 8% in 2022 versus the previous 2021 estimate, net of depletion. Franco-Nevada estimates that over 80% of the existing Mineral Resources and Mineral Reserves are covered by the stream agreement. Exploration success has grown Mineral Resources and Mineral Reserves Mineral Reserves grew by approximately 8% in 2022 2022 2021 2020 Revenue to Franco-Nevada ($ million) $ 74.2 $ 83.4 $ 79.0 M&I Resource (koz Au) 1 2,127 1,931 1,462 Inferred Resource (koz Au) 1 380 246 280 P&P Reserves (koz Au) 1 953 884 849 M&I Royalty Ounces (000s) 1, 2 535 467 342 Inferred Royalty Ounces (000s) 2 102 60 66 P&P Royalty Ounces (000s) 2 241 211 194 1 Please refer to the tables on pages 116-120 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Royalty Ounce calculation, Franco-Nevada estimates 91% of the Mineral Reserves (86% in 2021, 84% in 2020), 89% of the exclusive M&I Mineral Resource (90% in 2021, 89% in 2020) and 97% of the Inferred Mineral Resource (88% in 2021, 87% in 2020) are subject to our 50% stream interest. The stream interest has been factored by 56% to reflect $1,800 per ounce gold ($1,800/oz gold in 2021, $1,750/oz gold in 2020) and $800 per ounce ongoing payments (56% in 2021, 54% in 2020) Since January 2009, Franco-Nevada has received 50% of the gold produced from the Palmarejo operation located in Chihuahua Province, Mexico which is owned and operated by Coeur Mining, Inc. (“Coeur”). Palmarejo is an underground silver project with a considerable gold by-product. Starting in 2009, Franco-Nevada Mexico received 50% of the gold produced from Palmarejo in return for a $75 million investment. The original contract was terminated in 2014 and Coeur fulfilled its obligation under that agreement in the third quarter of 2016, once they delivered the minimum ounce obligation of 400,000 ounces of gold. In June 2014, Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, entered into a new 50% gold stream with Coeur on the Palmarejo project with ongoing payments equal to the lesser of $800 per ounce (no inflation provision) and the then prevailing spot price for gold for Guadalupe-Palmarejo, Mexico

2023 Asset Handbook Page 40 Page 42

2023 Asset Handbook Page 40 Page 42