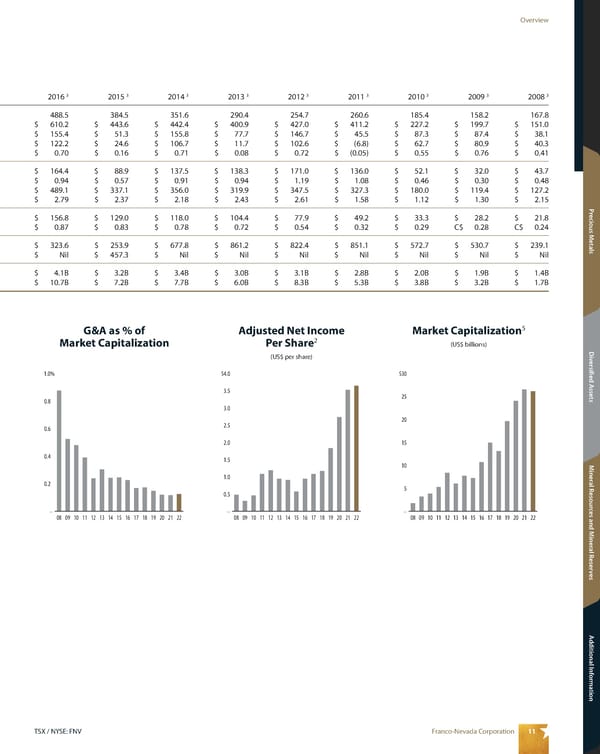

11 Franco-Nevada Corporation TSX / NYSE: FNV Overview Mineral Resources and Mineral Reserves Additional Information Diversified Assets Precious Metals 2016 3 2015 3 2014 3 2013 3 2012 3 2011 3 2010 3 2009 3 2008 3 488.5 384.5 351.6 290.4 254.7 260.6 185.4 158.2 167.8 $ 610.2 $ 443.6 $ 442.4 $ 400.9 $ 427.0 $ 411.2 $ 227.2 $ 199.7 $ 151.0 $ 155.4 $ 51.3 $ 155.8 $ 77.7 $ 146.7 $ 45.5 $ 87.3 $ 87.4 $ 38.1 $ 122.2 $ 24.6 $ 106.7 $ 11.7 $ 102.6 $ (6.8) $ 62.7 $ 80.9 $ 40.3 $ 0.70 $ 0.16 $ 0.71 $ 0.08 $ 0.72 $ (0.05) $ 0.55 $ 0.76 $ 0.41 $ 164.4 $ 88.9 $ 137.5 $ 138.3 $ 171.0 $ 136.0 $ 52.1 $ 32.0 $ 43.7 $ 0.94 $ 0.57 $ 0.91 $ 0.94 $ 1.19 $ 1.08 $ 0.46 $ 0.30 $ 0.48 $ 489.1 $ 337.1 $ 356.0 $ 319.9 $ 347.5 $ 327.3 $ 180.0 $ 119.4 $ 127.2 $ 2.79 $ 2.37 $ 2.18 $ 2.43 $ 2.61 $ 1.58 $ 1.12 $ 1.30 $ 2.15 $ 156.8 $ 129.0 $ 118.0 $ 104.4 $ 77.9 $ 49.2 $ 33.3 $ 28.2 $ 21.8 $ 0.87 $ 0.83 $ 0.78 $ 0.72 $ 0.54 $ 0.32 $ 0.29 C$ 0.28 C$ 0.24 $ 323.6 $ 253.9 $ 677.8 $ 861.2 $ 822.4 $ 851.1 $ 572.7 $ 530.7 $ 239.1 $ Nil $ 457.3 $ Nil $ Nil $ Nil $ Nil $ Nil $ Nil $ Nil $ 4.1B $ 3.2B $ 3.4B $ 3.0B $ 3.1B $ 2.8B $ 2.0B $ 1.9B $ 1.4B $ 10.7B $ 7.2B $ 7.7B $ 6.0B $ 8.3B $ 5.3B $ 3.8B $ 3.2B $ 1.7B Market Capitalization 5 (US$ billions) G&A as % of Market Capitalization Adjusted Net Income Per Share 2 (US$ per share) – 5 10 15 20 25 $30 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 0.2 0.4 0.6 0.8 1.0% 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08 – 0.5 1.0 1.5 2.0 2.5 3.0 3.5 $4.0 22 21 20 19 18 17 16 15 14 13 12 11 10 09 08

2023 Asset Handbook Page 12 Page 14

2023 Asset Handbook Page 12 Page 14