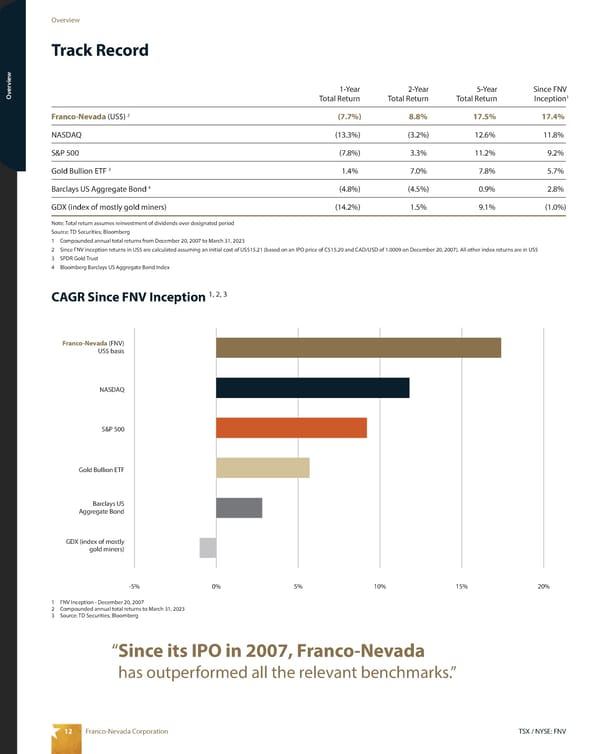

12 TSX / NYSE: FNV Franco-Nevada Corporation Overview Overview -5% 0% 5% 10% 15% 20% NASDAQ S&P 500 Gold Bullion ETF Barclays US Aggregate Bond Franco-Nevada (FNV) US$ basis GDX (index of mostly gold miners) Track Record CAGR Since FNV Inception 1, 2, 3 1-Year 2-Year 5-Year Since FNV Total Return Total Return Total Return Inception 1 Franco-Nevada (US$) 2 (7.7%) 8.8% 17.5% 17.4% NASDAQ (13.3%) (3.2%) 12.6% 11.8% S&P 500 (7.8%) 3.3% 11.2% 9.2% Gold Bullion ETF 3 1.4% 7.0% 7.8% 5.7% Barclays US Aggregate Bond 4 (4.8%) (4.5%) 0.9% 2.8% GDX (index of mostly gold miners) (14.2%) 1.5% 9.1% (1.0%) Note: Total return assumes reinvestment of dividends over designated period Source: TD Securities; Bloomberg 1 Compounded annual total returns from December 20, 2007 to March 31, 2023 2 Since FNV inception returns in US$ are calculated assuming an initial cost of US$15.21 (based on an IPO price of C$15.20 and CAD/USD of 1.0009 on December 20, 2007). All other index returns are in US$ 3 SPDR Gold Trust 4 Bloomberg Barclays US Aggregate Bond Index “ Since its IPO in 2007, Franco-Nevada has outperformed all the relevant benchmarks.” 1 FNV Inception - December 20, 2007 2 Compounded annual total returns to March 31, 2023 3 Source: TD Securities; Bloomberg

2023 Asset Handbook Page 13 Page 15

2023 Asset Handbook Page 13 Page 15